Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Online including 30-day access, the full 76-page QuickBooks Online Guide (details everything that you can do in the software) plus the video training library. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Class Tracking and Location Tracking In QuickBooks & When to Use Them

Paygration, Inc.

One of the features that make QuickBooks Online stand out is its class and location tracking features. You can use either of them individually or both of them to categorize your transactions. When these features are turned on in QuickBooks, you can accurately see which area of your business is thriving and which one needs your attention. This can help you make informed decisions and improve efficiencies across your organization.

Today, we’ll discuss class and location tracking in QuickBooks and some sample scenarios where you can use them.

What is class tracking?

Class tracking is a way to categorize transactions based on departments, product lines, or other segments of a business. For instance, your business might use class tracking to differentiate between income and expenses related to the different types of products you sell. This allows you to see the financial performance of each product line and make informed decisions about where to focus your resources. In every transaction you enter in QuickBooks (i.e., an expense), you can assign it to a class, which will later automatically reflect in your customized report.

If you would like to try the full version of QuickBooks Online Advanced, click here to get a free 30-day no-commitment trial plus access to the full video training library.

What is location tracking?

Location tracking, on the other hand, lets you track income and expenses by different physical locations, such as different store locations, warehouses, or offices. This can be useful if you have multiple locations or branches that operate differently or have different financial needs. For example, if you run a retail business with multiple stores, you might use location tracking to see which stores are most profitable or to identify areas where you need to improve.

Class tracking and location tracking are available in QuickBooks Online Plus and Advanced. With Plus, you can create up to 40 classes and locations combined. If you need unlimited class and location tracking, you need QuickBooks Advanced.

Benefits of Class and Location Tracking in QuickBooks

Improved financial reporting

Class and location tracking can help businesses create more detailed financial reports by allowing them to sort and filter data based on class or location. This can provide valuable insights into how different aspects of the business are performing and help with strategic decision-making.

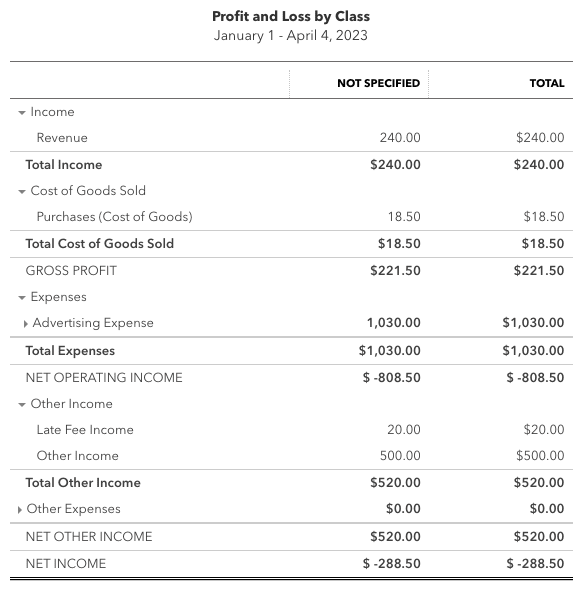

Below is a sample profit and loss report by class:

Better cost management

By tracking expenses and revenues by class or location, businesses can more easily identify where their resources are being spent and make adjustments to reduce costs or allocate resources more effectively.

Accurate job costing

Class and location tracking can be particularly useful for businesses that offer services or products that are customized for individual customers or projects. By assigning a class or location to each job, businesses can track expenses and revenues associated with each job and accurately calculate profitability.

Simplified tax reporting

It also makes tax reporting easier by allowing businesses to separate transactions based on tax implications, such as sales tax or VAT, or by region for international businesses.

Enhanced transparency

Businesses that want to be more transparent about their financial performance can benefit from class and location tracking in QuickBooks by providing a clear breakdown of revenues and expenses by class or location that they can share with their shareholders.

How Class and Location Tracking Can Be Used in Different Industries

Construction companies

You can use class tracking to separate income and expenses by project or job site. You can create classes for each construction project you undertake and track income and expenses associated with each project separately.

Retail businesses

If you have multiple retail store locations, you can use location tracking to track sales and expenses for each store location separately. This lets you determine which store makes the most money.

Property Management Companies

Property managers can use class tracking to separate income and expenses by property type (e.g. residential, commercial) and track income and expenses associated with each type.

Consulting Firms

A consulting firm can use location tracking to track where their consultants are working. For example, they can create locations for each client location and track revenue generated from each location separately.

Law Firms

Law firms and lawyers can use class tracking to track income and expenses by practice area (e.g., family law, corporate law) and track income and expenses associated with each practice area separately.

Service-based businesses

Service-based companies can use location tracking to track where their services are performed. For example, you can create locations for each client location and track revenue generated from each location individually.

Bottom line

Ultimately, whether you should use class and location tracking in QuickBooks depends on the needs of your business and the level of detail you need to track. If you have a simple business with only one location and few expenses, you may not need to use these features. However, if your business is more complex, using class and location tracking can help you better understand your finances and make more informed decisions.