Online Payroll Premium

QuickBooks Payroll Premium is fully automated and includes unlimited same-day direct deposit, 24/7 expert product support, PLUS QuickBooks Time tracking, expert review, and more!

$88.00 Original price was: $88.00.$44.00Current price is: $44.00. / month + $10.00 per employee

SPECIAL PROMOTION – 50% Off MSRP for the first 3 months.

Run payroll, manage and support your team, and get coverage at tax time. Premium Payroll includes same-day direct deposit, unlimited payroll runs, 1099 e-file and pay, QuickBooks Premium Time tracking, and expert review. Starting at $44.00 per month + only $10.00 per employee

- Features

Pay your team, track time, and get HR support

Manage your team and perfect payday with powerful tools and services.

Fully integrated

Your data is automatically synced with QuickBooks Online for simple and error-free accounting.

Pay employees fast

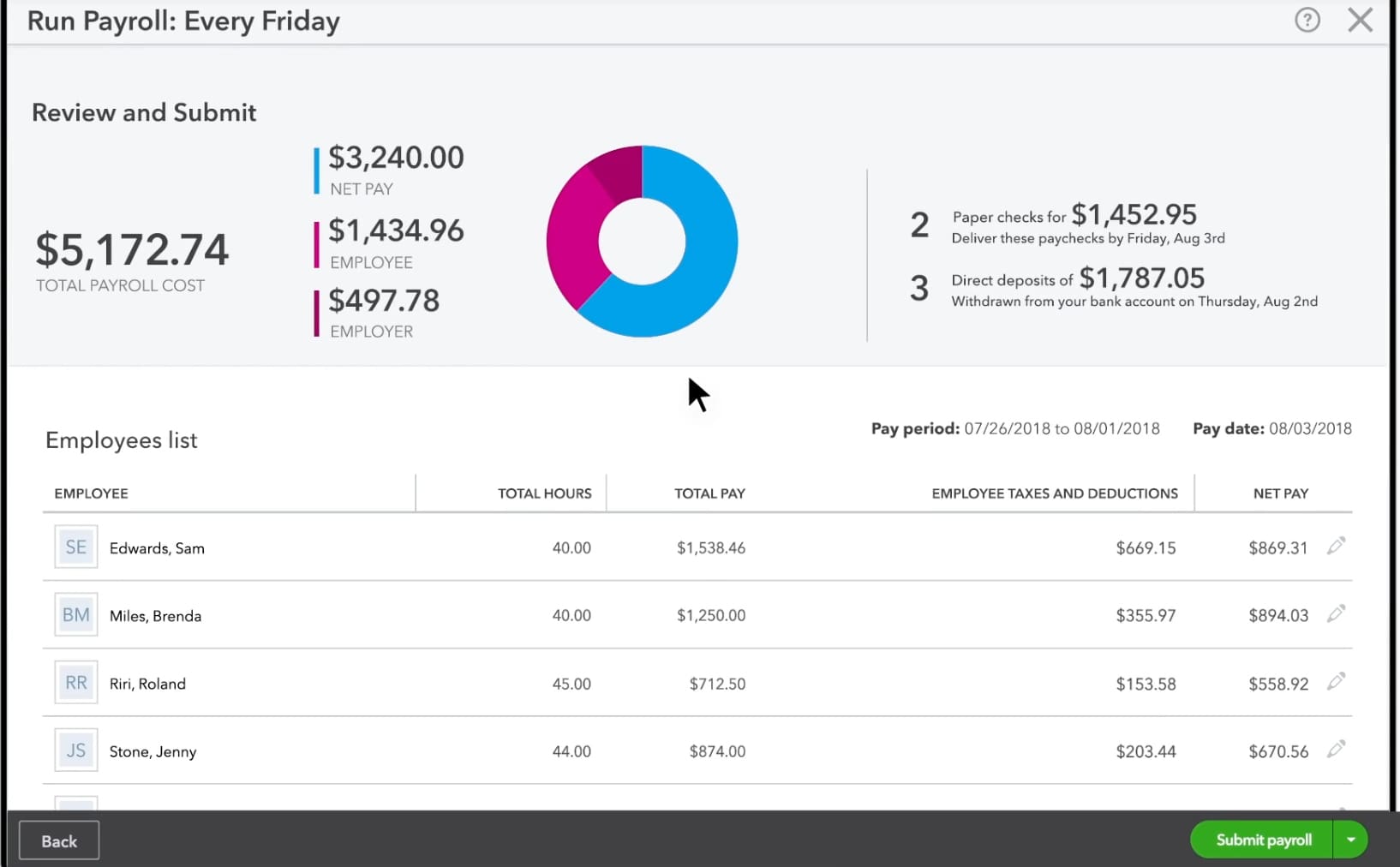

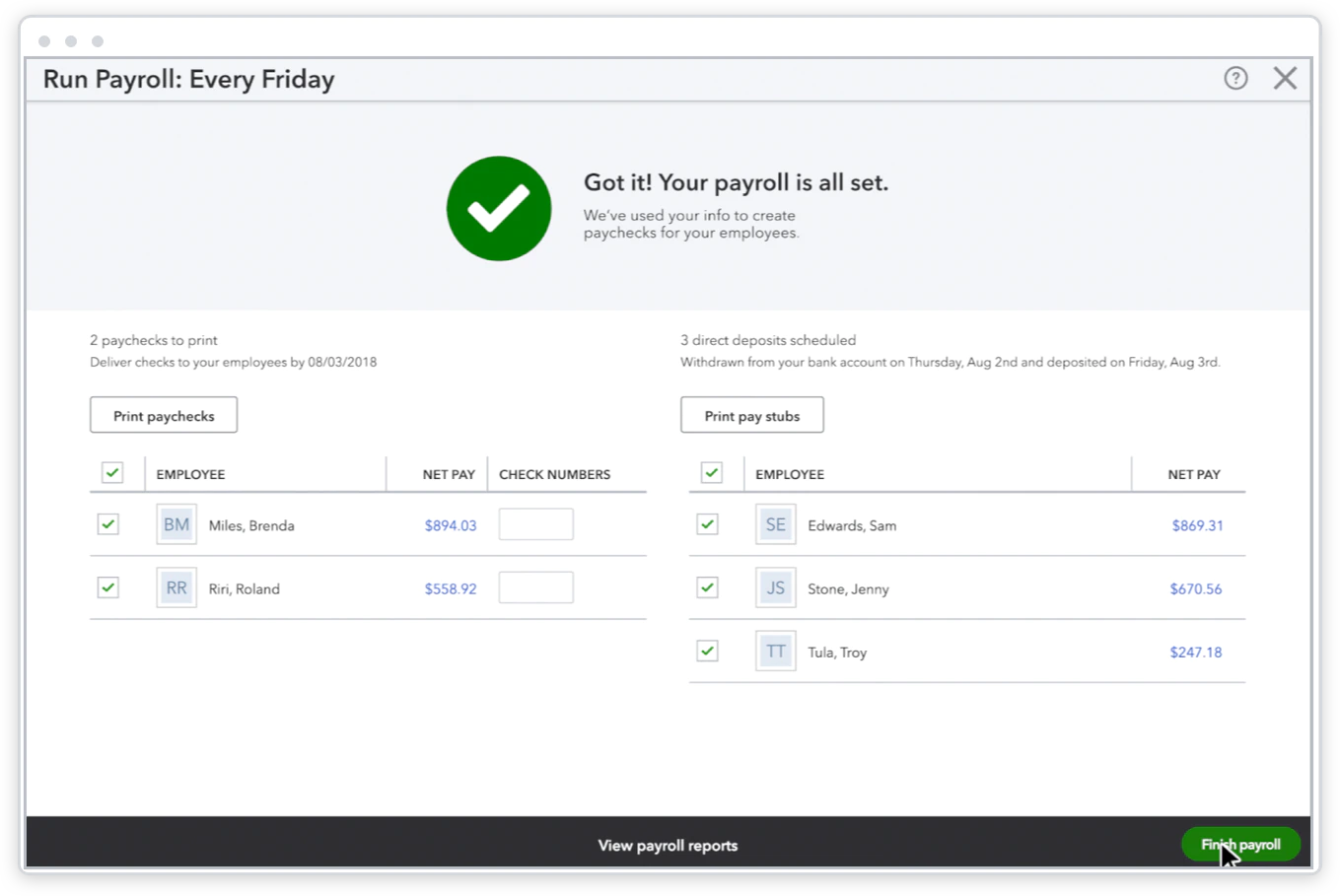

Schedule payroll and have your employees paid by paper check or direct deposit within the same day.

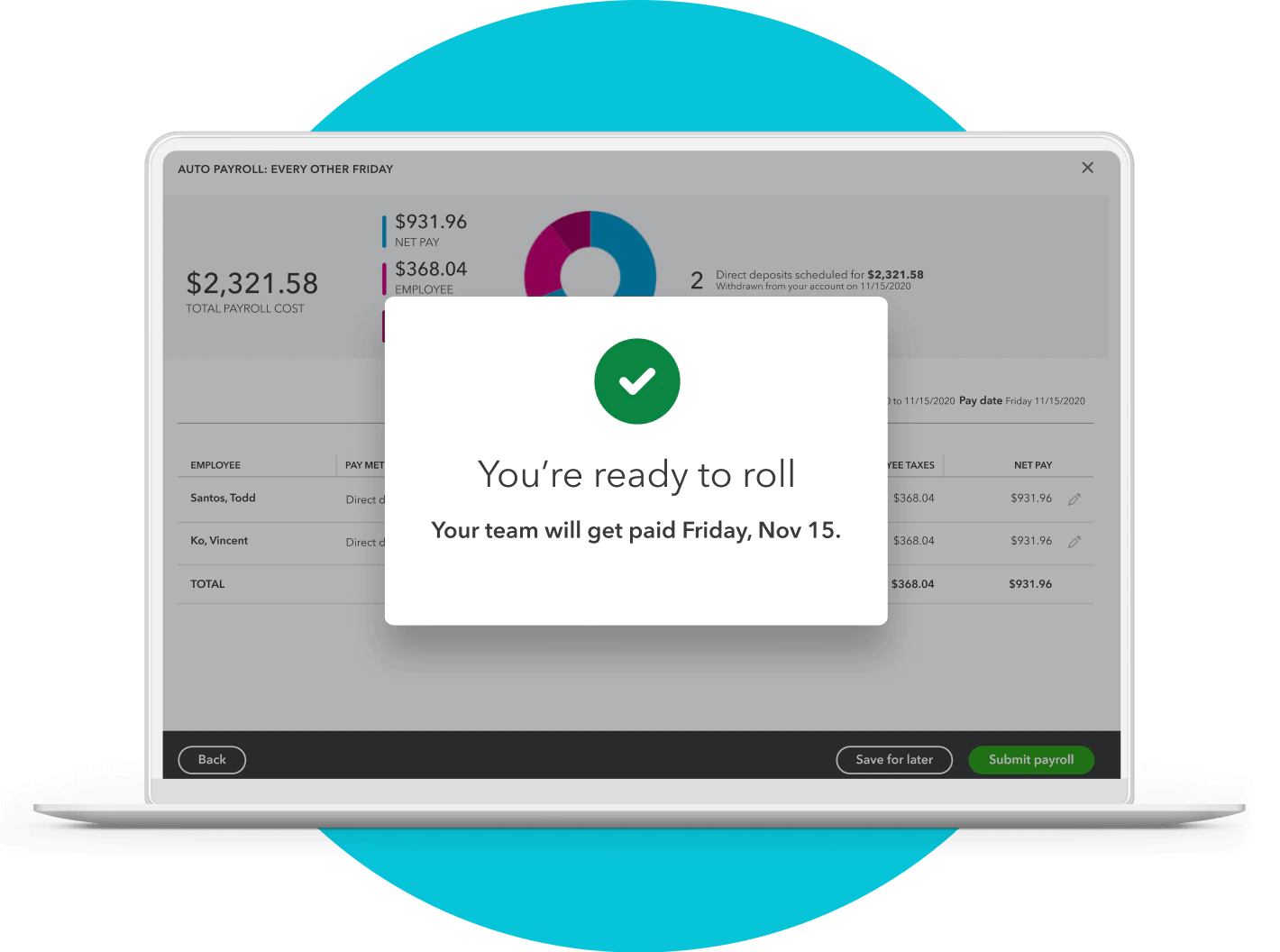

Automated Payroll

Run auto payroll for salaried employees on direct deposit and review, approve or edit before payday.

Expert review

Once you set up your payroll in QuickBooks, you can have an expert review it to avoid future tax issues.

Track time

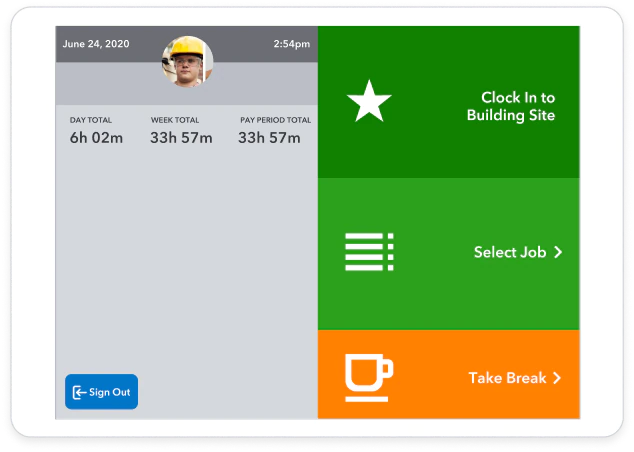

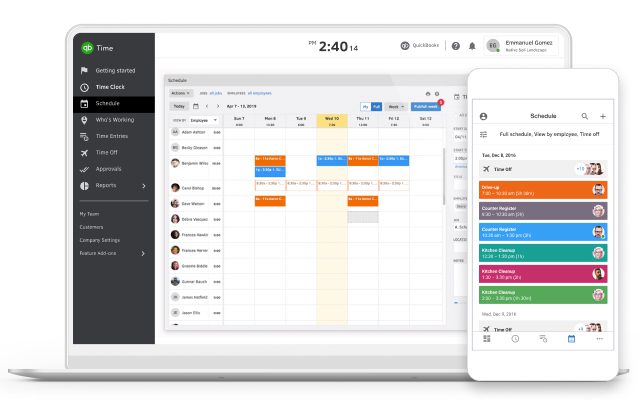

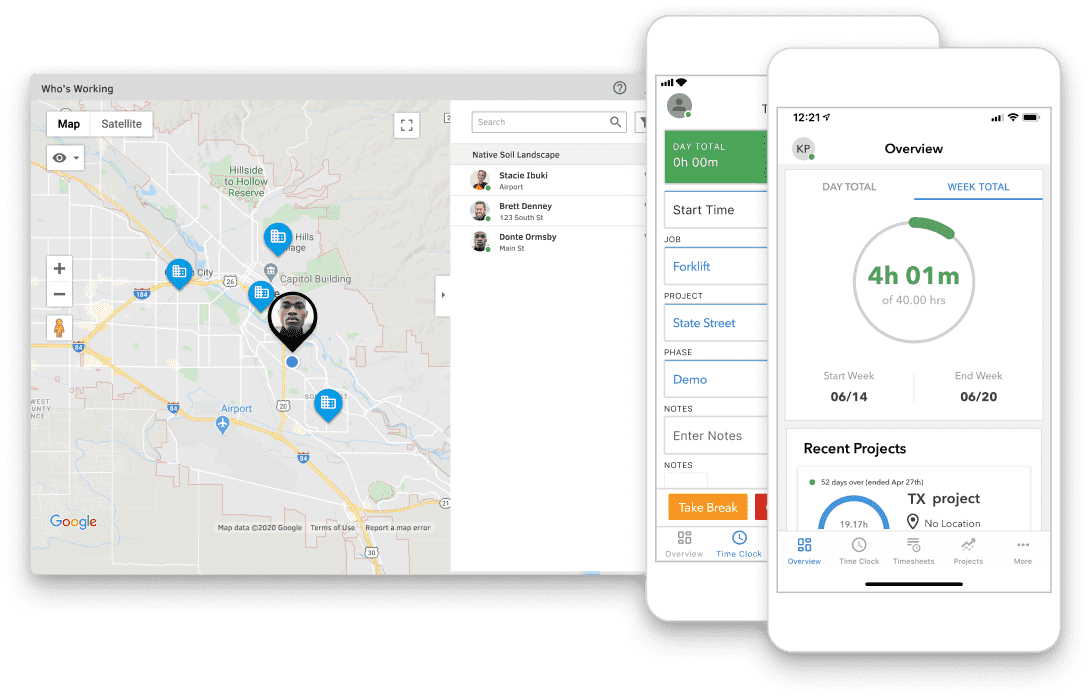

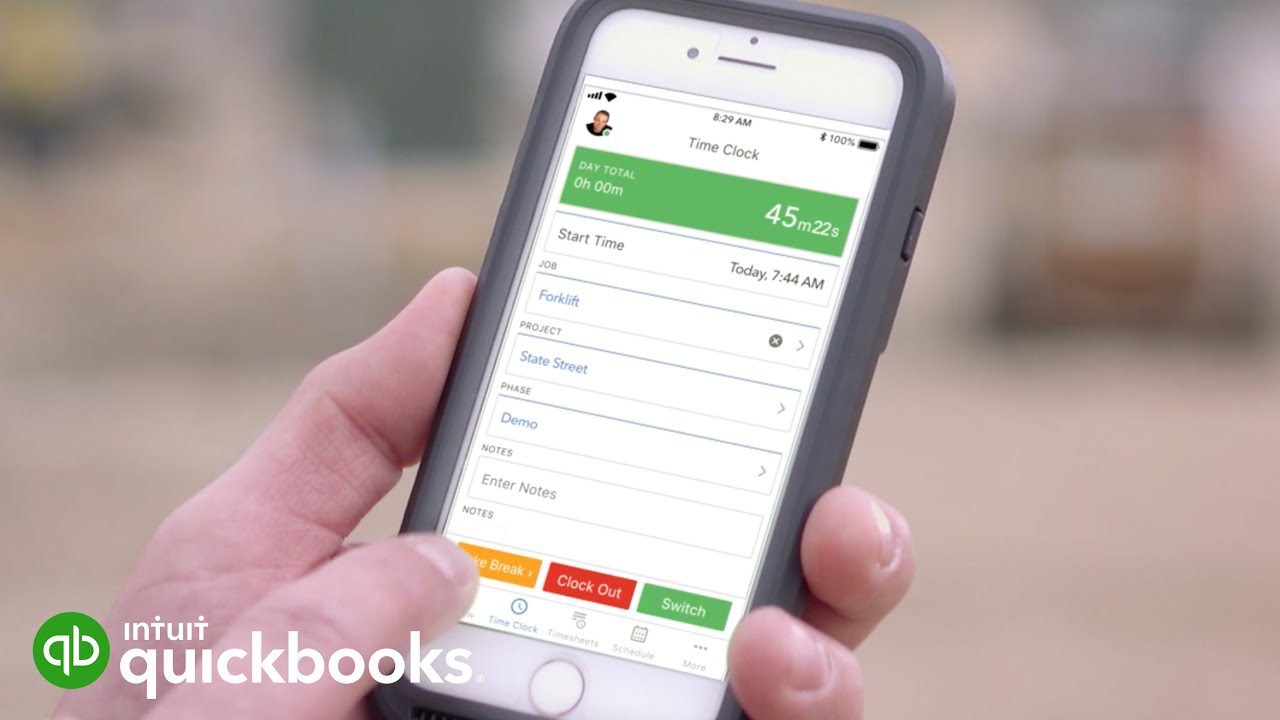

Easily track, submit, and approve your team’s time on any device and see who’s working anytime.

QuickBooks Online Payroll Premium gives you the tools efficiently pay a small team.

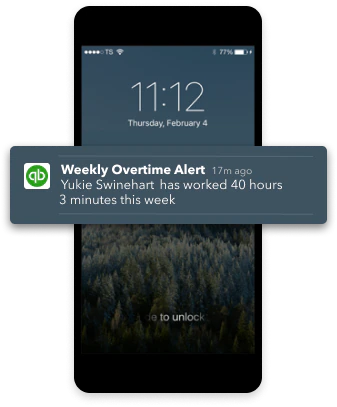

Manage your team with mobile time tracking that’s part of your payroll subscription. Workers can clock in or out anywhere, on any device, so you can review and approve payroll when you’re ready. With QuickBooks Time Premium you also get access to mobile scheduling software, overtime monitoring, customizable alerts, real-time reports, and more!

Access the right HR resources or talk to a personal advisor – all included free with QuickBooks Payroll Premium. We partnered with Mineral Inc. to provide HR guides and articles as well as customize onboarding checklists, offer letters, and employee handbooks. In addition, you can choose from other integrated add-on services like health benefits and 401K plans to run your business end-to-end.

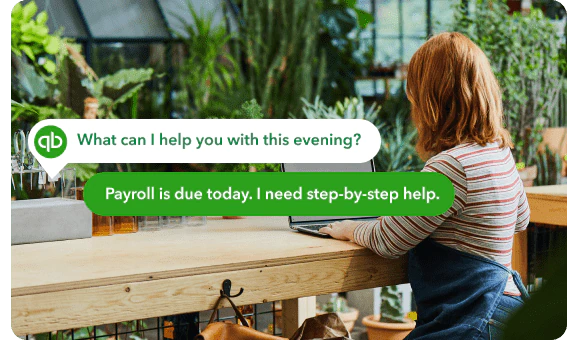

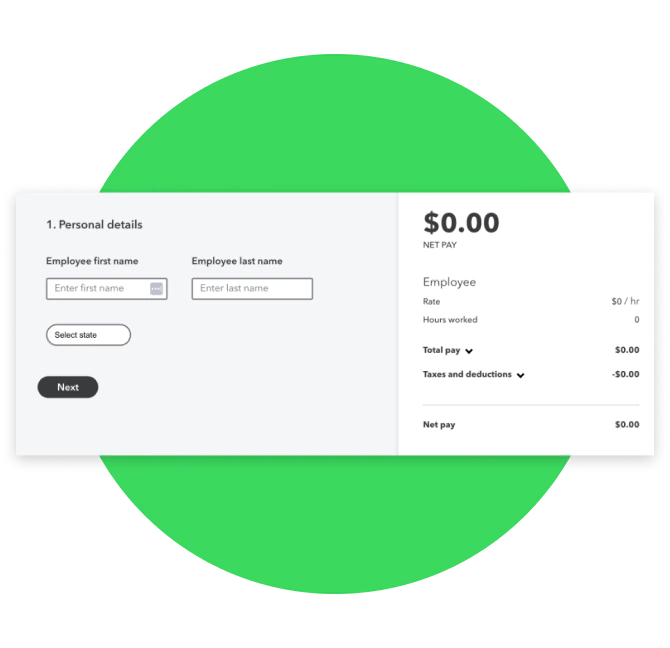

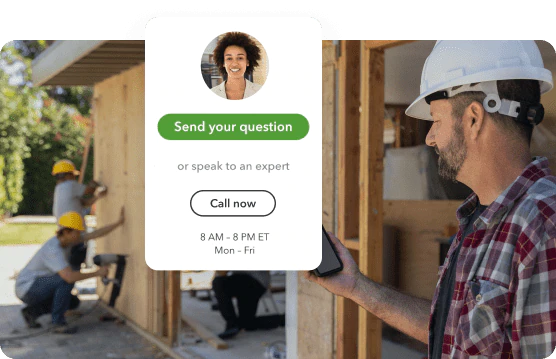

With Online Premium payroll, you can start paying your team right away. Once you add the necessary information a payroll expert will review your information to ensure everything is complete and set up correctly If you have any payroll questions, you can always chat with an expert 24/7 so you can get the answers you need whenever you need them.

Choose a QuickBooks Payroll plan with the right benefits for your team

Payroll core

Cover the basics- Fast unlimited payroll runs

- Calculate paychecks and taxes

- Automated tax and forms

- Workforce portal

- Manage deductions

- Payroll reports

- Automatic payroll

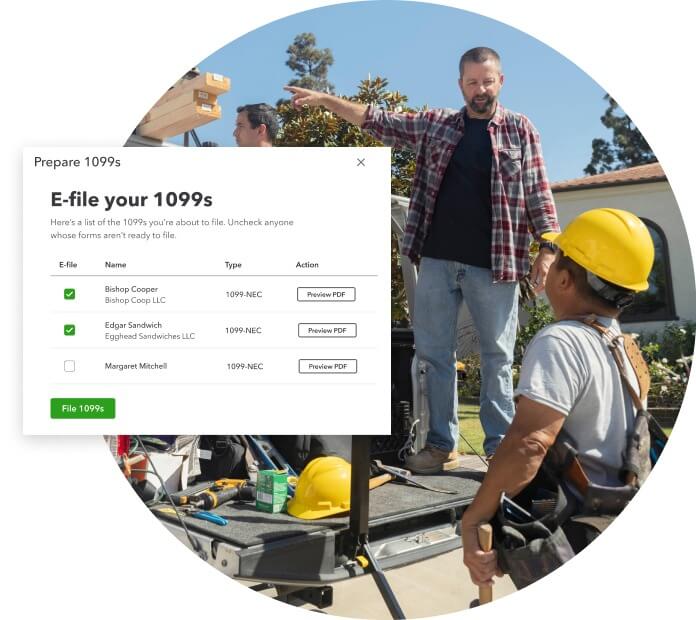

- 1099 E-File and pay

- Expert product support

- Next day direct deposit

- FOR YOUR TEAM

- 401K plans

- Health benefits for your team

Payroll Premium

Manage your team- Fast unlimited payroll runs

- Calculate paychecks and taxes

- Automated tax and forms

- Workforce portal

- Manage deductions

- Payroll reports

- Automatic payroll

- 1099 E-file and pay

- Expert product support

- Same day direct deposit

- Expert review

- Track time on the go

- FOR YOUR TEAM

- 401K plans

- Health benefits for your team

- HR support center

- Workers comp administration

Payroll Elite

Full service payroll solution- Fast unlimited payroll runs

- Calculate paychecks and taxes

- Automated taxes and forms

- Workforce portal

- Manage deductions

- Payroll reports

- Automatic payroll

- 1099 E-file and pay

- Expert product support

- Same day direct deposit

- Expert setup and review

- Track time and projects on the go

- 24/7 expert product support

- Tax penalty protection

- Personal HR advisor

- FOR YOUR TEAM

- 401K plans

- Health benefits for your team

- HR support center

- Workers comp administration

Frequently Asked Questions

How do I set up QuickBooks Online Payroll Premium?

Setting up QuickBooks Online Payroll Core is straightforward. Just order online above and we will create your account for you or give us a call at 866-949-7267 and we can walk you through the process over the phone.

What are the features included in QuickBooks Online Payroll Premium?

QuickBooks Online Payroll Premium offers features such as automatic payroll calculations, direct deposit, tax form filings, employee benefits tracking, and time tracking integration.

How do I run payroll in QuickBooks Online Payroll Premium?

To run payroll in QuickBooks Online Payroll Premium, navigate to the “Payroll” tab, select “Run Payroll,” review and approve employee hours and earnings, and then click “Submit Payroll” to process payments.

Can I add deductions and contributions in QuickBooks Online Payroll Premium?

Yes, QuickBooks Online Payroll Premium allows you to set up and manage deductions such as health insurance, retirement contributions, and garnishments for your employees.

How does QuickBooks Online Payroll Premium handle tax filings?

QuickBooks Online Payroll Premium automatically calculates and withholds federal and state taxes from employee paychecks and generates tax forms such as W-2s and 1099s at the end of the year.

Is QuickBooks Online Payroll Premium compatible with my state's payroll tax requirements?

Yes, QuickBooks Online Payroll Premium is designed to comply with the payroll tax requirements of all 50 states, including state-specific tax rates, forms, and regulations.

Can I customize payroll reports in QuickBooks Online Payroll Premium?

Yes, QuickBooks Online Payroll Premium allows you to customize payroll reports to track specific metrics, such as labor costs, employee hours, and tax liabilities, to meet your business needs.

Does QuickBooks Online Payroll Premium offer employee self-service options?

Yes, QuickBooks Online Payroll Premium provides employee self-service features, allowing employees to access pay stubs, tax forms, and update their personal information online.

How does QuickBooks Online Payroll Premium handle time tracking?

QuickBooks Online Payroll Premium integrates with time tracking software, allowing you to accurately record and track employee hours for payroll processing.

Can I set up automatic payroll runs in QuickBooks Online Payroll Premium?

Yes, QuickBooks Online Payroll Premium offers the option to schedule automatic payroll runs, saving you time and ensuring timely payments to your employees.

What level of customer support is available for QuickBooks Online Payroll Premium users?

QuickBooks Online Payroll Premium users have access to dedicated customer support via phone, chat, and email to assist with setup, troubleshooting, and any payroll-related questions.

Does QuickBooks Online Payroll Premium support multiple pay schedules?

Yes, QuickBooks Online Payroll Premium allows you to set up multiple pay schedules to accommodate different employee groups, such as hourly and salaried workers.

How does QuickBooks Online Payroll Premium handle overtime calculations?

QuickBooks Online Payroll Premium automatically calculates overtime based on your business’s overtime rules and employee work hours, ensuring accurate payments and compliance with labor laws.

Can I import employee data into QuickBooks Online Payroll Premium?

Yes, QuickBooks Online Payroll Premium offers the option to import employee data from spreadsheets or other payroll systems, streamlining the setup process and reducing manual data entry.

Is QuickBooks Online Payroll Premium scalable for growing businesses?

Yes, QuickBooks Online Payroll Premium is scalable and can accommodate businesses of all sizes, from startups to large enterprises, with flexible pricing plans and customizable features to meet evolving payroll needs.

What are the pricing plans for QuickBooks Online Payroll Premium?

QuickBooks Online Payroll Premium offers subscription-based pricing plans, with costs based on the number of employees. For pricing details or questions, just give us a call at 866-949-7267 and one of our experts can help you.

Still have questions on QuickBooks Online Payroll Premium?

Speak with an expert at 866-949-7267

Terms: *Important pricing details and product information

Purchase and any sales tax where applicable will be billed by Intuit and includes 60 Day Money Back Guarantee. Annual payment option not available for Diamond or Hosted Enterprise subscriptions. *Free software conversion includes QuickBooks Pro, Premier, Online and Sage 50. Please contact us for details if you are looking to convert from other software.