Working With Taxes In QuickBooks Desktop Payroll

Learn how to set up tax payments in QuickBooks Desktop Payroll, how to work with W-2's, all the way to ultimately paying your taxes and liabilities.

Working With Taxes

Setting up payroll taxes in QuickBooks Desktop Payroll.

How to set up tax payments and filings In QuickBooks Desktop Payroll.

How to file W-2 and W-3 forms in QuickBooks Desktop Payroll Enhanced.

How to enter tax payment history in QuickBooks Desktop Payroll.

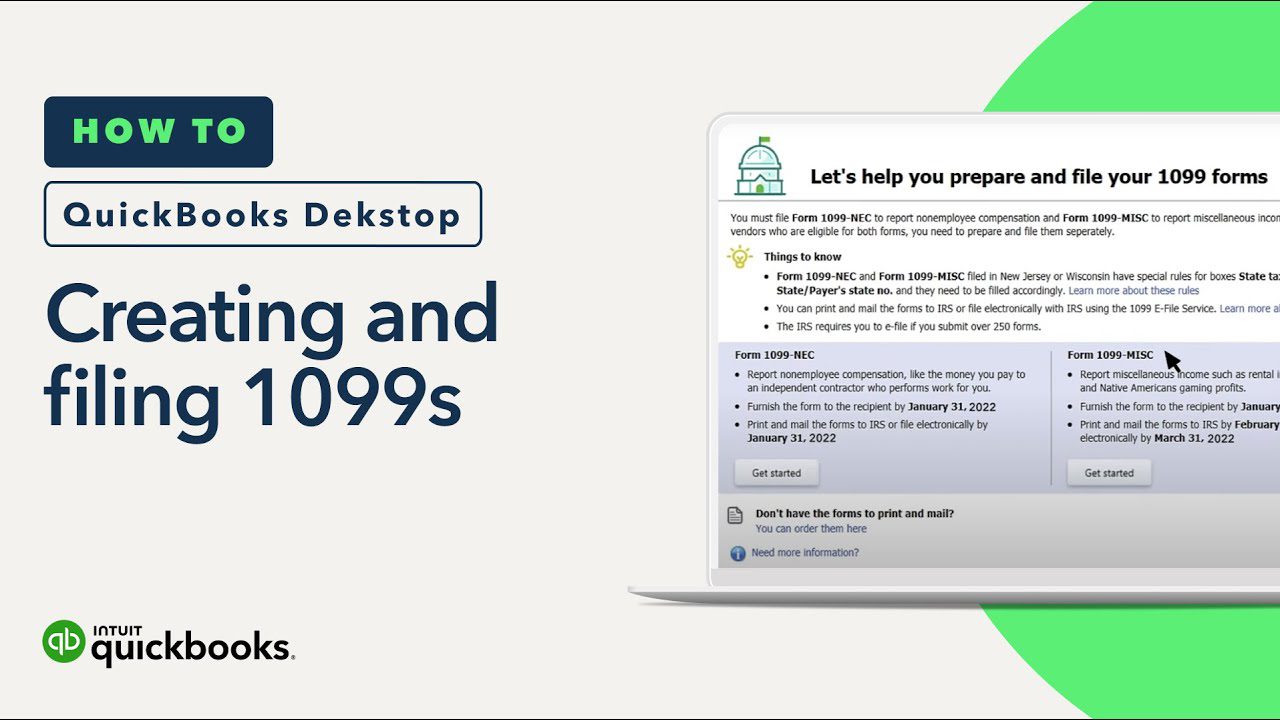

How to create and file 1099’s in QuickBooks Desktop Payroll.

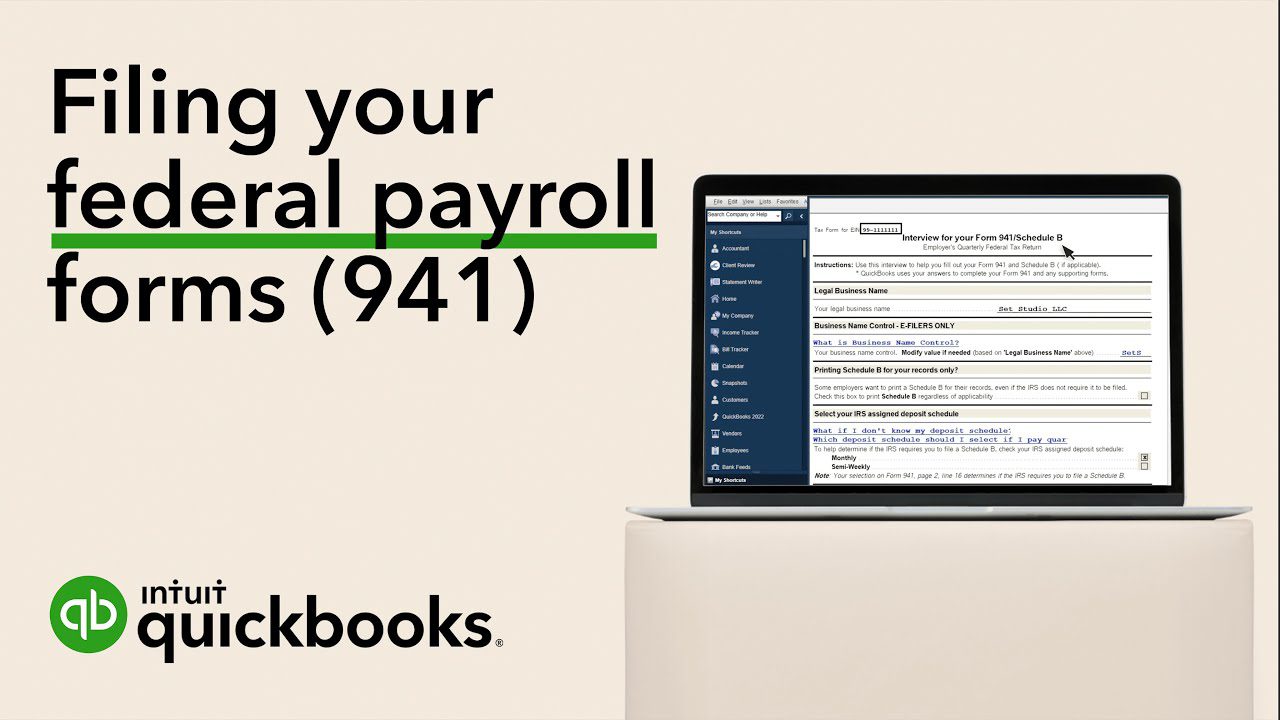

How to file your form 941 with QuickBooks Desktop Payroll Enhanced.

Still have questions on QuickBooks Desktop Payroll?

Just call our QuickBooks Experts at 866-949-7267 or chat with us for additional help.