Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Enterprise including 30-day access, sample company files, and the full 88-page QuickBooks Enterprise Guide that details everything that you can do in the software. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Paygration, Inc.

As your company grows, you acquire more assets to support the growth of your business. You will need a reliable fixed asset manager to ensure that all assets are accounted for and properly managed and that your organization stays compliant with all regulations.

QuickBooks Desktop Enterprise has a built-in fixed asset manager (FAM) that helps you manage your organization’s fixed assets, including equipment, buildings, and vehicles. It provides the tools you need to track the purchase, depreciation, and disposal of your fixed assets, which helps you stay on top of tax and accounting.

If you would like to try the full version of QuickBooks Enterprise Desktop, click here to get a free, 30-day no-commitment trial plus access to the Resource Guide that lists all the features available in Enterprise.

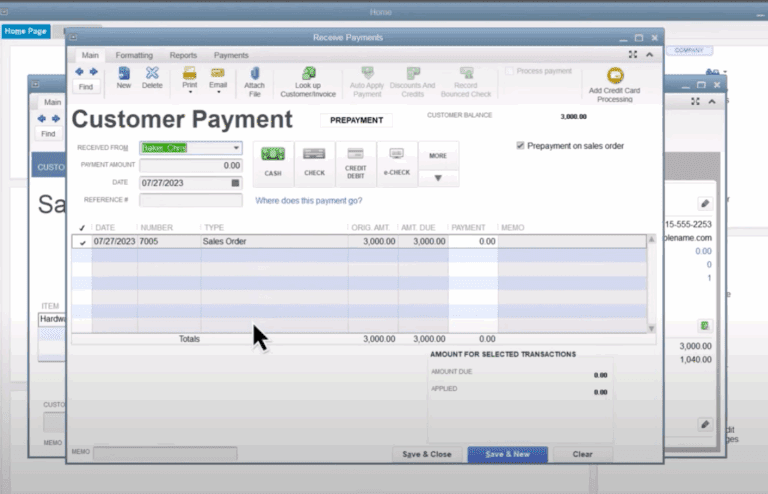

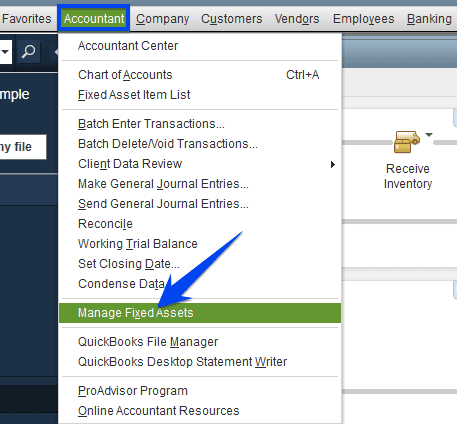

To open Fixed Asset Manager, click on the Accountant menu and then select Manage Fixed Asset. Next, select an option that best fits your needs.

Using QuickBooks Enterprise’s Fixed Asset Manager

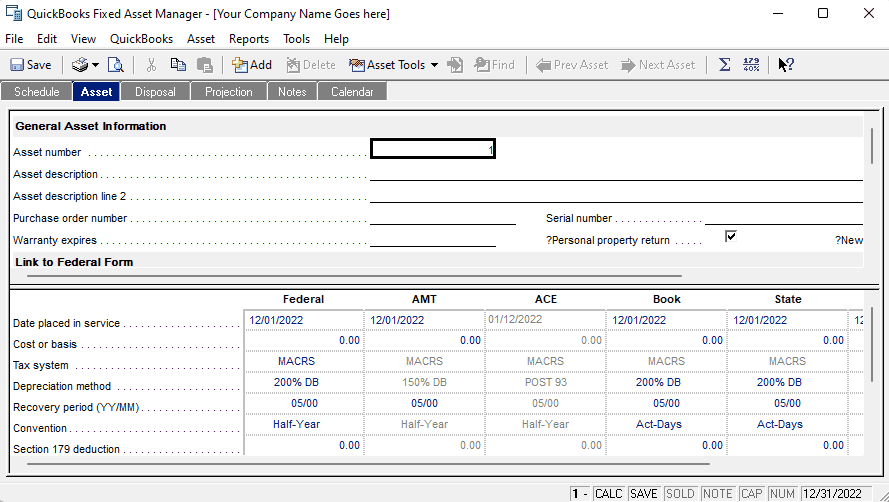

To add a new asset, click on Add Asset from the Asset menu. Once the asset is added, you can use the top portion of the form to set up requirement details, such as description and the federal form to report depreciation. The lower portion can be used to set up depreciation calculation including depreciation method, cost, and tax system.

Adding a new fixed asset in QuickBooks Enterprise

Advantages of QuickBooks Fixed Asset Manager

Automatically calculates depreciation

When you set up a fixed asset in QuickBooks Enterprise’s Fixed Asset Manager, you specify the asset’s purchase date, cost, useful life, and depreciation method. The system then uses this information to calculate the depreciation expense for the asset over its useful life. As time passes and you record depreciation transactions, the system automatically adjusts the asset’s value on your balance sheet.

AM also provides you with a variety of reports, such as:

- Asset register: A summary of all your fixed assets, including purchase date, cost, accumulated depreciation, and net book value

- Depreciation schedules: A detailed report of the depreciation expense for each asset, broken down by month or year

- Asset acquisitions and disposals: A report of all acquisitions and disposals of fixed assets.

Maintain Track Records of Equipment

As you use and maintain your equipment, you can record additional transactions in Fixed Asset Manager, such as repairs and upgrades. These transactions help you maintain an accurate record of the equipment’s history, which can be useful for insurance purposes, financial reporting, and tax preparation. Enterprise’s Fixed Asset Manager runs several reports that can help you manage your equipment more effectively, including:

- Equipment register: A summary of all your equipment, including purchase date, cost, accumulated depreciation, and net book value

- Maintenance history: A report of all maintenance activities performed on the equipment

- Asset utilization: A report of how frequently the equipment is used, which can help you identify opportunities to improve efficiency

Automates Depreciation Forms & Reports

Fixed Asset Manager allows you to set up depreciation schedules based on different methods, such as straight-line, declining balance, and sum-of-the-years’ digits. Once you have set up your depreciation schedules, Fixed Asset Manager automatically calculates the depreciation expense for each asset over its useful life.

Helps You Stay in Compliance with Regulations

QuickBooks Enterprise’s Fixed Asset Manager can help you stay in compliance with various regulations and standards related to fixed asset accounting.

For example, Fixed Asset Manager can help you comply with Generally Accepted Accounting Principles (GAAP), which require that fixed assets be recorded at their cost and depreciated over their useful lives. In addition, Fixed Asset Manager can help you comply with tax regulations by allowing you to generate tax forms such as Form 4562, which is used to claim depreciation deductions on your tax return. The Fixed Asset Manage can also help you comply with insurance requirements by generating insurance valuation reports that show the current replacement value of your fixed assets.

By maintaining accurate fixed asset records and generating reports in compliance with regulations and standards, Fixed Asset Manager can help you avoid penalties and fines that can result from non-compliance. This can be especially important for businesses that operate in heavily regulated industries, or for businesses that need to meet the requirements of auditors or other third-party stakeholders.

Industries that Should Use QuickBooks Fixed Asset Manager

Here are the top 5 industries that could benefit from using QuickBooks Enterprise’s Fixed Asset Manager:

Manufacturing Industry

- Purchase of machinery, equipment and tools used in production line

- Calculation and recording of depreciation of equipment

- Maintenance of equipment and repairs

- Generating reports for financial analysis and tax compliance

- Tracking and disposing of obsolete equipment

Construction Industry

- Purchase of heavy machinery, vehicles and equipment used in construction projects

- Calculation and recording of depreciation of equipment

- Maintenance of equipment and repairs

- Generating reports for financial analysis and tax compliance

- Tracking and disposing of obsolete equipment

Healthcare Industry

- Purchase of medical equipment, hospital beds and medical supplies

- Calculation and recording of depreciation of equipment

- Maintenance of equipment and repairs

- Generating reports for financial analysis and tax compliance

- Tracking and disposing of obsolete equipment

Hospitality Industry

- Purchase of furniture, fixtures and equipment

- Calculation and recording of depreciation of assets such as hotel furniture

- Maintenance of equipment and repairs

- Generating reports for financial analysis and tax compliance

- Tracking and disposing of obsolete equipment

Transportation Industry

- Purchase of vehicles, trucks and trailers

- Calculation and recording of depreciation of assets

- Maintenance of equipment and repairs

- Generating reports for financial analysis and tax compliance

- Tracking and disposing of obsolete equipment

QuickBooks Enterprise’s Fixed Asset Manager can be beneficial for any industry that owns fixed assets and needs to track their activity, maintain accurate records, and comply with regulations and standards.