Online Payroll Core

QuickBooks Online Core Payroll is fully automated and includes 24/7 expert product support and next-day direct deposit so you can manage and pay your team.

$50.00 Original price was: $50.00.$25.00Current price is: $25.00. / month + $6.50 per employee

SPECIAL PROMOTION – 50% Off MSRP for the first 3 months.

Access on-demand experts to simplify payday and protect what matters most. Includes next-day direct deposit, auto payroll, unlimited payroll runs, 1099 E-File & Pay plus product support.

- Features

QuickBooks Payroll Core – Basic payroll for small teams

Easily pay your team and have your payroll taxes done for you.

Fully integrated

Your data is automatically synced with QuickBooks Online for simple and error-free accounting.

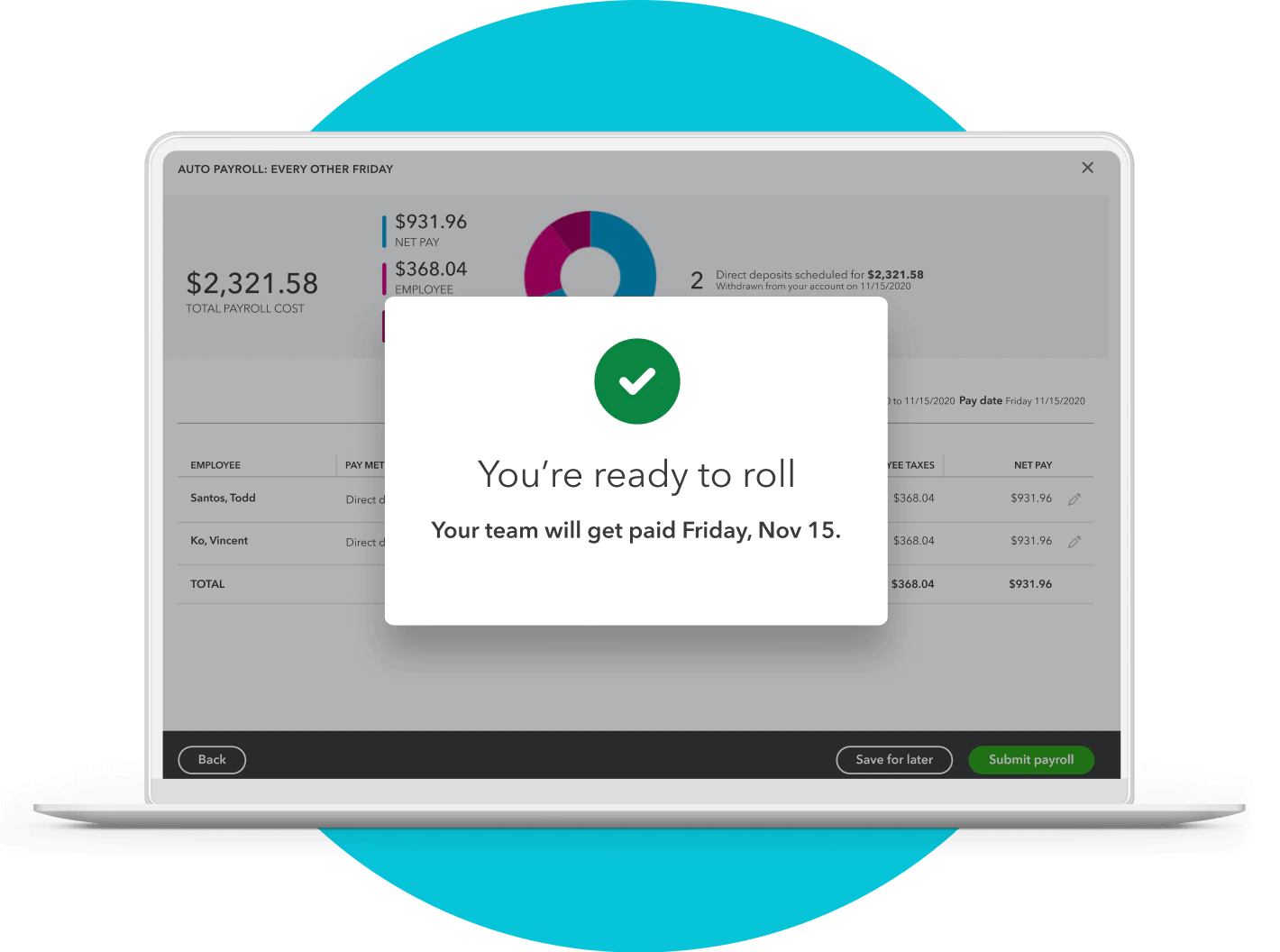

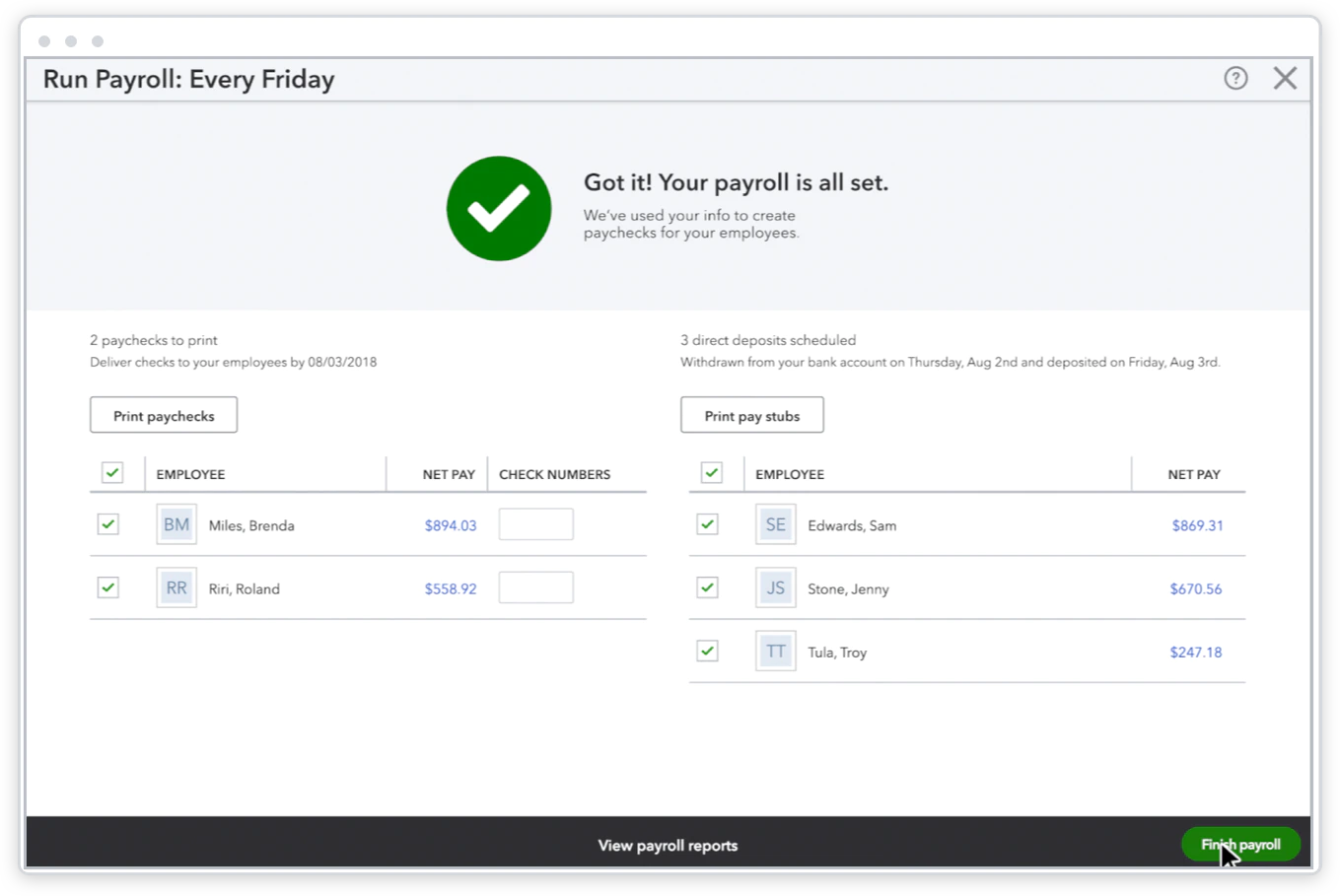

Pay employees fast

Schedule payroll and have your employees paid by direct deposit the very next day.

Automated Payroll

Run auto payroll for salaried employees on direct deposit and review, approve or edit before payday.

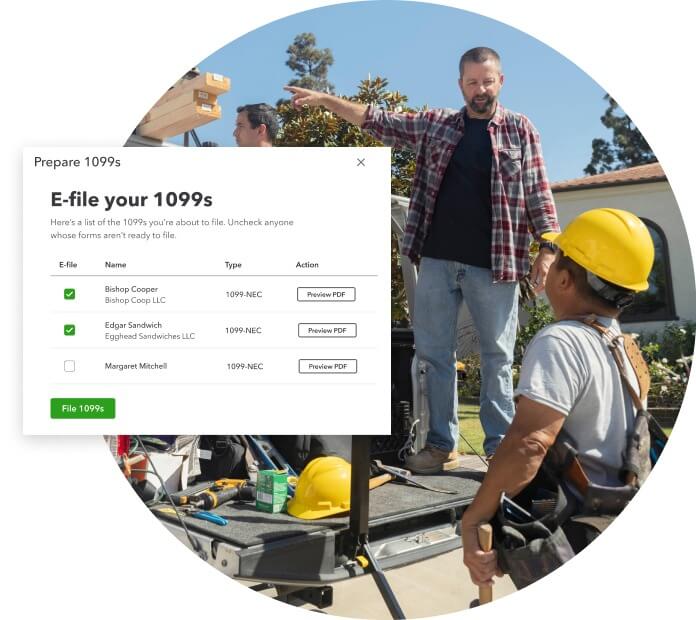

1099 e-file and pay

Create and file unlimited 1099-MISC and 1099-NEC forms and get copies automatically sent

Direct Deposit

With QuickBooks Payroll Core you can keep your cash longer and submit payroll when you’re ready with next-day direct deposit.

QuickBooks Online Payroll Core gives you the tools efficiently pay a small team.

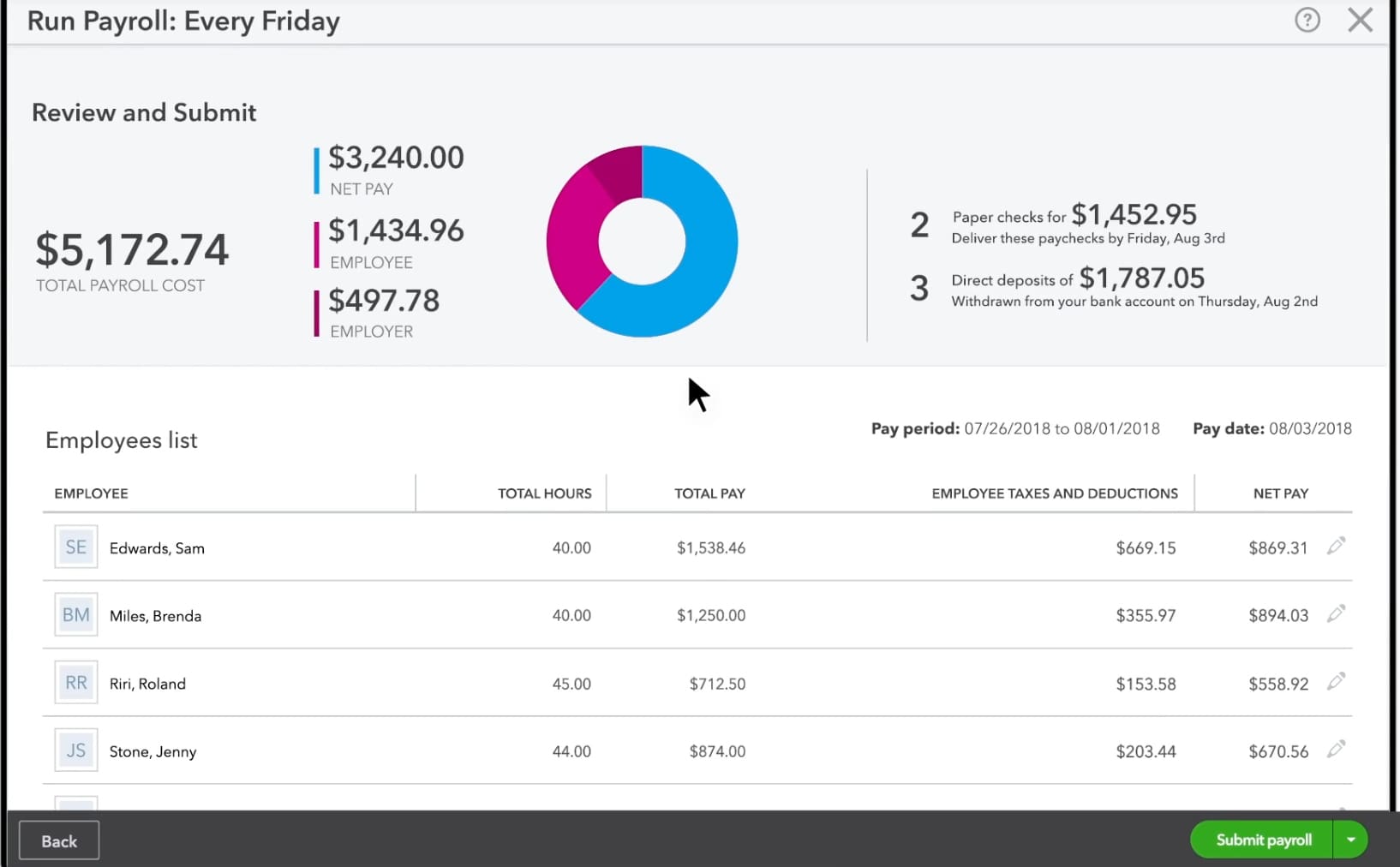

Get payroll that’s accurate, easy, and built for small teams. You can easily approve payroll when you’re ready, and manage everything in one place. Additionally, you can set payroll to run automatically and we’ll calculate, file, and pay your federal and state payroll taxes for you.

Choose a QuickBooks Payroll plan with the right benefits for your team

Payroll core

Cover the basics- Fast unlimited payroll runs

- Calculate paychecks and taxes

- Automated tax and forms

- Workforce portal

- Manage deductions

- Payroll reports

- Automatic payroll

- 1099 E-File and pay

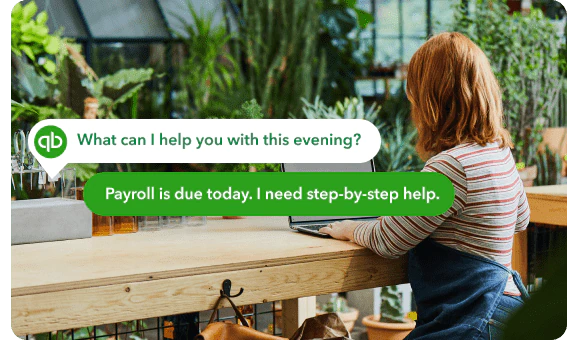

- Expert product support

- Next day direct deposit

- FOR YOUR TEAM

- 401K plans

- Health benefits for your team

Payroll Premium

Manage your team- Fast unlimited payroll runs

- Calculate paychecks and taxes

- Automated tax and forms

- Workforce portal

- Manage deductions

- Payroll reports

- Automatic payroll

- 1099 E-file and pay

- Expert product support

- Same day direct deposit

- Expert review

- Track time on the go

- FOR YOUR TEAM

- 401K plans

- Health benefits for your team

- HR support center

- Workers comp administration

Payroll Elite

Full service payroll solution- Fast unlimited payroll runs

- Calculate paychecks and taxes

- Automated taxes and forms

- Workforce portal

- Manage deductions

- Payroll reports

- Automatic payroll

- 1099 E-file and pay

- Expert product support

- Same day direct deposit

- Expert setup and review

- Track time and projects on the go

- 24/7 expert product support

- Tax penalty protection

- Personal HR advisor

- FOR YOUR TEAM

- 401K plans

- Health benefits for your team

- HR support center

- Workers comp administration

Frequently Asked Questions

What is QuickBooks Online Payroll Core?

QuickBooks Online Payroll Core is an automated payroll solution designed for small businesses to manage their employee payroll easily within QuickBooks Online.

How do I set up QuickBooks Online Payroll Core?

Setting up QuickBooks Online Payroll Core is straightforward. Just order online above and we will create your account for you or give us a call at 866-949-7267 and we can walk you through the process over the phone.

What features are included in QuickBooks Online Payroll Core?

QuickBooks Online Payroll Core includes features such as automated payroll calculations, direct deposit, tax form filing, and employee self-service.

Is QuickBooks Online Payroll Core compliant with tax regulations?

Yes, QuickBooks Online Payroll Core automatically calculates and files federal and state payroll taxes, staying up-to-date with the latest tax laws and regulations.

Can I run payroll on different schedules with QuickBooks Online Payroll Core?

Yes, QuickBooks Online Payroll Core allows you to run payroll on a weekly, bi-weekly, semi-monthly, or monthly basis, depending on your preferred payroll schedule.

Does QuickBooks Online Payroll Core offer employee self-service?

Yes, QuickBooks Online Payroll Core provides employees with self-service capabilities, allowing them to access their pay stubs, W-2 forms, and update their personal information.

How does QuickBooks Online Payroll Core handle time tracking?

QuickBooks Online Payroll Core integrates seamlessly with QuickBooks Time (formerly TSheets) for accurate time tracking, enabling businesses to track employee hours and sync them with payroll effortlessly. To be able to track time with payroll, you will want to upgrade to Payroll Premium or Payroll Elite versions.

Can QuickBooks Online Payroll Core handle multiple pay rates for employees?

Yes, QuickBooks Online Payroll Core supports multiple pay rates for employees, accommodating variations such as hourly, salaried, or contract rates.

Is QuickBooks Online Payroll Core scalable for growing businesses?

Yes, QuickBooks Online Payroll Core is scalable and can accommodate the payroll needs of small to mid-sized businesses as they grow and expand their workforce.

How does QuickBooks Online Payroll Core handle garnishments and deductions?

QuickBooks Online Payroll Core automates the calculation and processing of garnishments, deductions, and contributions, ensuring accuracy and compliance with legal requirements.

What customer support options are available for QuickBooks Online Payroll Core users?

QuickBooks Online Payroll Core users have access to customer support via phone, chat, and online resources such as help articles and community forums.

Can I integrate QuickBooks Online Payroll Core with other QuickBooks products?

Yes, QuickBooks Online Payroll Core seamlessly integrates with other QuickBooks products, allowing for streamlined accounting, expense tracking, and reporting.

Does QuickBooks Online Payroll Core provide year-end tax reporting?

Yes, QuickBooks Online Payroll Core generates year-end tax forms such as W-2s and 1099s for employees and contractors, simplifying the tax filing process.

Is there a mobile app for QuickBooks Online Payroll Core?

Yes, QuickBooks Online Payroll Core offers a mobile app that allows business owners and employees to manage payroll on the go, including running payroll and accessing pay stubs.

What security measures does QuickBooks Online Payroll Core have in place to protect sensitive payroll data?

QuickBooks Online Payroll Core employs robust security measures such as encryption, multi-factor authentication, and regular security updates to safeguard sensitive payroll information.

Can I customize payroll reports in QuickBooks Online Payroll Core?

Yes, QuickBooks Online Payroll Core provides customizable payroll reports, allowing businesses to analyze payroll data and track key metrics relevant to their operations.

Does QuickBooks Online Payroll Core support contractor payments?

Yes, QuickBooks Online Payroll Core facilitates contractor payments, enabling businesses to pay contractors accurately and efficiently while automatically generating necessary tax forms.

How does QuickBooks Online Payroll Core handle paid time off (PTO) accruals and tracking?

QuickBooks Online Payroll Core allows businesses to set up and manage PTO policies, including accrual rates and tracking, ensuring accurate PTO calculations for employees.

Can I run payroll for multiple companies with QuickBooks Online Payroll Core?

Yes, QuickBooks Online Payroll Core supports multi-company payroll, enabling businesses with multiple entities to manage payroll for each company separately within the same account.

What are the pricing plans for QuickBooks Online Payroll Core?

QuickBooks Online Payroll Core offers subscription-based pricing plans, with costs based on the number of employees. For pricing details or questions, just give us a call at 866-949-7267 and one of our experts can help you.

Still have questions on QuickBooks Online Payroll Core?

Speak with an expert at 866-949-7267

Terms: *Important pricing details and product information

Purchase and any sales tax where applicable will be billed by Intuit and includes 60 Day Money Back Guarantee. Annual payment option not available for Diamond or Hosted Enterprise subscriptions. *Free software conversion includes QuickBooks Pro, Premier, Online and Sage 50. Please contact us for details if you are looking to convert from other software.