Paygration, Inc.

Bill.com is a cloud-based billing and invoicing software designed to help businesses automate their accounts payable (A/P) and receivable (A/R) processes. With excellent features like automated workflows, customizable approval processes, and real-time reporting and analytics, Bill.com has become a go-to platform for companies looking to streamline their financial operations.

In this article, we will dive into the features of Bill.com and explore how this platform can help businesses save time, reduce costs, and improve efficiency. This will help you decide whether Bill.com is right for your business.

Bill.com Features

Bill.com offers a wide range of features that help businesses manage their A/P and A/R workflows efficiently. Here are some of the key features of Bill.com:

Accounts Payable Automation

Bill.com automates the accounts payable process by capturing bills, digitizing them, and routing them for approval. The A/P automation process starts with capturing invoices through scanning or forwarding electronic invoices to a dedicated email address and then digitizing them to extract relevant information.

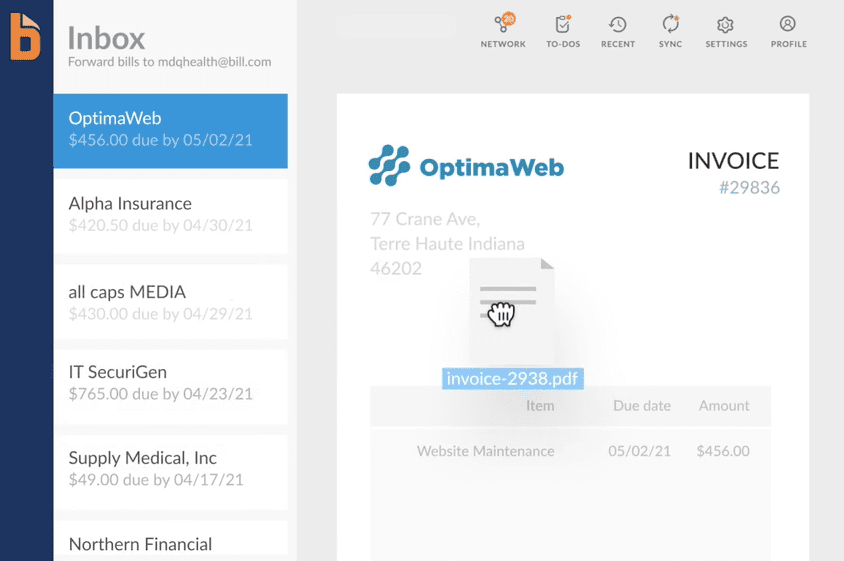

Bill.com has a feature called Inbox and it allows vendors to send their bills electronically to a unique email address created by Bill.com.

Inbox in Bill.com (Source: Bill.com)

After a vendor sends bills to your inbox in Bill.com, the software will automatically extract the relevant data from the bill, including the invoice number, date, amount due, and due date. This information will be used to create a digital record of the bill, which can be easily accessed and managed within the Bill.com platform.

Once the bill is in the system, you can review and approve it for payment, set up payment schedules, and even send payment directly through the Bill.com platform. By automating this process, you can save time, reduce errors, and improve efficiency in your accounts payable workflows.

Accounts Receivable Automation

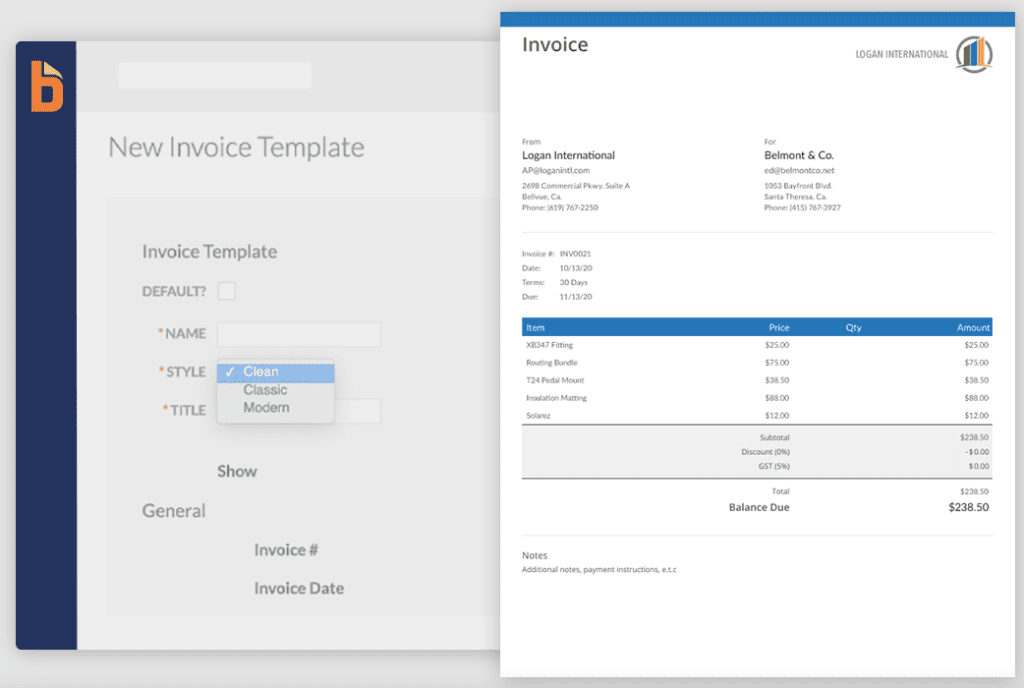

Bill.com makes it easy to create invoices, with customizable invoice templates available or the ability to upload your own templates.

Sample invoice template in Bill.com (Source: Bill.com)

Once created, invoices can be sent electronically via email, and businesses can track their status in real time through Bill.com. Once an invoice is sent, Bill.com automates the payment processing process, enabling customers to pay electronically through ACH or credit card, and providing businesses with real-time tracking of payments.

Bill.com also enables businesses to schedule recurring invoices, which can be automatically sent to customers at regular intervals. Also, you can send automatic reminders to customers with outstanding invoices, reducing the need for manual follow-up.

Document Management

With Bill.com, you can store and manage invoices, receipts, bills, and other financial documents in one centralized location, making it easy to find and retrieve documents when needed. The document management feature in Bill.com supports electronic document storage and eliminates the need for paper documents, reducing manual effort and improving efficiency.

Businesses can upload documents directly to Bill.com or capture them by scanning and forwarding electronic invoices to a dedicated email address. Once uploaded or captured, the documents are digitized, making it easy to search and retrieve documents through Bill.com’s advanced search capabilities.

Customizable Approval Workflows

Approval workflows in Bill.com can be configured to match a business’s specific approval process and can include multiple levels of approval and custom rules for different types of documents. Certain users are assigned to approve invoices or bills based on their role within the organization. For example, an invoice may be automatically routed to a manager for approval before being sent to a finance department for final approval. This enables businesses to maintain strict control over their approval process, ensuring that invoices and bills are only paid once they have been approved by the appropriate parties.

Custom rules can also be set up within approval workflows in Bill.com. These rules can be based on criteria such as invoice amount, vendor, or department and can determine which users are responsible for approving specific invoices or bills. For example, a bill above a certain dollar amount may be automatically routed to a senior manager for approval.

Creating a bill approval workflow in Bill.com (Source: Bill.com)

Approval workflows in Bill.com enable businesses to track the approval process in real time and receive notifications when invoices or bills are approved. This provides businesses with real-time visibility into their financial operations and helps to ensure that invoices and bills are paid on time.

Automatic Bill Codification

One of the best features of Bill.com is that it learns from past transactions, enabling the system to automatically assign the correct general ledger (GL) codes based on the business’s historical data. As bills are captured in Bill.com, the system analyzes past transactions to identify patterns and establish rules for automatic bill codification. For example, if a business consistently assigns a certain GL code to bills from a particular vendor, the system will learn this pattern and automatically apply the same code to future bills from that vendor.

The system also takes into account any changes made to GL codes by the user during the approval process. If a user changes the GL code assigned by the system, the system learns from this change and applies it to future bills with similar criteria.

Automatic bill codification saves time by eliminating the need for manual bill categorization. Also, it reduces the risk of errors by ensuring that bills are consistently categorized and assigned the correct GL codes. Finally, it provides businesses with real-time visibility into their financial operations, making it easy to track expenses and analyze spending patterns.

Reporting & Analytics

With Bill.com, you can create customized reports based on specific criteria such as vendor, expense category, or project. Reports can be generated in various formats, including PDF, CSV, and Excel, and can be easily exported to accounting software or shared with stakeholders.

In addition to generating custom reports, Bill.com provides businesses with a dashboard that displays key financial metrics such as cash flow, outstanding invoices, and bills to pay. The dashboard also provides visual representations of data, such as charts and graphs, making it easy for businesses to identify trends and patterns in their financial data.

Ready to Use Bill.com?

If you think that Bill.com is right for you, contact us and we will help you get started. Our team of experts will work with you to ensure a smooth transition to Bill.com, providing training and support every step of the way. Because we can get Bill.com accounts at wholesale, our costs are less for the same product and services, and we can offer exclusive discounts to our clients – especially on multiple user licenses. That means by working with our team, you can enjoy the same benefits and features of Bill.com plus additional included support and account management – all at a reduced cost. Like to find out more? Call us at 866-949-7267 and one of our Bill.com experts can help answer your questions and get you set up for exactly what you need.