Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Online including 30-day access, the full 76-page QuickBooks Online Guide (details everything that you can do in the software) plus the video training library. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Paygration, Inc.

If you need (First-In, First-Out) FIFO inventory tracking for your business, you need to subscribe to either QuickBooks Online Plus or Advanced. Using the FIFO method in QuickBooks is a powerful way to accurately track the cost of goods sold (COGS) and the inventory quantity on hand.

In this article, we’ll discuss FIFO inventory in QuickBooks Online Advanced, who can benefit from it, and how to set it up and use it in QuickBooks.

What is FIFO Inventory?

Available in QuickBooks Plus and Advanced, FIFO inventory is an inventory tracking method that assumes that the first items received are the first items sold. This method is based on the principle that the oldest inventory is sold first, so it provides an accurate valuation of inventory and cost of goods sold (COGS).

FIFO inventory is a good fit for businesses that sell perishable or time-sensitive products, as well as businesses that experience fluctuating costs for their inventory. For example, a grocery store that sells perishable goods such as fruits, vegetables, and dairy products can benefit from using the FIFO method to ensure that the oldest items are sold first to prevent spoilage.

If you would like to try the full version of QuickBooks Online Advanced, click here to get a free 30-day no-commitment trial plus access to the full video training library.

How FIFO Inventory Works in QuickBooks

- Purchase inventory items: When you purchase inventory items in QuickBooks, the system records the cost and the date of the purchase. This information is used to determine the cost of the items sold later on.

- Receive inventory: When you receive inventory items, QuickBooks will add them to your inventory account and update the quantity on hand.

- Sell inventory items: When you sell inventory items, QuickBooks will automatically reduce the quantity on hand and calculate the cost of the items sold using the FIFO method. The cost of the oldest items in stock will be used first.

- View inventory reports: You can view inventory reports in QuickBooks to see the current quantity on hand and the cost of each item in stock. This information can help you make informed decisions about purchasing and selling inventory.

Here’s an example of how FIFO inventory works in QuickBooks Advanced:

Let’s say you receive three shipments of a product:

- Shipment 1: 100 units at $10 per unit

- Shipment 2: 200 units at $12 per unit

- Shipment 3: 150 units at $15 per unit

You then sell $250 units of the product. Using the FIFO method, the COGS is calculated based on the cost of the oldest inventory (i.e., the first shipment received) first. The COGS calculation would look like this:

- 100 units at $10 per unit = $1,000

- 150 units at $12 per unit = $1,800

- Total COGS = $2,800

The remaining inventory would be valued based on the cost of the most recent shipment received (i.e., the last-in, first-out or LIFO method). In this case, the value of the remaining inventory would be:

50 units at $15 per unit = $750

How to Set up Inventory in QuickBooks Online

Enable Inventory Tracking

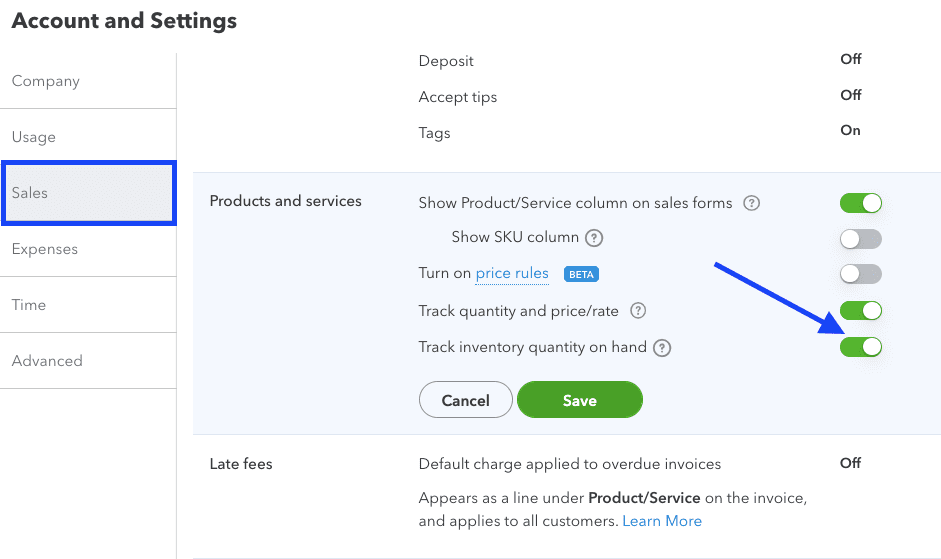

First, you need to enable inventory tracking in your QuickBooks Advanced account. Click on the cog wheel on your company dashboard, then choose Account and Settings. Under the Sales tab, select Products and Services. Finally, Toggle Track inventory quantity on hand to on.

Preparing to enable inventory tracking in QuickBooks Online

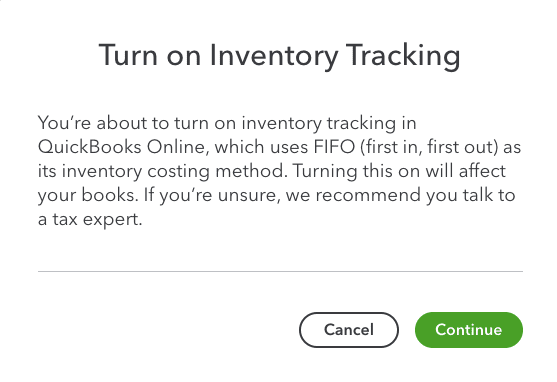

When you turn on inventory tracking in QuickBooks, the system will automatically use FIFO as its inventory costing method, as highlighted in the message prompt below.

Enable inventory tracking in QuickBooks Online

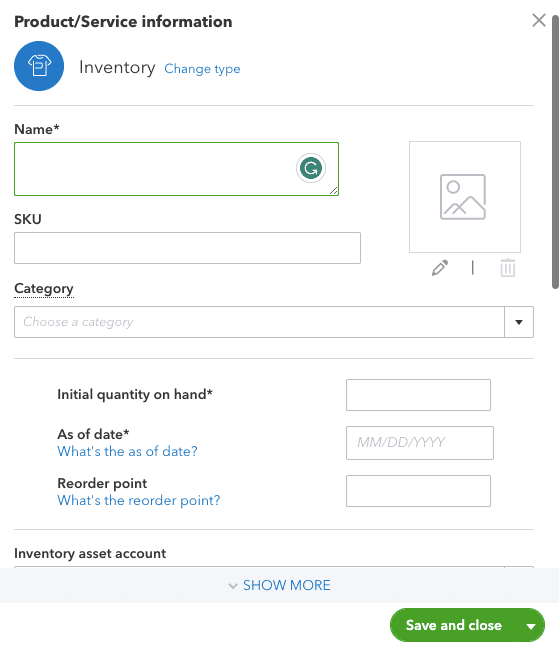

Set up Inventory Items

Once you have enabled inventory tracking, you can create your inventory items. Click on the cog wheel, and then choose Products and Services under Lists. Select New to create a new product or service item, and then select Inventory as the item type. Enter the required details in the Product/Service information screen, as shown below.

Adding a new inventory item in QuickBooks Online

Track Inventory

QuickBooks offers a variety of inventory reports that can help you track your inventory levels and COGS, such as the Inventory Valuation Summary, the Inventory Stock Status by Item, or the Inventory Valuation Detail. These reports can help you understand your inventory levels and the cost of your inventory.

Bottom Line

By using FIFO inventory tracking in QuickBooks Plus or Advanced, you can have a more accurate view of your inventory levels and the cost of goods sold. This can help you make better purchasing and pricing decisions and ensure that you are running your business efficiently.

While both QuickBooks Plus and Advanced offer FIFO inventory tracking, Advanced is preferred by many growing businesses because of the level of customization and additional features it offers. Explore the top reasons why you should consider QuickBooks Online Advanced.

- inventory tracking in QuickBooks Online Advancedkey features in quickbooks online advancedquickbooks online advancedquickbooks online advanced automationquickbooks online advanced custom workflowquickbooks online advanced reportsquickbooks online advanced vs online plusquickbooks online advanced workflows