Paygration, Inc.

Job costing is a critical aspect of financial management for businesses involved in projects or contracts, allowing them to track expenses and revenue associated with specific jobs or projects. While both QuickBooks Enterprise and QuickBooks Online offer job costing features, QuickBooks Enterprise provides several advantages that make it the preferred choice, particularly for industries like construction where job costing is essential.

What is Job Costing in QuickBooks Enterprise?

Job costing in QuickBooks Enterprise is a feature designed to help businesses track and manage the costs associated with specific jobs, projects, or contracts. It provides detailed insights into the expenses and revenue related to each job, enabling businesses to accurately estimate costs, monitor profitability, and make informed decisions about resource allocation.

How Job Costing Works in QuickBooks Enterprise

- Setting Up Jobs or Projects:

- In QuickBooks Enterprise, businesses can create a separate job for each project or contract they undertake. This allows them to track expenses and revenue specific to each job. Each job is assigned a unique job name or number for easy identification.

- Allocating Costs to Jobs:

- Businesses can allocate various expenses to specific jobs, including labor costs, materials, subcontractor expenses, equipment rentals, and overheads. Expenses can be entered directly into QuickBooks Enterprise and assigned to the appropriate job. For example, if a construction company purchases materials for a building project, they can record the expense and allocate it to the corresponding job in QuickBooks Enterprise.

- Tracking Time and Labor Costs:

- QuickBooks Enterprise offers integrated time tracking and payroll features, allowing businesses to track employee hours and allocate labor costs to specific jobs. Employees can record their time against specific jobs, and this time data can be seamlessly integrated with payroll. For instance, if a contractor works on multiple projects in a week, they can enter their hours for each project, and QuickBooks Enterprise will calculate the labor costs accordingly.

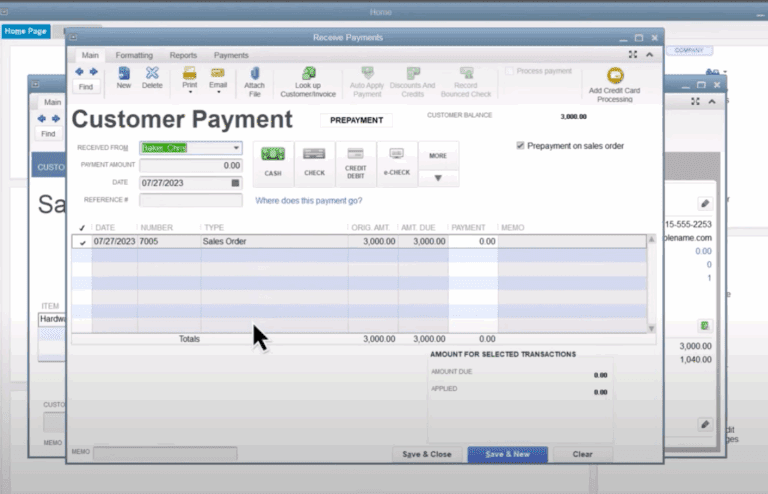

- Recording Revenue and Invoicing:

- Businesses can also track revenue associated with each job, including invoices, progress billings, and change orders. Invoices can be generated directly from QuickBooks Enterprise and linked to the appropriate job, ensuring accurate revenue tracking. When a customer pays an invoice, the revenue is automatically recorded and allocated to the corresponding job.

- Generating Job Reports:

- QuickBooks Enterprise provides customizable job reports that offer insights into project performance. Businesses can generate reports showing job profitability, budget vs. actual comparisons, and project status updates. These reports help businesses make informed decisions about resource allocation, pricing strategies, and project management.

Key Features of Job Costing in QuickBooks Enterprise

Detailed Cost Tracking

- QuickBooks Enterprise allows businesses to track every expense related to a job, including labor costs, materials, subcontractor expenses, equipment rentals, and overheads. Each cost can be allocated to specific jobs, providing a detailed breakdown of project expenses.

Benefits:

- Businesses gain visibility into the true cost of each job, helping them accurately estimate project budgets, identify cost overruns, and improve cost control.

Sample Scenario:

- A construction company tracks labor costs, materials, and equipment rentals for a building project. By allocating these costs to the project in QuickBooks Enterprise, they can monitor expenses in real-time and adjust their budget as needed.

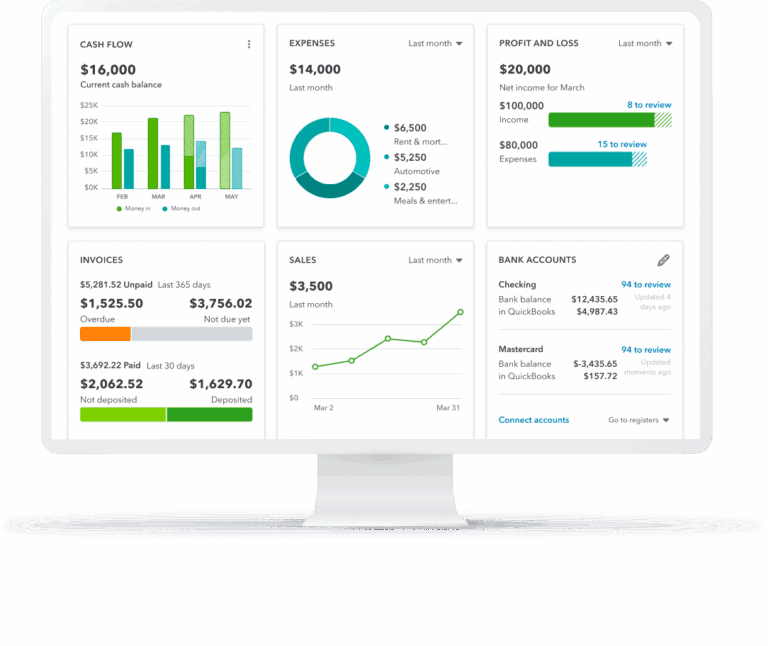

Revenue Tracking

- In QuickBooks Enterprise, businesses can also track revenue associated with each job, including invoices, progress billings, and change orders. This allows businesses to compare actual revenue with estimated revenue for each project.

Benefits:

- By monitoring revenue alongside expenses, businesses can evaluate project profitability, identify profitable projects, and address any billing discrepancies.

Sample Scenario:

- A consulting firm tracks billable hours and invoices for each client project. With QuickBooks Enterprise, they can easily compare actual revenue against estimated revenue, ensuring that they are billing clients accurately and maximizing profitability.

Time Tracking and Payroll Integration

- QuickBooks Enterprise offers integrated time tracking and payroll features, allowing businesses to track employee hours and allocate labor costs to specific job. Time data can be seamlessly integrated with payroll, simplifying the process of paying employees for their work on various projects.

Benefits:

- Businesses can accurately track labor costs, ensure compliance with labor regulations, and streamline payroll processing.

Sample Scenario:

- A landscaping company uses QuickBooks Enterprise to track employee hours spent on different landscaping projects. The integrated payroll feature automatically calculates wages based on the hours worked, reducing manual data entry and payroll errors.

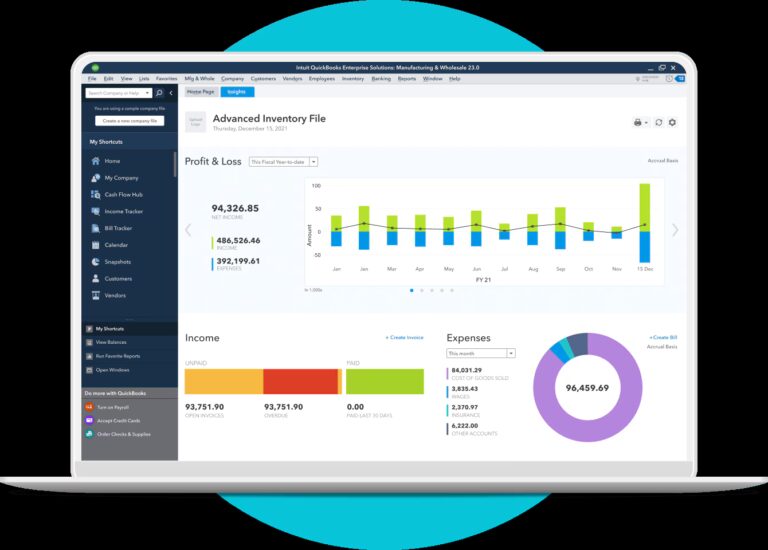

Customized Job Reports

- QuickBooks Enterprise provides customizable job reports that offer insights into project performance. Businesses can create reports showing job profitability, budget vs. actual comparisons, and project status updates.

Benefits:

- Customized reports help businesses make informed decisions about resource allocation, pricing strategies, and project management.

Important Job Costing Reports in QuickBooks Enterprise

Enterprise offers several key job costing reports that provide valuable insights into project performance, profitability, and budgeting. These reports allow businesses to analyze their projects in detail, make informed decisions, and ensure that projects are completed within budget and on time. Here are some of the key job costing reports available in QuickBooks Enterprise:

- Job Profitability Summary: This report provides a summary of the profitability of each job or project. It shows total income, total expenses, and net profit for each job, allowing businesses to quickly assess the overall profitability of their projects.

- Job Profitability Detail: This report provides a detailed breakdown of income and expenses for each job. It lists all transactions associated with the job, including sales, expenses, and labor costs, along with the net profit.

- Job Estimates vs. Actuals: Description: This compares estimated costs and revenue with actual costs and revenue for each job. It shows variances between estimated and actual amounts, highlighting where the project is over or under budget.

- Job Costs by Vendor: This lists all expenses associated with each job, organized by vendor. It shows how much each vendor has billed for materials, services, or subcontracted work for each job.

Explore the top 10 most popular reports in QuickBooks Enterprise.

Get Started with QuickBooks Enterprise

Ready to experience the power of QuickBooks Enterprise for your construction business? Sign up for a free trial with Paygration today and take advantage of our expertise in implementing and optimizing QuickBooks Enterprise for job costing. Contact us at 866-949-7267 to get started and see how QuickBooks Enterprise can streamline your construction project management and drive profitability.