Intuit Assisted Payroll

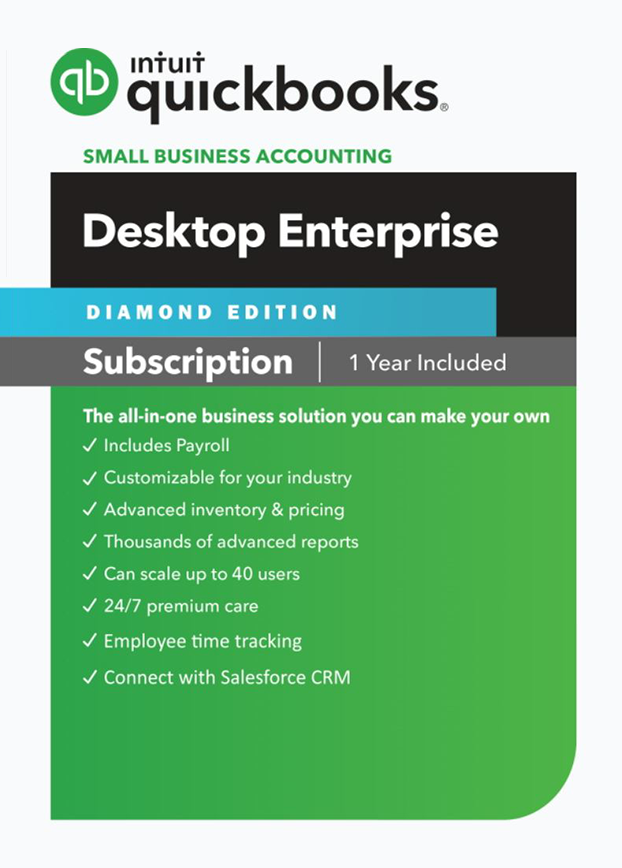

Get the benefits of full service payroll at a lower cost than what you could hire an outside firm or bookkeeper for. Our payroll experts can guide you step-by-step through the payroll setup and answer any questions you have along the way. Get detailed job costing, class tracking, and an open platform for third-party time tracking solutions. Your employees can view their pay stubs and W-2s online anytime at Paychecks.intuit.com. Print checks or use direct deposit, choose whichever your employees prefer We handle all new hire reporting for your W-2 employees and we prepare your W-2s at year-end. QuickBooks Desktop Payroll is now included in QuickBooks Enterprise. Choose from the do-it-yourself Enhanced version, or Assisted payroll where tax filings are done for you and guaranteed. QuickBooks Assisted Payroll is a payroll processing service offered by Intuit, where payroll tasks are managed by payroll experts on behalf of the business. With QuickBooks Assisted Payroll, businesses submit their payroll data to Intuit, and payroll experts handle tasks such as payroll tax calculations, form preparation, and tax filing on their behalf. Benefits of QuickBooks Assisted Payroll include accurate payroll tax calculations, timely tax filings, reduced compliance risks, and access to expert payroll support. Yes, QuickBooks Assisted Payroll is suitable for businesses of all sizes, including small businesses that may not have dedicated payroll staff or expertise. Yes, QuickBooks Assisted Payroll supports direct deposit, allowing businesses to pay employees electronically. QuickBooks Assisted Payroll is now included exclusively in the QuicBooks Enterprise Diamond Edition. For more information, click here or contact us at 866-949-7267. Yes, QuickBooks Assisted Payroll includes tax filing services, where Intuit handles payroll tax filings on behalf of the business. Yes, QuickBooks Assisted Payroll stays up-to-date with the latest federal and state tax regulations to ensure compliance for businesses. Yes, businesses using QuickBooks Assisted Payroll have access to payroll reports, providing insights into payroll expenses, tax liabilities, and employee compensation. QuickBooks Assisted Payroll allows businesses to run payroll as frequently as needed, whether it’s weekly, bi-weekly, semi-monthly, or monthly. Yes, QuickBooks Assisted Payroll can accommodate businesses with complex payroll needs, including multiple pay rates, pay schedules, and deductions. Yes, QuickBooks Assisted Payroll supports payroll processing for both employees and independent contractors. QuickBooks offers a free trial of Assisted Payroll, allowing businesses to test its features and functionality before committing to a subscription. Yes, QuickBooks Assisted Payroll provides customer support to assist businesses with setup, troubleshooting, and general inquiries. QuickBooks Assisted Payroll employs advanced security measures to protect sensitive payroll data, including encryption and multi-factor authentication. Yes, QuickBooks Assisted Payroll seamlessly integrates with other QuickBooks products, allowing for streamlined financial management. Yes, QuickBooks Assisted Payroll offers features such as employee self-service portals, customized payroll reports, and HR support resources. QuickBooks Assisted Payroll is now included exclusively in the QuickBooks Enterprise Diamond edition and can be purchased with any major credit card or bank ACH. For more details on how to purchase, click here. Yes, QuickBooks Assisted Payroll allows businesses to access and review historical payroll data for reporting and compliance purposes. Setting up QuickBooks Assisted Payroll involves purchasing QuickBooks Enterprise Diamond and then having us set up an onboarding appoint where a payroll expert will work with you to set your payroll up correctly. To find out more details on QuickBooks Enterprise Diamond, click here or call us at 866-949-7267.Get expert payroll assistance & avoid costly tax penalties.

Less than the cost of outsourcing

Free live U.S.-based support

Includes advanced features for payroll

No tax penalties, guaranteed

Free direct deposit

W-2s included

See how Assisted Payroll makes running payroll a breeze.

Compare Intuit Payroll

Enhanced Payroll

Included In QuickBooks Enterprise Gold

$194

$155

Intuit Assisted Payroll

Included in QuickBooks Enterprise Diamond

QuickBooks Assisted Payroll Frequently Asked Questions