Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Enterprise including 30-day access, sample company files, and the full 88-page QuickBooks Enterprise Guide that details everything that you can do in the software. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Avoid These Costly Errors: The 10 Worst Mistakes You Can Make Using QuickBooks Enterprise

Paygration, Inc.

QuickBooks Enterprise is a powerful solution for businesses seeking advanced financial management solutions. However, even with its robust features, some businesses still make mistakes along the way. In this guide, we’ll take a look at the most common mistakes that most businesses make when using QuickBooks Enterprise.

By understanding and avoiding these missteps, businesses can harness the full power of QuickBooks Enterprise and pave the way for financial success.

1. Neglecting Proper Training

One of the gravest mistakes businesses can make is failing to invest in proper training for their staff. QuickBooks Enterprise offers a plethora of features and functionalities, but without adequate training, users may struggle to maximize its potential. Investing in comprehensive training programs ensures that users understand the software’s capabilities, reducing the likelihood of errors and increasing efficiency.

2. Ignoring Data Backups

Data loss can be catastrophic for any business, yet many users neglect to implement regular backups of their QuickBooks Enterprise data. Whether due to hardware failure, human error, or cyber threats, losing critical financial data can have severe consequences. Implementing automated backup procedures and storing backups in secure locations mitigates the risk of data loss and ensures business continuity.

3. Failing to Customize Permissions

QuickBooks Enterprise allows businesses to customize user permissions to control access to sensitive financial information. However, failing to tailor permissions to match each user’s role within the organization can lead to security breaches and data leaks. By customizing permissions appropriately, businesses can safeguard their financial data and ensure that users only have access to information relevant to their responsibilities.

If you would like to try the full version of QuickBooks Enterprise Desktop, click here to get a free, 30-day no-commitment trial plus access to the Resource Guide that lists all the features available in Enterprise.

4. Neglecting Software Updates

Regular software updates are crucial for maintaining the security and functionality of QuickBooks Enterprise. Yet, many businesses neglect to install updates promptly, leaving their systems vulnerable to security threats and missing out on valuable new features. Implementing a proactive approach to software updates ensures that businesses stay current with the latest enhancements and security patches, reducing the risk of errors and vulnerabilities.

5. Overlooking Reconciliation

Reconciliation is a critical process for ensuring the accuracy of financial data in QuickBooks Enterprise. Yet, many users overlook or delay this essential task, leading to discrepancies and errors in their financial records. Regular reconciliation of bank accounts, credit cards, and other accounts is essential for detecting errors, identifying fraudulent transactions, and maintaining the integrity of financial data.

6. Misconfiguring Chart of Accounts

The Chart of Accounts serves as the backbone of financial reporting in QuickBooks Enterprise. Misconfiguring the Chart of Accounts, such as failing to assign correct account types or using inconsistent naming conventions, can lead to confusion and inaccuracies in financial reports. Taking the time to set up a well-organized and properly configured Chart of Accounts ensures accurate financial reporting and analysis.

7. Neglecting Security Measures

Security is paramount when it comes to financial data, yet many users neglect to implement adequate security measures in QuickBooks Enterprise. Failing to set up strong passwords, enabling multi-factor authentication, and restricting access to authorized users increases the risk of data breaches and unauthorized access. Implementing robust security measures protects sensitive financial information and safeguards the integrity of business operations.

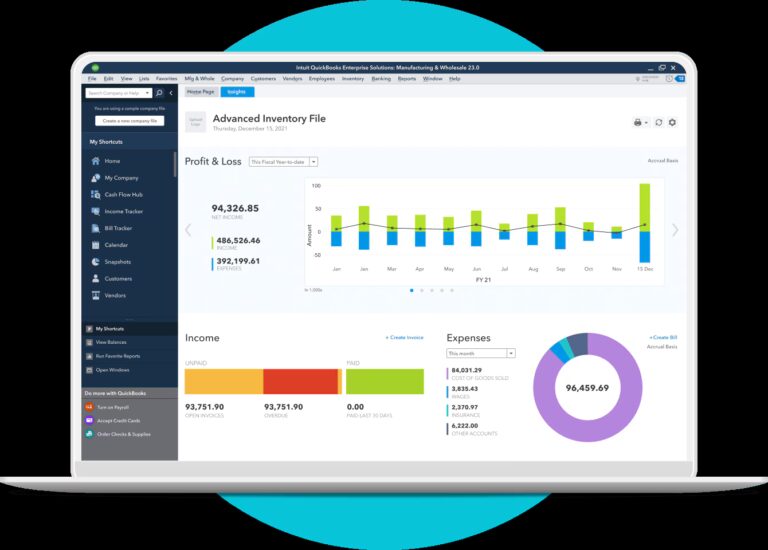

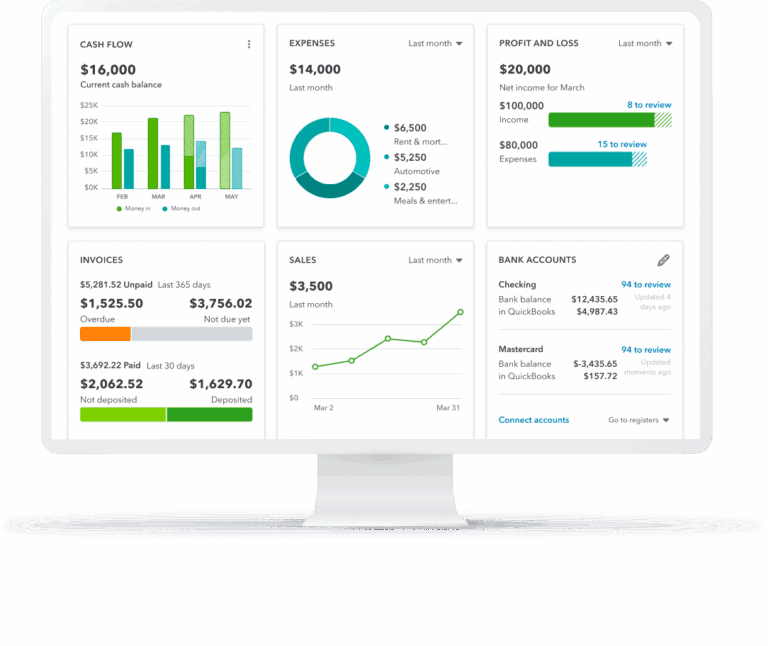

8. Relying Solely on Default Reports

While QuickBooks Enterprise offers a variety of default reports, relying solely on these standard reports may limit insights into specific business metrics and KPIs. Businesses that fail to customize or create custom reports tailored to their unique needs may miss out on valuable insights and opportunities for optimization. Leveraging custom reports allows businesses to track key metrics, identify trends, and make data-driven decisions that drive growth and profitability.

9. Inadequate Documentation

Documentation is essential for maintaining transparency, accountability, and compliance in financial management. Yet, many users neglect to maintain accurate and up-to-date documentation within QuickBooks Enterprise. Failing to document transactions, adjustments, and other financial activities can lead to confusion, errors, and compliance issues. Establishing clear documentation procedures ensures that financial records are accurate, auditable, and compliant with regulatory requirements.

10. Lack of Regular Audits

Regular audits are crucial for ensuring the accuracy and integrity of financial data in QuickBooks Enterprise. Yet, many businesses neglect to conduct audits of their QuickBooks data, leaving errors and inconsistencies undetected. Implementing regular internal audits or enlisting the help of external auditors helps businesses identify and rectify errors, ensure compliance with accounting standards, and maintain the trust and confidence of stakeholders.

Conclusion

While QuickBooks Enterprise offers powerful tools and features for managing finances, avoiding common pitfalls is essential for maximizing its benefits. By understanding and addressing the worst mistakes one can make while using QuickBooks Enterprise, businesses can optimize their financial management processes, enhance accuracy and efficiency, and pave the way for long-term success. With proper training, diligent maintenance, and a proactive approach to security and compliance, businesses can harness the full power of QuickBooks Enterprise and achieve their financial goals with confidence. If you are making any of these mistakes or are looking to avoid doing so, give us a call at 866-949-7267 and one of our QuickBooks Enterprise experts can help make sure you are on the right track!