Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Enterprise including 30-day access, sample company files, and the full 88-page QuickBooks Enterprise Guide that details everything that you can do in the software. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Paygration, Inc.

If fixed assets are a significant part of your business, then you need a scalable fixed asset management system that can help you accurately manage your asset information. QuickBooks Desktop Enterprise has a robust Fixed Asset Management system that can help you track physical assets, such as computers and machinery.

What Are Fixed Assets?

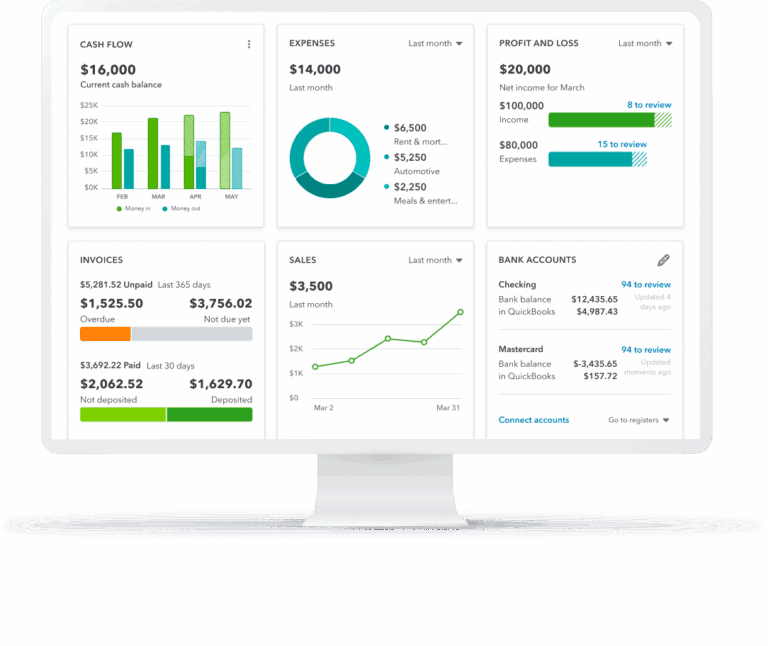

Fixed assets are tangible items that have a useful life of more than a year. They are owned and used by a company to generate income over time. Examples of fixed assets include land, buildings, computers, plant and machinery, and fixtures and fittings. It’s important for businesses to track and understand the real asset value of their company in order to get a complete picture of how their business is performing.

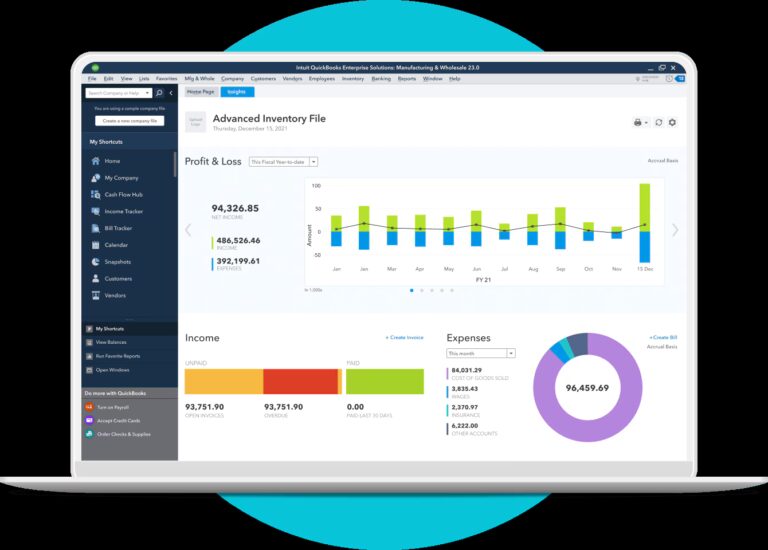

QuickBooks Desktop Enterprise Fixed Asset Manager

Fixed Asset Manager (FAM) in QuickBooks Desktop Enterprise is a great feature that allows you to calculate depreciation of fixed assets based on IRS guidelines. With QuickBooks’ FAM, you can enter fixed asset purchases, set up depreciation entries, and even track gain or loss on fixed asset disposal.

FAM is only available in QuickBooks Desktop Premier, QuickBooks Desktop Enterprise, and Enterprise Accountant. See our steps for recording a new fixed asset in QuickBooks.

If you would like to try the full version of QuickBooks Enterprise Desktop, click here to get a free, 30-day no-commitment trial plus access to the Resource Guide that lists all the features available in Enterprise.

Benefits of FAM in QuickBooks

- It gives you an accurate calculation of the depreciation of your assets, which is essential especially if you’re planning to sell them in the future.

- It streamlines journal recordings. Whenever your company purchases a new asset, a journal entry is created in the books of accounts. The journal entry is the initial step done by an accountant in order to maintain books of accounts.

- It helps ensure that your business assets are properly maintained, which can help extend their life and avoid unexpected downtime.

- It can help lower insurance cost through proof of ownership and maintenance history records.

- It can improve tax compliance by ensuring that all of your assets are properly accounted for for tax purposes.

- QuickBooks Desktop’s automated fixed asset manager eliminates the need for using manual tools, such as spreadsheets and whiteboards, which can sometimes cause errors, are difficult to share among teams and have no historical records.