Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Online including 30-day access, the full 76-page QuickBooks Online Guide (details everything that you can do in the software) plus the video training library. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Revenue Recognition: A New Feature in QuickBooks Online Advanced

Paygration, Inc.

One of the latest features introduced in QuickBooks Advanced is automatic revenue recognition. This new feature is designed to automate the process of recognizing revenue, which is a critical aspect of accounting.

In this article, we will discuss the new revenue recognition feature in QuickBooks Advanced, its benefits, and how to set it up and use it in QuickBooks.

What is Revenue Recognition?

Revenue recognition is an essential aspect of accounting that determines when and how revenue should be recognized in the financial statements. The revenue recognition standard (ASC 606) requires that revenue should be recognized when it is earned, regardless of when the payment is received. Revenue recognition is important because it affects the financial statements’ accuracy, which is essential for decision-making by investors, creditors, and other stakeholders.

What is Revenue Recognition in QuickBooks Advanced?

Revenue recognition in QuickBooks Online uses advanced algorithms to recognize revenue as soon as it is earned, without any manual intervention required. This feature is beneficial for businesses that use accrual accounting, where revenue is recognized when it is earned, not when a payment is received, or a sale happens. This will save time and effort for business owners and accountants who previously had to use third-party apps or complex spreadsheets to track recurring revenue and move funds from liability accounts to asset accounts.

If you would like to try the full version of QuickBooks Online Advanced, click here to get a free 30-day no-commitment trial plus access to the full video training library.

How Revenue Recognition Works in QuickBooks Advanced

Here are some examples of how revenue recognition works in QuickBooks Advanced:

Let’s say you provide consulting services to a client and invoice the client for the services provided. The client pays the invoice three weeks later. In this example, revenue recognition in QuickBooks Advanced would recognize the revenue as soon as the consulting services were provided, regardless of when the payment was received. The new revenue recognition feature in QuickBooks Advanced would analyze the financial transaction and recognize the revenue immediately, without any manual data entry required.

Another example is when a company provides a service to a customer that spans over multiple periods. For example, a software development company may enter into a contract with a client to provide ongoing software maintenance and support for a period of one year. In this case, the revenue should be recognized over the duration of the contract rather than all at once. QuickBooks Advanced’s revenue recognition feature allows businesses to create revenue schedules that will automatically recognize revenue over the course of the contract period.

How to Use Revenue Recognition in QuickBooks Advanced

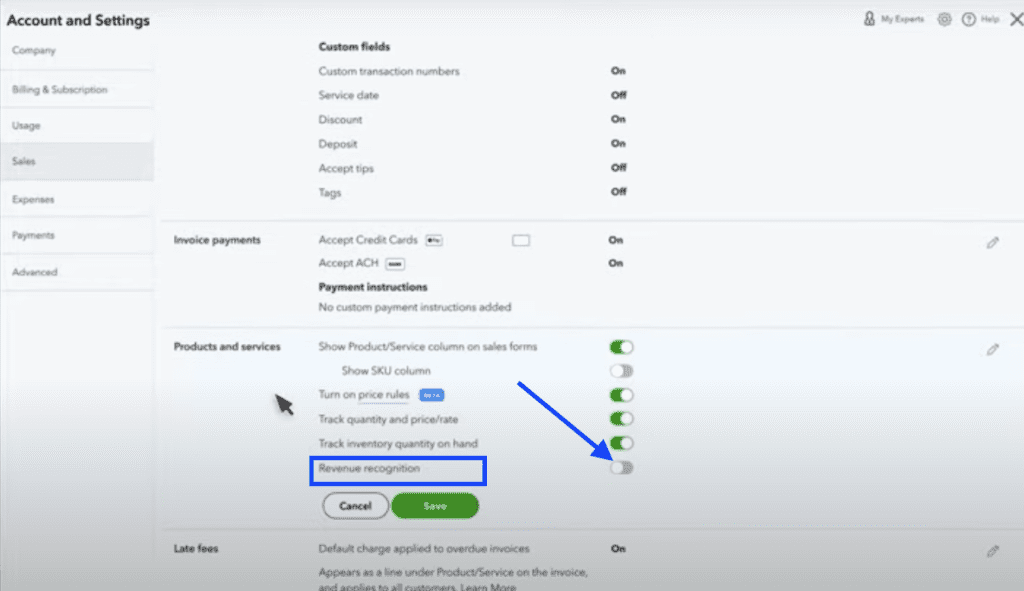

To use revenue recognition in QuickBooks Advanced, you first need to activate this feature. To do this, click the gear icon on your QuickBooks dashboard and then select Account and settings under Your Company. Click on the Sales tab, select the Products and services section, and then toggle Revenue recognition to on. Click Save to proceed.

Activating Revenue Recognition in QuickBooks Online Advanced

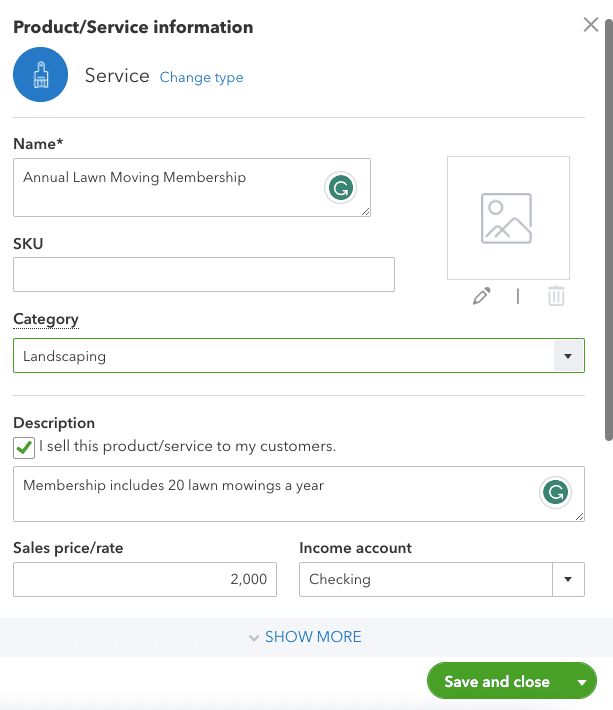

After enabling revenue recognition, you need to set up a service that will use the revenue recognition. Click on the gear icon and select Products and Services. Then, click on the New button and then select the Service dropdown to launch the Product/service information screen.

To illustrate how to set up a service that will use revenue recognition, we’ll use the following example.

A landscaping company offers an annual lawn moving membership to its clients. The membership is priced at $2,000 and is payable upfront at the start of the membership period.

To set up this service to use revenue recognition in QuickBooks Advanced, you must follow these steps:

From the Product/service information screen, create a new service item called “annual lawn mowing membership,” enter a clear description of the service in the item description field, and enter $2,000 in the Sales price/rate field. Provide all the other important details, such as the income account where the revenue earned from the membership will be tracked.

Setting up a new service that will use Revenue Recognition in QuickBooks Online Advanced

Scroll down the form and select the revenue recognition checkbox. Under this section, you’ll see the liability account that will be used to categorize the funds you’ll receive. Over time, the balance of your liability account automatically decreases while the balance of your income account increases. Click Save and close to save the new item.

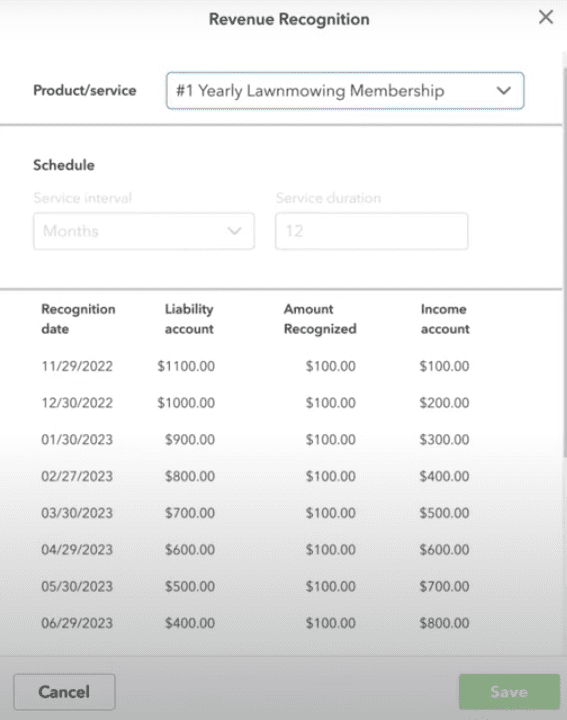

Then when you create an invoice for that item, QuickBooks will track it with the revenue recognition feature. It will show you when you’ll recognize revenue, what the balance of your liability account will be, the amount you will recognize, and the total amount you will have recognized at that time. QuickBooks Online Advanced recognizes revenue at the end of each month.

Revenue Recognition report in QuickBooks Online Advanced

Bottom Line

The new revenue recognition feature in QuickBooks Advanced provides many benefits, including improved financial visibility, simplified accounting, and compliance with accounting standards. By automating revenue recognition, businesses can save time and effort, reduce the chances of errors, and ensure accurate financial reporting.

- advantages of quickbooks online advancedkey features in quickbooks online advancedquickbooks onlinequickbooks online advancedquickbooks online advanced automationquickbooks online advanced custom workflowquickbooks online advanced workflowsquickbooks online invoicingrevenue recognition in QuickBookstop features of quickbooks online advancedwhy buy quickbooks online advanced