NetSuite Payments

Easy to use credit card and electronic check processing that are integrated right into your Netsuite Accounting for seamless, secure payment processing.

- Features

Do more in NetSuite with less work

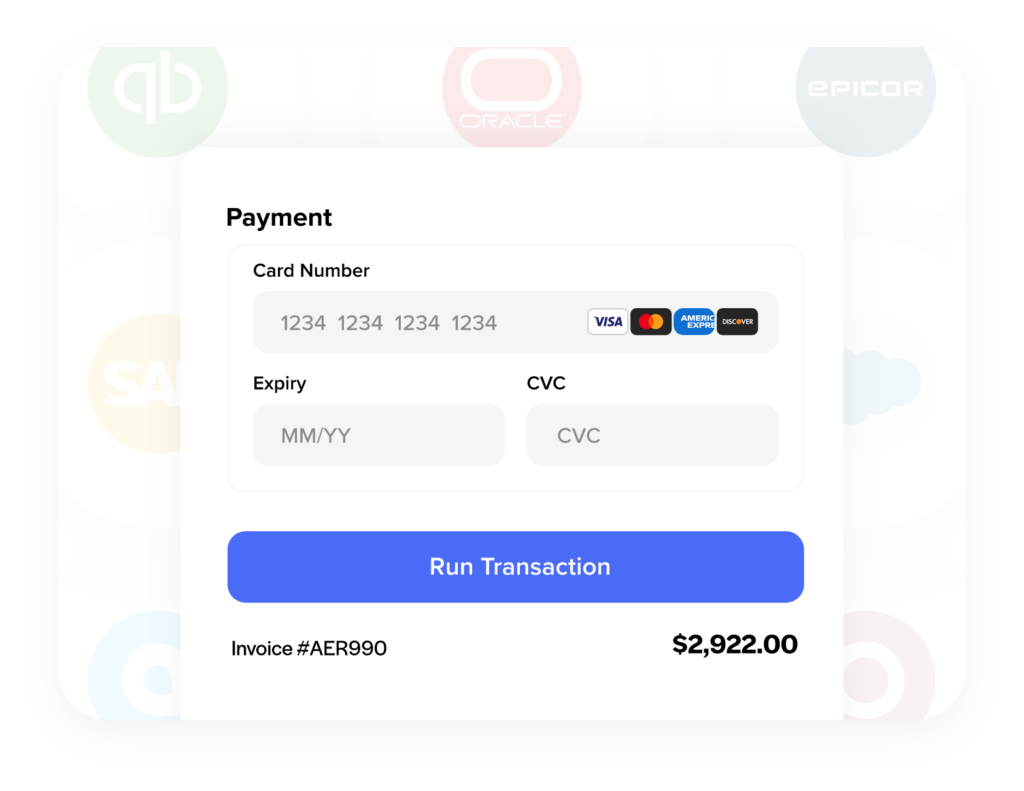

Use our integration inside of NetSuite to easily run transactions and collect payments without ever leaving your software.

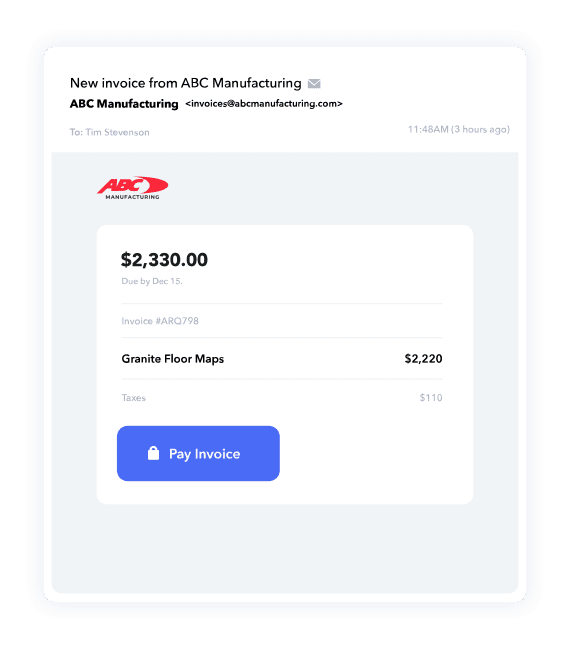

Collect Payments Faster

Speed up payments with built in collection tools like e-invoicing, customer payment portals and reminder workflows

Reduce Processing Costs

Built-in interchange optimization guarantees the lowest rates and surcharging eliminates processing costs.

Automate Receivables

Sync transaction data back to your accounting platform or ERP to save time, eliminate manual entry and any human error

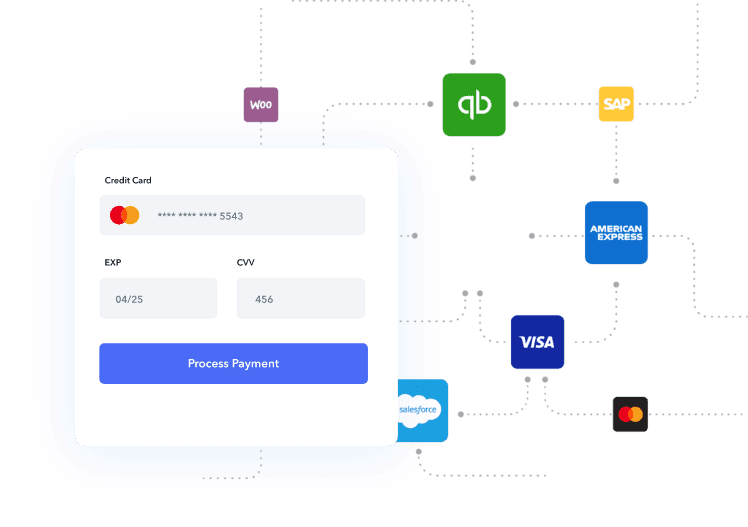

No-Code Integrations

Pre-built integrations allow you to easily connect payments with your favorite software – all with no development needed

100% PCI

Compliant

Eliminate the worry of PCI compliance with Enterprise grade protection, offsite data storage, tokenization and security modules

Accepting payments just got a lot easier in NetSuite

Instantly turn on features in NetSuite that give customers easy payment options, automate processes, and save you time and money.

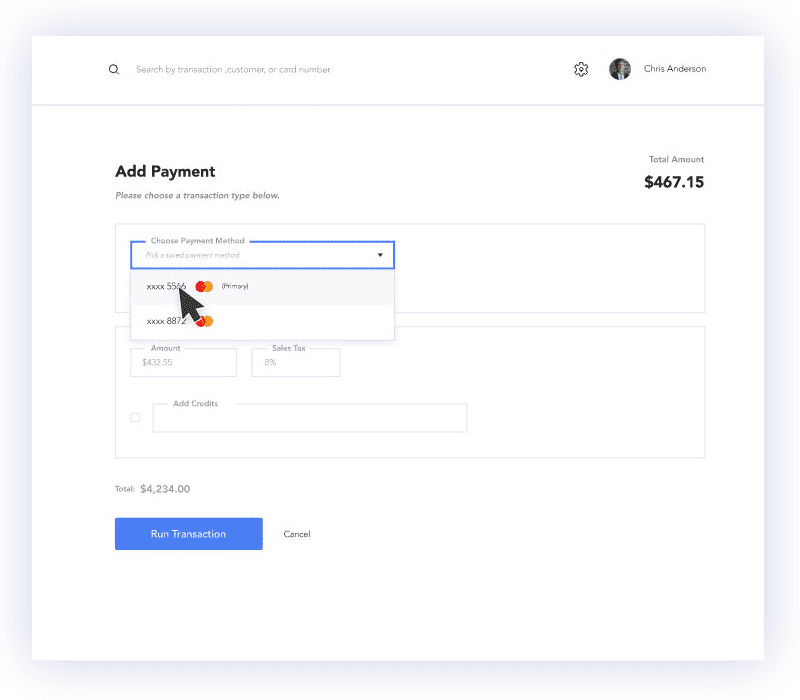

Get paid faster, and reduce double-data entry and keying errors by using NetSuite as your centralized location for payment processing. No more extra steps of having to transfer data to different interfaces plus all sales, returns, and credits are tracked and reconciled automatically.

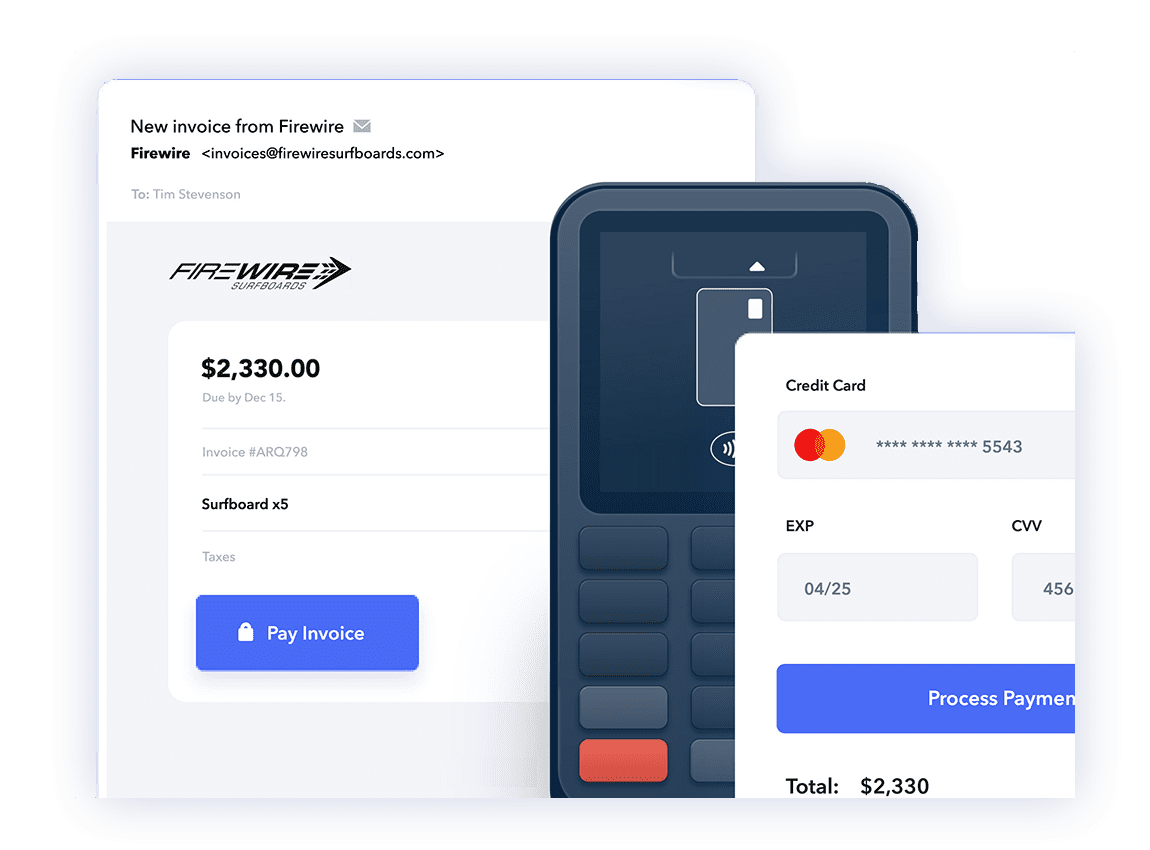

Speed up receivables and eliminate late payments with “click and pay” invoicing. Simply email your invoices from NetSuite, and when your customer pays, the invoice is automatically reconciled and marked as paid in NetSuite. Best of all, the process is integrated within your existing NetSuite software, so there’s nothing new to learn making it an effective way to manage receivables, get paid faster, and reduce late payments.

Are you tired of paying high credit card fees? With our solution, you can reduce your processing fees by up to 95% by automatically adding surcharges or technology fees to your NetSuite invoices. Choose from two compliant methods to offset your processing costs: Surcharging or Dual Pricing. Both options align with card association guidelines, provide flexible payment choices for your customers, and significantly cut the cost of accepting credit cards.

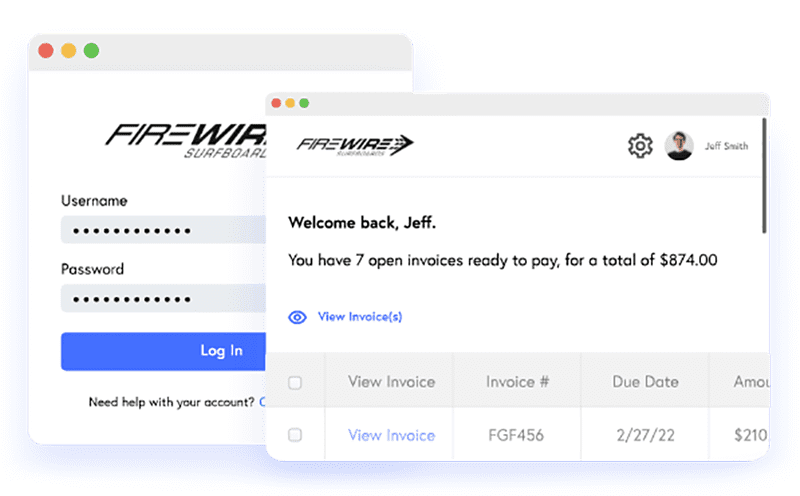

Simplify your payment collections with a fully branded, secure online portal that lets customers easily pay invoices and view their payment history. Customers can pay single or multiple invoices, save payment methods for quick future checkout, and export payment details. Paid invoices are automatically updated in NetSuite, eliminating manual reconciliation and accounting errors.

Take the hassle out of invoicing with our automatic payment processing for NetSuite that ensures an effortless experience for your customers. Say goodbye to missed payments and hello to the convenience of auto-pay. Streamline your billing process, improve cash flow, and enhance customer satisfaction with our seamless invoicing solution.

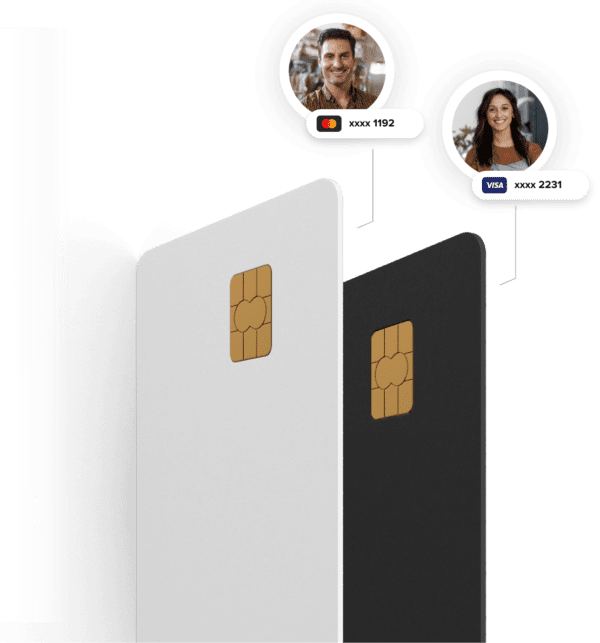

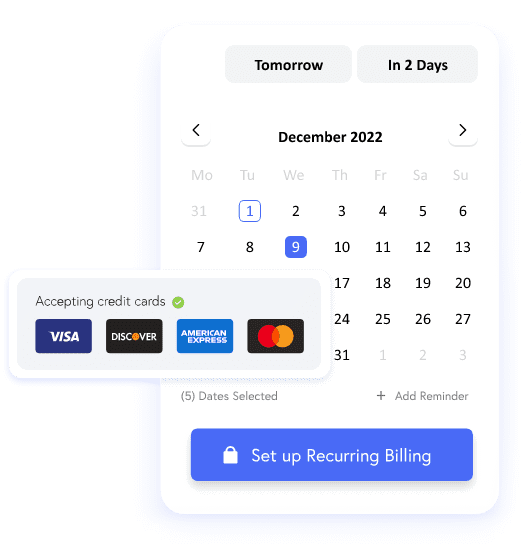

Save multiple customer payment methods to effortlessly create recurring payments with saved cards for specific dates or date ranges. Say goodbye to late payments with and give your customers the flexibility to choose which payment method they wat to use for specific transactions with no intervention on your part. Simply set up billing details for each customer and let us handle the rest.

Effortlessly connect your payments account to over 30 pre-built eCommerce plugins for popular platforms like WooCommerce, Magento, and BigCommerce, all without the need for development or coding. Our integrations utilize advanced payment security measures, including tokenization, encryption, and address verification, to ensure complete customer data protection. Setup is fast and easy, and our support team is ready to assist you through the process, even if you have no prior website experience.

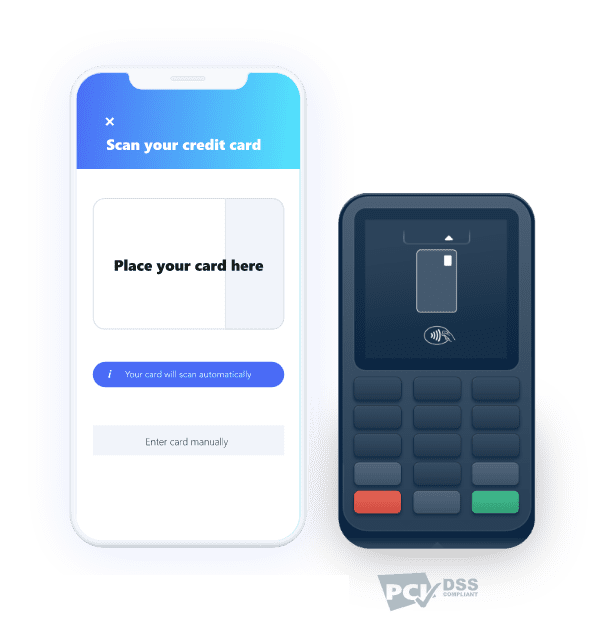

Eliminate payment delays with our seamless mobile payment integration. Whether at trade shows or in the field, your team can easily accept payments on invoices and orders directly from any mobile device using our app. Quickly scan credit cards or use our mobile EMV devices. Once a payment is approved, the invoice automatically syncs back to your NetSuite accounting system as paid, ensuring efficient and accurate financial management.

Effortlessly create new recurring payments for customers using any payment option, including credit cards and eChecks. Simply schedule the billing frequency—whether within a set date range or indefinitely—and let the system handle the rest. All payments are automatically synced with your NetSuite, ensuring hassle-free reconciliation at the end of the day.

Looking to accept payments in person? No problem! Our powerful and flexible EMV terminals enable you to process transactions both in the office and on the go. With the ability to swipe, chip, or tap for contactless payments, these terminals streamline your payment process. Once a transaction is complete, easily sync payments to your NetSuite accounting software, saving valuable reconciliation time.

Run transactions from any web browser with a cloud-based virtual terminal, ideal for managing customer payments without NetSuite. Accept credit cards and eChecks for one-time transactions, set up recurring billing schedules, email payment links, and add secure checkout pages and payment buttons to your website.

Accept payments across multiple channels

Here’s why NetSuite users process payments with us.

Never Leave NetSuite

Easy Setup and Training

Guaranteed Cost Savings

Free, Unlimited Support

Enterprise Grade Security

For over 16 years we have been providing best-in-class payment integration with a sole purpose of saving businesses like yours time, money, and creating efficiency. Combine that with our commitment to transparency and a genuine desire to see you succeed, and you have the core of what we are all about.

Frequently Asked Questions

How do I track payment statuses in NetSuite?

Track payment statuses by using NetSuite’s reporting and dashboard features, which provide real-time updates on payment processing, outstanding invoices, and transaction history.

What are the integration options for e-commerce platforms with NetSuite?

NetSuite integrates with various e-commerce platforms, such as Shopify and WooCommerce, through third-party apps and plugins, facilitating seamless synchronization of sales data and payment processing.

How do I configure recurring payments in NetSuite?

Configure recurring payments by setting up automated billing schedules for customers, allowing for regular, recurring charges to be processed automatically.

Can NetSuite process international payments?

Yes, NetSuite supports international payments by integrating with global payment processors and enabling multi-currency transactions, allowing businesses to manage payments from customers worldwide.

What are the security features for payment processing in NetSuite?

NetSuite ensures secure payment processing with PCI-compliant encrypted card numbers, fraud management tools like CyberSource’s Decision Manager, and payer authentication for enhanced security.

How do I set transaction limits for ACH payments in NetSuite?

Set transaction limits for ACH payments by configuring the payment instrument under the Financial tab in customer profiles, specifying the per-transaction limit and ensuring compliance with your bank’s requirements.

Is it possible to accept mobile payments with NetSuite?

Yes, NetSuite supports mobile payments through integrated payment solutions that work with mobile card readers and digital wallets, providing flexibility for businesses on the go.

How do I handle refunds and chargebacks in NetSuite?

Process refunds and handle chargebacks by configuring the refund and credit options in the payment gateway settings. NetSuite allows for tracking and managing these transactions efficiently.

What is the best payment gateway for NetSuite?

Popular choices for payment gateways include Cybersource, MerchantE, and Freedom Pay, all of which integrate well with NetSuite and offer comprehensive payment processing solutions.

Can I automate payment processing in NetSuite?

Yes, NetSuite allows for the automation of payment processes, including invoice generation, payment collection, and reconciliation, reducing manual tasks and improving efficiency.

What are the costs associated with NetSuite payment processing?

Costs can include transaction fees for credit card payments, typically around 2.9% + $0.30 per transaction, and lower fees for ACH payments, often around $0.50 per transaction. Exact fees depend on the payment processor and volume of transactions.

How do I manage payment methods in NetSuite?

Manage payment methods by creating and configuring different payment instruments, such as credit cards and ACH, under customer profiles and ensuring they are properly set up for transactions.

What are the benefits of using NetSuite for payment processing?

NetSuite streamlines payment workflows, improves cash flow, enhances customer experience with diverse payment options, and reduces processing costs with features like automated invoicing and payment reconciliation.

How can I enable ACH payments for invoices in NetSuite?

Enable ACH payments for invoices by configuring the payment methods in the SuiteCommerce Configuration record, allowing customers to pay invoices in the My Account area or during checkout.

What are Level II and Level III credit card processing in NetSuite?

Level II and Level III processing involves providing additional transaction data to qualify for reduced processing fees. This includes detailed item, freight, and destination information for Level III cards.

How do I set up payment gateways in NetSuite?

To set up a payment gateway, establish an account with a gateway provider, add the gateway in NetSuite, configure the types of transactions (authorizations, captures, sales, refunds, and credits), and test the setup before going live.

Can I use third-party payment processors with NetSuite?

Yes, NetSuite supports third-party payment processors. You can integrate processors like Cybersource and Freedom Pay through SuitePayments for seamless payment processing.

What are the steps to set up ACH payments in NetSuite?

Set up ACH payments by creating a new ACH account for the customer in NetSuite under the Financial tab. You must enter the bank account and routing numbers, select the payment method, and configure any necessary limits and customer consent messages.

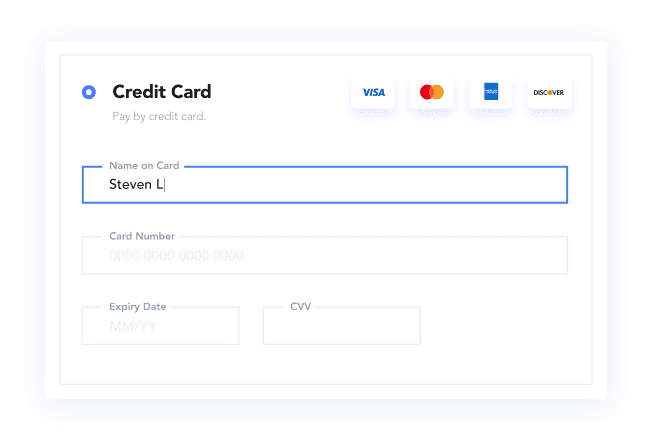

How can I accept credit card payments in NetSuite?

To accept credit card payments, you need to configure a payment gateway in NetSuite, such as CyberSource or MerchantE, and set up credit card processing profiles. This allows for secure authorization and funds capture for sales orders and web store transactions.

How do I integrate payments into NetSuite?

NetSuite offers SuitePayments, an integrated solution that supports various payment methods, including credit cards and ACH. Integration involves setting up payment processors, configuring payment methods, and enabling necessary features in the NetSuite environment.

Still have questions on NetSuite payments?

Speak with an expert at 866-949-7267

Terms: *Important pricing details and product information

Purchase and any sales tax where applicable will be billed by Intuit and includes 60 Day Money Back Guarantee. Annual payment option not available for Diamond or Hosted Enterprise subscriptions. *Free software conversion includes QuickBooks Pro, Premier, Online and Sage 50. Please contact us for details if you are looking to convert from other software.