Advanced Reporting

- Features

Get deeper insights with Advanced Reporting

See the data you want, the way you want it, with customizable, built-in reports—or create your own from scratch.

Unleash Your Data

Now you can unleash the power of all your QuickBooks data to give you an end-to-end view of how your business is truly performing.

Total Flexibility

Advanced Reporting lets you create reports that look exactly the way you want – from statistical data, colorful graphs, charts and more.

Built Into QuickBooks

Advanced Reporting comes included in all versions of QuickBooks Enterprise so there is nothing extra to add or purchase.

Deep Insights

Quickly discover untapped insights into how your business is really doing with the ability to drill down into the key details

Robust Functionality

With all new enhanced searching fields and filtering options, it’s our most customizable QuickBooks reporting tool yet.

Get reports built for your business

Modify included starter templates to your liking, or craft your own reports to highlight the data that’s important to you.

Adjust any of the 200+ pre-existing reports by using filters, adding or removing data elements, or incorporating custom fields to concentrate on key metrics essential to your business. Additionally, you can save these tailored reports as templates for future use.

You can create an unlimited number of fully customizable reports from any data set, starting from scratch. It’s even possible to merge financial reports from various entities or businesses to obtain a comprehensive overview. Additionally, extensive support is available online at the Advanced Reporting Training Center to help you master the tools for building your own reports.

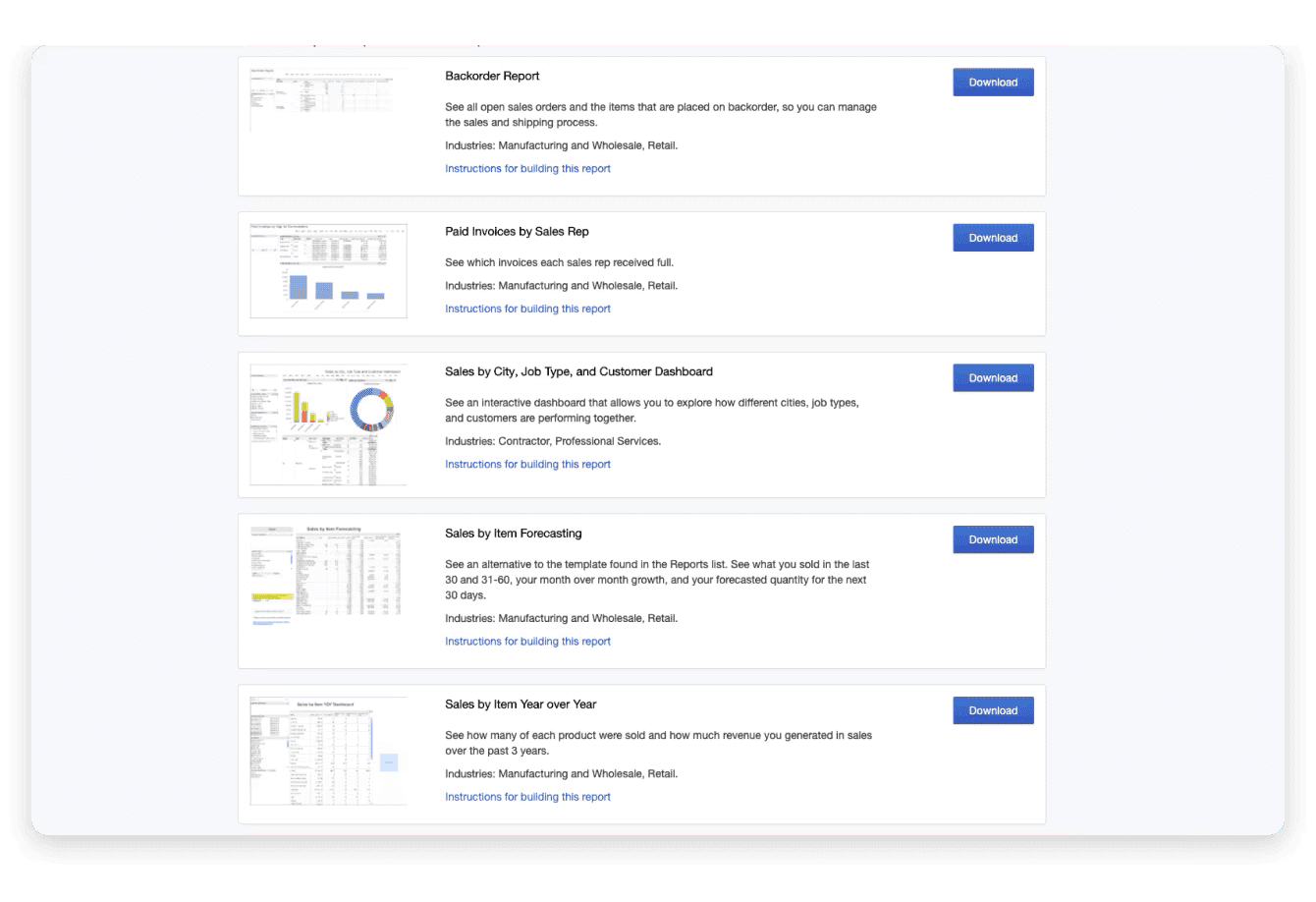

Leverage specialized reports tailored for specific industries such as manufacturing and wholesale/distribution, construction, nonprofit organizations, professional services, and retail. Some examples include:

- Sales Graph

- Sales by Class, Customer, Item, or Rep

- Profit & Loss by Job

- Unbilled Costs by Job

- Cost to Complete by Job

- Open Purchase Order by Vendor

- Inventory Valuation Summary

- Inventory Stock by Item

- Assembly Shortage

- Assembly Bill of Materials

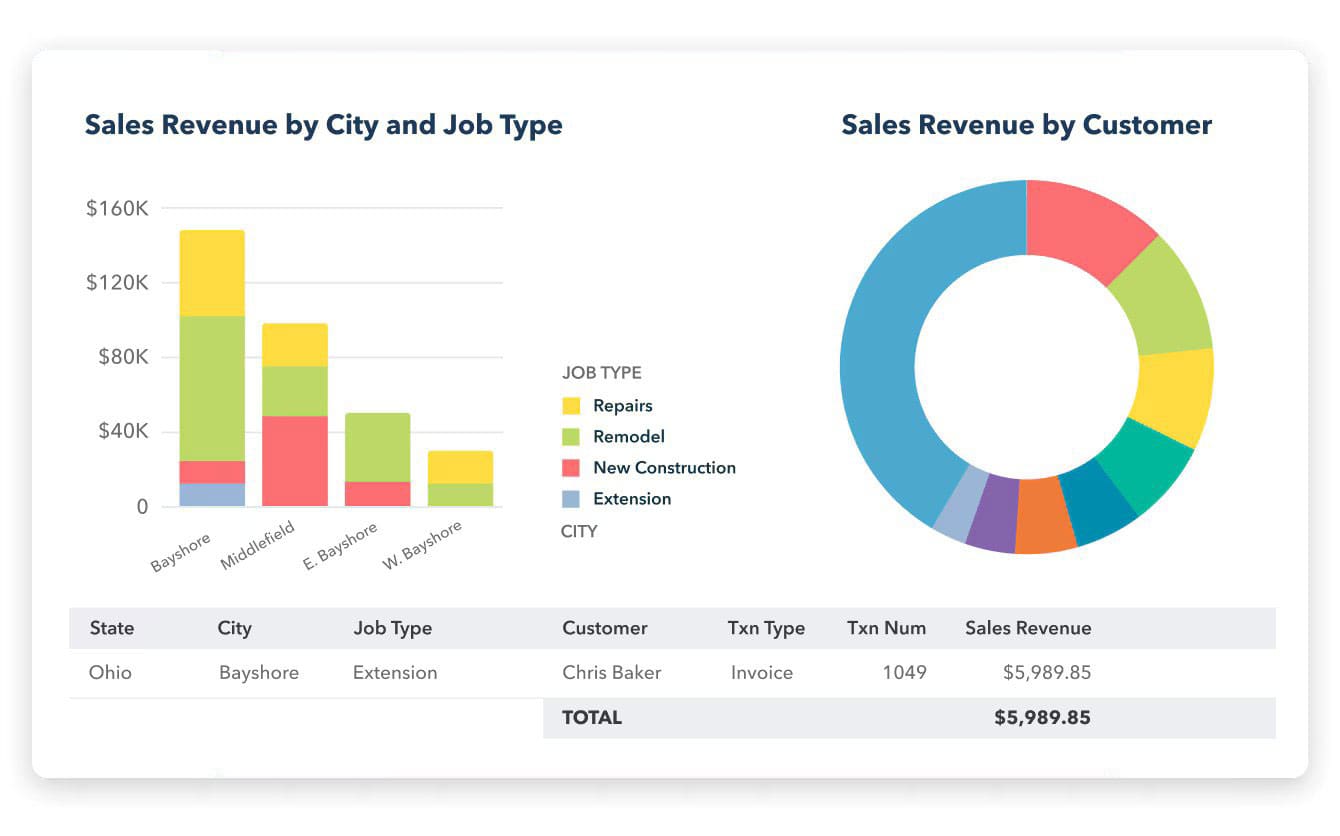

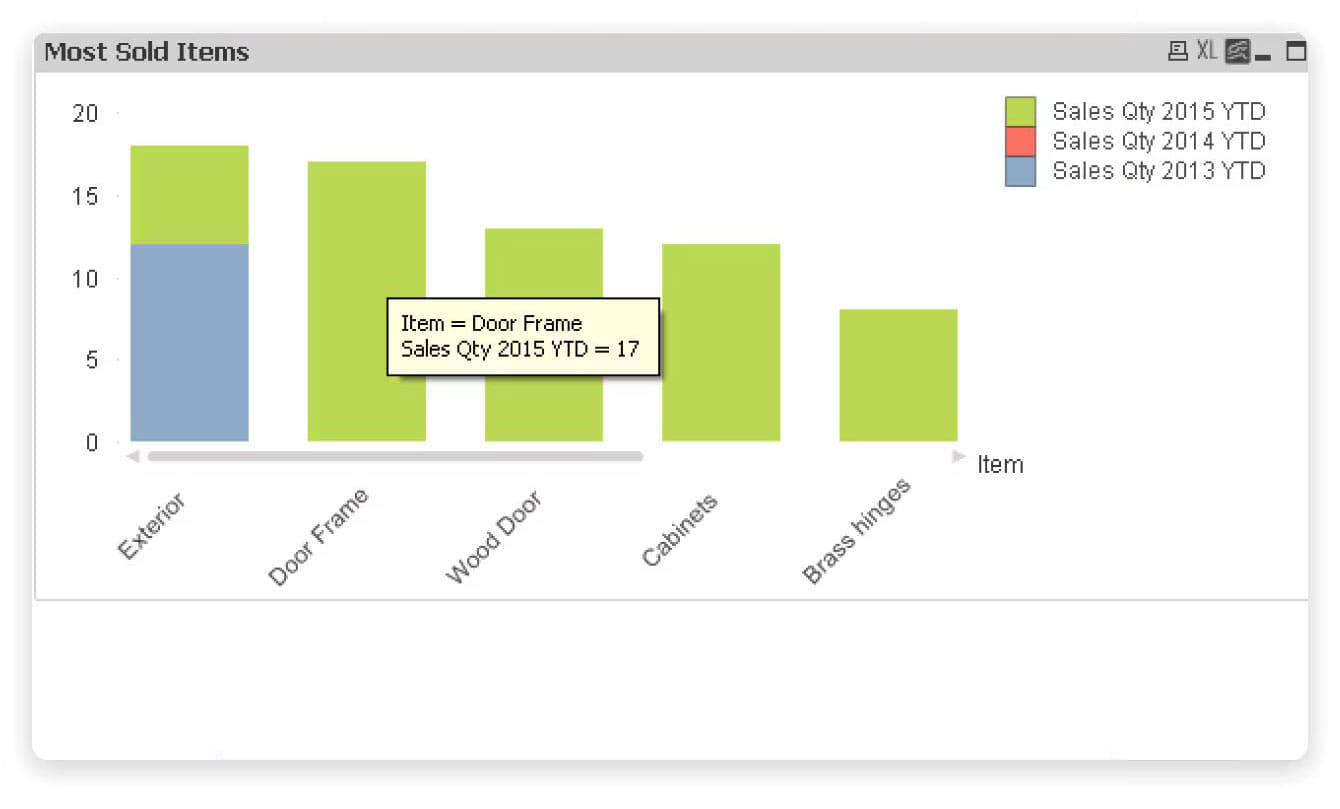

Explore an interactive dashboard that lets you analyze performance across various dimensions including different cities, job types, and customer interactions, tailored specifically for industries like contracting and professional services.

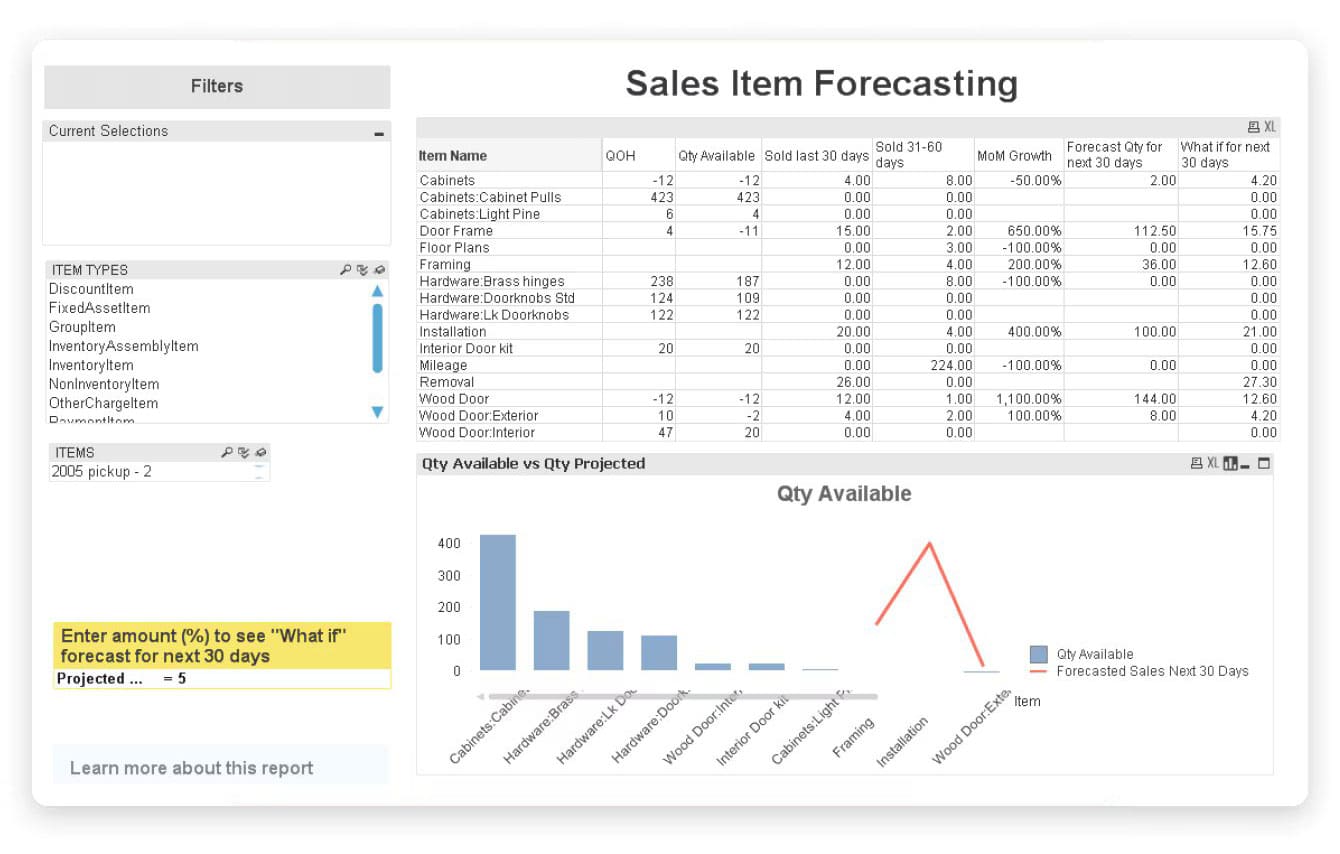

Explore an alternative report template in the Reports list tailored for the Manufacturing and Wholesale, and Retail industries. This report provides insights into your sales over the last 30 days and from 31-60 days ago, tracks your month-over-month growth, and forecasts expected sales quantities for the upcoming 30 days.

View an interactive dashboard that displays sales profitability by customer, which you can customize to analyze profitability based on sales representatives, geographic regions, customer fields, and more. This tool is designed for industries such as Contractor, Manufacturing and Wholesale, Retail, and Professional Services.

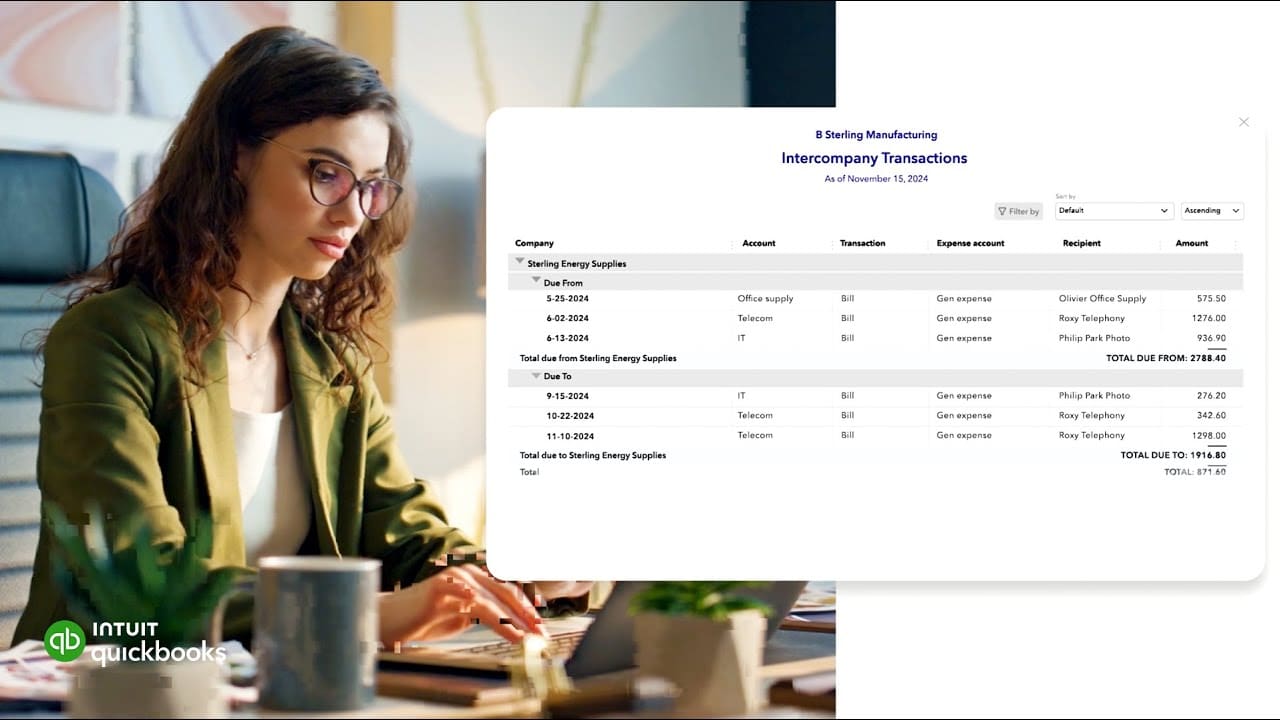

Enterprise simplifies multi-company reporting by enabling the consolidation of reports from different business entities. Additionally, you can generate intercompany transactions reports and apply filters by date range to gain deeper insights into historical transactions.

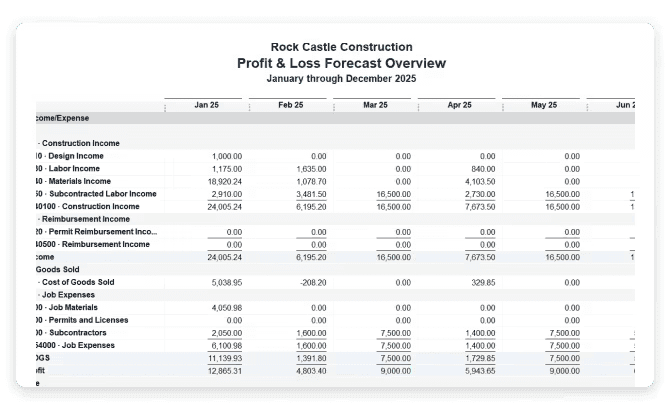

Enterprise offers budgeting and forecasting tools that aid in creating and adjusting budget plans and forecast scenarios. You can either start your next year’s budget from the ground up or initiate it using the previous year’s Profit and Loss data. Enterprise also enables you to forecast future revenues and cash flows; you can base your financial forecasts on last year’s data or develop them from scratch.

Powerful, customizable reports come standard

Enterprise includes more than 200 built-in reports, including 70 industry-specific reports, all customizable to suit your business needs. Take a look below to see what comes with Enterprise right out of the box:

- Profit & Loss Standard: How much money did my company make or lose over a specific period of time?

- Profit & Loss Detail: What are the year-to-date transactions (and totals) for each income and expense account, so I can determine what contributed to my company’s net profit?

- Profit & Loss Year to Date Comparison: How do my income and expenses for a recent period of time compare to the entire fiscal year to date?

- Profit & Loss Previous Year Comparison: Is my company making more money now than for the same period a year ago?

- Profit & Loss by Job: How much money is my company making or losing on each job?

- Profit & Loss by Class: How much money did my company make or lose on each business segment that is tracked through QuickBooks classes?

- Profit & Loss Unclassified: How much money did my company make or lose that is not tracked through QuickBooks classes?

- Balance Sheet Standard: What is the value of my company (its assets, liabilities, and equity), showing me the individual balances for each account?

- Balance Sheet Detail: What is the value of my company (its assets, liabilities, and equity), showing me the transactions and the starting and ending balances for each account?

- Balance Sheet Summary: What is the value of my company (its assets, liabilities, and equity), showing me the total balance for each type of account?

- Previous Year Comparison: How has the value of my company (its assets, liabilities, and equity), changed compared to the same date one year ago?

- Balance Sheet by Class: What is the value of my company/organization (its assets, liabilities, and equity), broken down by class?

- Net Worth Graph: How have my company’s assets, liabilities, and equity (i.e., its net worth) changed over a specific period of time?

- Income by Customer Summary: What is the gross profit (sales minus cost of goods sold) received from each customer?

- Income by Customer Detail: What is the gross profit (sales minus cost of goods sold), broken down by transaction, received from each customer?

- Expenses by Vendor Summary: What are my company’s total expenses for each vendor?

- Expenses by Vendor Detail: What are my company’s total expenses, per transaction, for each vendor?

- Income & Expense Graph: How does my company’s income compare to expenses? What are the largest sources of income and expenses?

- Statement of Cash Flows: What was the cash inflow (from profit and additional cash received) and cash outflow (cash spent) during a specific period of time?

- Cash Flow Forecast: What income and expenses can I anticipate over the next few weeks from receivables, payables, and banking?

- A/R Aging Summary: How much does each customer owe? How much of each customer’s balance is overdue?

- A/R Aging Detail: Which invoices or statement charges are due and overdue? Send out batch reminders to customers behind in their payments. And with recent performance updates made by QuickBooks, you can run your A/R Aging Detail report more quickly.

- Account Receivable Graph: For the total amount owed by my customers, what proportion of that amount is overdue? ( i.e., show me a graph of the information in the A/R aging summary report.)

- Open Invoices: Which invoices or statement charges haven’t been paid and when are they due?

- Collections Report: Which customers are overdue, how much do they owe, and what are their phone numbers?

- Average Days to Pay: On average, how many days does it take a customer to pay you?

- Customer Balance Summary: How much does each customer owe?

- Customer Balance Detail: What payments and invoices make up each customer’s current balance?

- Unbilled Cost by Job: What job-related expenses haven’t been charged to customers?

- Transaction List by Customer: What transactions has my company had with each customer?

- Price Rules by Customer: What price rules apply to each customer?

- Customer Phone List: What is the phone number for each customer?

- Customer Contact List: What is the contact information and current balance of each customer?

- Item Price List: What is the price of each item or service my company sells?

- Vendor Phone List: What is the phone number for each vendor?

- Vendor Contact List: What is the contact information and current balance for each vendor?

- Employee Contact List: What is the contact information and social security number for each employee?

- Other Names Phone List: What are the phone numbers of the people on my Other Names list? What transaction names (such as ATM) are on the list?

- Other Names Contact List: What is the contact information for each name?

- Sales by Customer Summary: What are the total sales for each customer and job?

- Sales by Customer Detail: What are the sales to each customer and job, broken down by transaction?

- Sales by Ship to Address: What are the sales by ship to address, broken down by transaction?

- Pending Sales: Which sales are marked as pending?

- Sales Graph: Which month has the highest sales revenue? Which items, customers, or sales reps bring in the most income?

- Sales by Item Summary: For each item or service: how many have been sold, what is the total dollar sales, and what is its percentage of my total sales? Which items and/or services bring in the most/least income?

- Sales by Item Detail: What are the sales of each item, broken down by transaction?

- Sales by Rep Summary: What is the total sales for each sales representative?

- Sales by Rep Detail: Which sales did each sales representative make?

- Open Sales Orders by Customer: What are the open sales orders for each customer or job?

- Open Sales Orders by Item: What are the open sales orders for each item?

- Job Profitability Summary: What total amount has my company made or lost on each job?

- Job Profitability Detail: For a particular job, what activities have generated the most (and least) profit? You’ll be prompted to select the job for which you want to run this report.

- Profit & Loss by Job: How much money is my company making or losing on each job?

- Item Profitability: What total amount has my company made or lost on each inventory item, part, service, or expense for which we bill customers?

- Unbilled Costs by Job: What job-related expenses haven’t been charged to customers?

- Committed Costs Report: What are my committed expenses for this job, including purchase orders and unpaid employee hours?

- Work in Progress Report (WIP): For my current jobs, how am I doing on revenue compared to forecast?

- Job Estimates vs. Actuals Summary: How well does my company estimate the costs and revenue for each job?

- Job Estimates vs. Actuals Detail: How well does my company estimate the costs and revenue for each aspect of a particular job?

- Job Progress Invoices vs. Estimates: For each progress invoice, how much of the estimated amount has been billed?

- Item Estimates vs. Actuals: How well did my company estimate the costs and revenue for each item, part, service, or expense for which we bill customers?

- Estimates by Job: What estimates have been assigned to each customer or job?

- Open Purchase Orders by Job: What purchase orders are currently open (i.e., have items still on order) for each job?

- Time by Job Summary: How much time did my company spend on each job?

- Time by Job Detail: How much time did my company spend on each aspect of each job?

- Time by Name: How much time has each employee (or subcontractor) spent on each job?

- Time by Item: How much time has my company spent on each service we provide?

- Mileage by Vehicle Summary: For each vehicle, what is the total mileage and the mileage expense? What is the total miles for all vehicles?

- Mileage by Vehicle Detail: What is the trip information for each vehicle, including mileage,trip date, mileage rate, and mileage expense? What is the total mileage and mileage expense for all vehicles?

- Mileage by Job: Summary For each job, what is the total mileage and the billable amount?

- Mileage by Job Detail: What is the trip information for each job, including the vehicle used, mileage, trip date, mileage rate, and mileage expense? What is the total mileage and mileage expense for all jobs?

- A/P Aging Summary: How much does my company owe each vendor? How much of the balance for each vendor is overdue?

- A/P Aging Detail: Which bills are due and overdue?

- Accounts Payable Graph: For the total amount owed to vendors, what proportion of that amount is overdue? (i.e., show me a graph of the information in the A/P aging summary report.)

- Vendor Balance Summary: What is my company’s current balance with each vendor?

- Vendor Balance Detail: What transactions make up my company’s current balance with each vendor?

- Unpaid Bills Detail: How much does my company owe each vendor, and are any payments overdue?

- Transaction List by Vendor: What transactions has my company had with each vendor?

- 1099 Summary: What amounts need to be reported for each vendor that receives a 1099-MISC form? Important: Check this report before you print the forms.

- 1099 Detail: Which vendor transactions are subject to reporting on the 1099-MISC form?

- Sales Tax Liability: For my company’s total sales, how much is taxable, at what rate, and how much sales tax is currently due to be paid?

- Sales Tax Revenue Summary: For my company’s total sales, how much is taxable? For the non-taxable sales, how much is for non-taxable labor?

- Summary: What are my company’s total purchases from each vendor?

- Detail: What are my company’s total purchases, broken down by transaction, from each vendor?

- Accounts Payable Graph: For the total amount owed to vendors, what proportion of that amount is overdue? (i.e., show me a graph of the information in the A/P aging summary report.)

- Summary: For each item or service, how many has my company bought, and what is the total amount spent?

- Detail: What are my company’s total purchases for each item and service, broken down by transaction?

- Open Purchase Orders: For all open purchase orders, what are the vendor name, PO number, amount, order date, and the expected delivery date?

- Open Purchase Orders Detail: What purchase orders are currently open (i.e., have items open on order) for each job?

- Open Purchase Orders by Job: What purchase orders are currently open (i.e., have items still on order) for each job?

- Inventory Valuation Summary: What is the current asset and retail value of each inventory item?

- Inventory Valuation Detail: Which transactions have affected the value of my inventory?

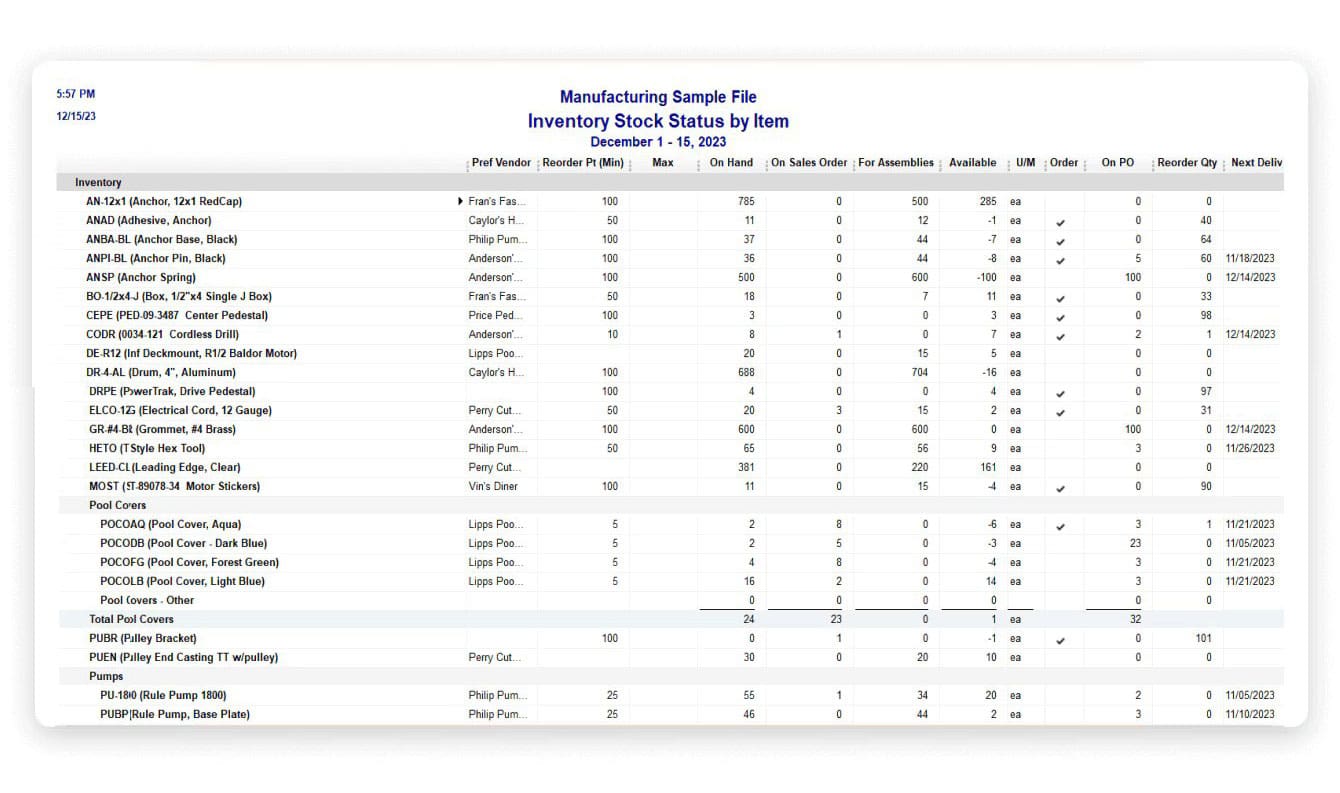

- Inventory Stock Status by Item: What is the detailed information about each inventory item? Includes stock on hand, to show if it’s time to reorder.

- Inventory Stock Status by Vendor: What is the detailed information about each inventory item, organized by vendor? Includes stock on hand, to show if it’s time to reorder.

- Physical Inventory Worksheet: A worksheet that you can use to check your physical inventory against your QuickBooks records.

- Pending Builds*: Which builds are marked as pending, and what is the detailed information for each of them?

- Quantity on Hand by Site*: What is the quantity on hand for each inventory item at each site?

- Inventory Valuation – Summary by Site*: Report that summarizes the value of your inventory at each site and groups your inventory items by site.

- Inventory Stock Status by Site*: For each site, what is the reorder point, quantity on hand, quantity on order, quantity on PO, and average sales per week? What items do I need to order for each site?

- Pending Build by Site*: Which build transactions are pending and in which site(s)?

- Inventory Sales by Site*: What are the quantity and sales amounts for each inventory part at each site?

- Transaction List by Serial/Lot Number: Which transactions were associated with which serial numbers or lot numbers? Find all transactions, including assemblies, subassemblies, purchases, adjustments, transfers and sales of a lot – for recall purposes.

- Serial/Lot Numbers in Stock: Which serial or lot numbers do I have in stock for each item?

- Quantity on Hand by Serial/Lot Number: How many items of a particular serial or lot number do I have on hand?

- Items by Bin Location*: Lists items and quantities in each bin, ordered by bins within each site.

* These reports are included with QuickBooks Desktop Enterprise Advanced Inventory. Additional fees apply for the Advanced Inventory add-on subscription.

- Payroll Summary: What are the accumulated totals for the payroll items (taxes withheld, etc.) on each employee’s recent paychecks?

- Payroll Item Detail: What is the line-by-line breakdown of each recent payroll transaction by item?

- Payroll Detail Review: What values are used to calculate individual payroll items on employee paychecks?

- Payroll Transactions by Payee: Who received paychecks and what was the net pay? What payroll liability checks were written for payroll taxes and expenses?

- Payroll Transaction Detail: What is the line-by-line breakdown of each recent payroll transaction by employee?

- Payroll Liability Balances: What payroll-related taxes and fees does my company currently owe to the government and other agencies?

- Payroll Item Listing: What is the latest information (amount, rate, annual limit, agency, etc.) for the line items in my company’s payroll transactions?

- Employee Earnings Summary: What are the total earnings and deductions for each employee?

- Employee State Taxes Detail: What wage and withholding information do I need for my state payroll taxes?

- Employee Contact List: What is the contact information and social security number for each employee?

- Employee Withholding: What is the federal and state withholding information for each employee?

- Paid Time Off List: What are the sick and vacation time balances for each employee?

- Emergency Contact List: What is the emergency contact information for each employee?

- New Hire List: Who are the new employees that were hired by the company this month?

- Terminated Employees List: Who are the employees that were terminated by the company this month?

- Workers Comp Summary: How much workers compensation insurance does my company owe?

- Workers Comp by Code & Employee: How much workers compensation insurance does my company owe for each employee?

- Workers Comp by Job Summary: How much workers compensation insurance does my company owe for each job?

- Workers Comp Detail: What is the breakdown of my company’s workers compensation premiums, by transaction?

- Workers Comp Listing: What are my company’s workers compensation job classification codes and their rates?

- Deposit Detail: Lists all deposited and undeposited payments, including the customer who made the payment and how much of each payment was included in the deposit.

- Check Detail: What checks have been written, including the details of each one?

- Missing Checks: For a specified account, lists all checks that have been written so you can check for missing and duplicate check numbers. You can also use this report to check for duplicate or missing invoices in accounts receivable or payments in a current asset account.

- Reconciliation Discrepancy: For a specified account, what reconciled transactions have been modified since this account was last reconciled? (You’ll be prompted for some account information before you can display this report.)

- Previous Reconciliation: What transactions were cleared or outstanding from a previous reconciliation? (You’ll be prompted for some account information before you can display this report.)

- Adjusted Trial Balance: For accountants only. What are the effects of my adjustments on the trial balance?

- Check Detail: Adjusting Journal Entries

- Trial Balance: What is the ending balance for all accounts?

- General Ledger: What is the recent activity in all my company’s accounts, with beginning and ending balances for each account?

- Transaction Detail by Account: What are the recent transactions for each account in my Chart of Accounts?

- Journal: What are the most recent transactions, in chronological order?

- Audit Trail: What changes affected my company’s books during a specified accounting period? Who made the changes?

- Closing Date Exception Report: What changes were made after the last closing date was set to transactions dated on or before that closing date?

- Voided / Deleted Transactions: Which transactions have been voided or deleted?

- Voided / Deleted Transactions History: What is the detailed history of voided and deleted transactions?

- Transaction List by Date: What transactions were entered for a specified period of time?

- Account Listing: What are the names of each of my company’s accounts? What is the current balance of each balance sheet account?

- Fixed Asset Listing: For my company’s fixed assets, what are the purchase date, description, and original cost of each asset?

- Item Price List: What is the price of each item or service my company sells?

- Item Listing: What is the latest information (price, cost, quantity on hand, etc.) for each product or service that my company sells?

- Unit of Measure Set: Listing For each unit of measure set, what are the current base, purchase, sales, and shipping units?

- U/M Sets with Related Units: What related units are in each unit of measure set? How many base units does each related unit contain?

- Items with Units of Measure: Which items are currently assigned units of measure?

- Payroll Item Listing: What is the latest information (amount, rate, annual limit, agency, etc.) for the line items in my company’s payroll transactions?

- Workers Comp Listing: What are my company’s workers compensation job classification codes and their rates?

- Fixed Asset Listing: For my company’s fixed assets, what are the purchase date, description, and original cost of each asset?

- Terms Listing: What are the due dates and discounts available for customer payments and payments to vendors?

- To Do Notes: What tasks on my To Do list haven’t been done yet?

- Memorized Transaction Listing: What is the latest information for all memorized transactions?

- Income Tax Preparation: What tax line is assigned to each account in my chart of accounts?

- Income Tax Summary: Based on tax line assignments, what amounts does my company need to report on its income tax forms?

- Income Tax Detail: What transactions make up each amount on my company’s income tax forms?

- Budget Overview: What are my company’s projected income and expenses for each month?

- Budget vs. Actual: For the company as a whole, how do the actual income and expenses compare to what has been budgeted?

- Profit & Loss Budget Performance: How do the actual income and expenses compare to what has been budgeted for the current month and year?

- Budget vs. Actual Graph: Are my company’s income and expenses over or under budget?

- Forecast Overview: What are my company’s forecasted income and expenses for each month?

- Forecast vs. Actual: For the company as a whole, how do the actual income and expenses or account balances compare to what has been forecasted?

19 additional custom-built reports for contractors

JOB COSTS & BILLS REPORTS

- Job Status: What is the status of all active jobs?

- Job Costs by Vendor & Job Summary: What are my company’s job-related expenses for each vendor, subtotaled by job?

- Job Costs by Vendor & Job Detail: What are my company’s job-related expenses for each vendor, subtotaled by job? What are the transactions for those expenses?

- Job Costs by Job & Vendor Summary: What are my company’s job-related expenses for each job, subtotaled by vendor?

- Job Costs by Job & Vendor Detail: What are my company’s job-related expenses for each job, subtotaled by vendor? What are the transactions for those expenses?

- Job Costs Detail: What are the expenses my company has incurred for each job?

- Cost to Complete by Job Summary: What is the expected cost to complete all of my jobs? How much is each job over or under estimate?

- Cost to Complete by Job Detail: What is the expected cost to complete a particular job, and what should it cost to complete each item of that job? How much is each item over or under estimate?

- Unpaid Bills by Job: For each job, which bills haven’t been paid?

- Unpaid Job Bills by Vendor: For each vendor, which bills haven’t been paid?

- Expenses Not Assigned to Jobs: What are the expenses that haven’t been assigned to a customer or job?

BILLED/UNBILLED HOURS REPORTS

- By Person: How much time has each employee or subcontractor worked? What is the billable status of that time?

- By Person & Job: How much time has each employee or subcontractor spent on each job? What is the billable status of that time?

- By Person & Activity: How much time has each employee or subcontractor spent on each job and item? What is the billable status of that time?

OPEN PURCHASE ORDERS REPORTS

- Open Purchase Orders by Vendor: What are the open purchase orders, by vendor?

- Open Purchase Orders by Vendor Detail: What are the open purchase orders, by vendor, including detailed information about each transaction?

- Certified Payroll – Box 1 Employee Information: What is each employee’s social security number and address for filling out Box 1 of a Certified Payroll Report?

- Vendor Account Information: What is the detailed information about each vendor, including balance and contact information?

- Customer Account Information: What is the detailed information about each customer, including billing and contact information?

11 additional custom-built reports for manufacturers and wholesalers

SALES REPORTS

- Sales by Rep Detail: Which sales did each sales representative make?

- Sales by Product: What are my company’s best-selling products? Which products have brought in the most revenue?

- Sales by Customer Type: Which group of customers provides my company with the most sales revenue?

- Sales Volume by Customer: Which customers bring in the most revenue?

- Sales By Class & Item Type: How much does my company make on each item type, listed by class?

- Profitability by Product: Which products are most profitable?

- Open Sales Orders by Customer: What are the open sales orders for each customer or job?

- Open Sales Orders by Item: What are the open sales orders for each item?

OTHER REPORTS

- Inventory Reorder Report by Vendor: What items, from each vendor, do I need to reorder?

- Assembly Bill of Materials Report: What components parts are included in my Bill of Materials? What is the cost of these components?

- Open Purchase Orders by Item: What are the open purchase orders for each item?

FORMS & WORKSHEETS

- Return Materials – Authorization (RMA) Form: Use this form to capture data on which items are being returned, who is returning them, and why they are being returned.

- Damaged Goods Log: Use this form to document inventory items that are being scrapped so that you can adjust your inventory accordingly.

- Non-conforming Materials Worksheet: Use this form to document which items are being returned to your vendors, and why.

- Physical Inventory Worksheet: When it’s time to do a physical inventory, use this printout to record the actual quantity on the shelves and compare it to the quantity in QuickBooks

9 additional custom-built reports for Nonprofits

DONORS/GRANTS REPORTS

- Biggest Donors / Grants: Who are my biggest donors and what were their total contributions?

- Budget vs. Actual by Donors / Grants: How much money was contributed by each donor, and how much of that money has been spent versus what was budgeted?

- Donors / Grants Report: How much money was contributed by each donor or grant and how much of that money has been spent?

- Donor Contribution Summary: How much money was contributed by each donor or grant?

PROGRAMS/PROJECTS REPORTS

- Budget vs. Actual by Program / Projects: How much money was contributed to and spent on each program versus what was budgeted?

- Programs / Projects Report: How much money was contributed to and spent on each program?

- Statement of Financial Income & Expense: What money came in (income) and how it was spent (expense)?

- Statement of Financial Position: What is the financial position of my organization at any point in time?

- Statement of Functional Expenses (990): What are my expenses and how can I show that information to my board, major donors, and other important funders?

17 additional custom-built reports for Consultants, Engineers, Architects, Attorneys, Designers, Ad Agencies, and more.

PROJECTS REPORTS

- Project Costs Detail: What expenses has my company incurred for each project?

- Unbilled Expenses by Project: What expenses incurred for each project haven’t been billed?

- Expenses Not Assigned to Projects: What expenses haven’t been assigned to a customer or project?

- Billed vs. Proposal by Project: How well did estimated income match actual income for each project?

- Open Balances by Customer / Project: Which invoices or statement charges haven’t been paid, and when are they due?

- A/R Aging Detail by Class: For each class (for example, for each partner), which invoices or statement charges are due and overdue?

- Project Status: What is the status of all active projects?

- Project Contact List: What is the contact information and balance for each customer or project?

BILLED/UNBILLED HOURS REPORTS

- Billed / Unbilled Hours by Person: How much time has each employee or subcontractor worked? What is the billable status of that time?

- Billed / Unbilled Hours by Person & Project: How much time has each employee or subcontractor spent on each project? What is the billable status of that time?

- Billed / Unbilled Hours by Person & Activity: How much time has each employee or subcontractor spent on each job and item? What is the billable status of that time?

JOB COSTS & BILLS REPORTS

- Job Costs by Vendor & Job Summary: What are my company’s job-related expenses for each vendor, subtotaled by job?

- Job Costs by Vendor & Job Detail: What are my company’s job-related expenses for each vendor, subtotaled by job? What are the transactions for those expenses?

- Job Costs by Job & Vendor Summary: What are my company’s job-related expenses for each job, subtotaled by vendor?

- Job Costs by Job & Vendor Detail: What are my company’s job-related expenses for each job, subtotaled by vendor? What are the transactions for those expenses?

- Cost to Complete by Job Summary: What is the expected cost to complete all of my jobs? How much is each job over or under estimate?

- Cost to Complete by Job Detail: What is the expected cost to complete a particular job, and what should it cost to complete each item of that job? How much is each item over or under estimate?

14 additional reports designed specifically to help retailers manage sales, inventory and customer information.

COMPANY & FINANCIAL REPORTS

- Profit & Loss Monthly Comparison: How does my company’s profit and loss for this month compare to last month?

- Balance Sheet Monthly Comparison: How does my company’s balance sheet compare to last month? Is my company’s financial condition improving?

SALES REPORTS

- Sales Graph: Which month has the highest sales revenue? Which items, customers, or sales reps bring in the most income?

- Monthly Sales by Customer: If my company tracks sales by customer, who were the best customers and what was their sales activity over the last fiscal year?

- Gross Margin by Inventory Item: If my company records each sales transaction, what is its gross margin for each inventory item?

CUSTOMERS & RECEIVABLES REPORTS

- Customer Payments by Payment Item: What methods are my customers using to provide payment? What are the monthly payments trends from the past year?

- Estimates by Customer: What outstanding estimates does my company have for each customer?

VENDORS REPORTS

- Bills by Due Date: What bills are due and when? Which bills are due first?

- Sales Tax Liability: For my company’s total sales, how much is taxable, at what rate, and how much sales tax is currently due to be paid?

- Purchase Volume by Vendor: From which vendors does my company purchase the most goods?

- Vendor Returns Summary: Which vendors generate the largest volume of returned goods?

- Vendor Returns Detail: What goods are most commonly returned to each vendor?

- Open Purchase Orders by Vendor: What are the open purchase orders, by vendor?

- Accounts Payable Graph: For the total amount owed to vendors, what proportion of that amount is overdue?

Looking for more? See what Diamond can do for you.

Enterprise Diamond includes key features like full service payroll, mobile time tracking, inventory, pricing rules, and workflow automations so you can get more done.

Assisted Payroll built in to Enterprise Diamond includes automated tax filings, direct deposit and tax penalty protection.

Enterprise Diamond Edition includes QuickBooks Time Elite for scheduling, time tracking and job costing.

See why people choose QuickBooks Enterprise

What clients say…

More than 200,000 companies have chosen QuickBooks Enterprise to manage their accounting, inventory, payroll, and payments and according to recent data, 88% of users rated it 4 or 5 stars.

Where we were making guesses before, now with QuickBooks Enterprise, we can calculate the cost down to a screw.

We can figure out how much actual profit we’re making, which is truly remarkable in the service-based industry.

The Advanced Inventory module allows me to track inventory in all of our locations. It’s brilliant!

We’re able to use QuickBooks Enterprise’s features to predict and forecast inventory that we will need in the future.

We must have visibility into what a job costs. With QuickBooks Enterprise, we can get a really good picture of where we’re at.

Quickbooks makes it easy for me to customize reports and see where my money is coming from and where it’s going, so I know where to focus my efforts.

I love Quickbooks because I can access important information about my business from anywhere.

Managing your own finances, it can be very daunting… [Quickbooks] has made it much more approachable. I would say anybody can do it.

Frequently Asked Questions

What is QuickBooks Advanced Reporting?

QuickBooks Advanced Reporting lets you create tailored reports by utilizing your QuickBooks data to meet specific business requirements, enhancing your understanding of business performance.

How can I customize a report in QuickBooks Advanced Reporting?

To customize reports, you can modify starter templates or configure elements like tables, charts, and filters within the reporting tool to suit your data presentation needs.

How do I install QuickBooks Advanced Reporting?

Start by updating QuickBooks Enterprise to the most recent version, then sync your license data and select Advanced Reporting from the Reports menu to begin the installation.

How can I access QuickBooks Advanced Reporting?

If you are subscribed to QuickBooks Enterprise at Silver, Gold, or Platinum levels, you can access the QBAR through the Reports menu after installation. If you have questions, you can call one of our QuickBooks Experts at 866-949-7267 and they can help.

Can I create industry-specific reports with QuickBooks Advanced Reporting?

QBAR enables you to craft reports specific to various industries, including manufacturing and wholesale, which helps tailor insights to your particular business context.

What types of reports can I create with QuickBooks Advanced Reporting?

You can generate various reports such as financial statements, payroll details, sales analyses by customer, and detailed vendor purchase records.

How can I ensure my QuickBooks reports use the most accurate and up-to-date information?

Keep your QuickBooks Enterprise updated and regularly sync your license data to ensure the accuracy and currency of the data in your reports.

How can I get training or support for QuickBooks Advanced Reporting?

We have resources like training videos and user guides that we can provide to you. For further assistance, contact our team at 866-949-7267.

Still have questions on QuickBooks Advanced Reporting?

Speak with an expert at 866-949-7267

Terms: *Important pricing details and product information

Purchase and any sales tax where applicable will be billed by Intuit and includes 60 Day Money Back Guarantee. Annual payment option not available for Diamond or Hosted Enterprise subscriptions. *Free software conversion includes QuickBooks Pro, Premier, Online and Sage 50. Please contact us for details if you are looking to convert from other software.