Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Online including 30-day access, the full 76-page QuickBooks Online Guide (details everything that you can do in the software) plus the video training library. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Project Estimate vs. Actual Reporting: A New Feature of QuickBooks Online Advanced

Paygration, Inc.

In a previous article where we compared QuickBooks Online to another software, we pointed out that one area where QuickBooks falls short is tracking estimated vs. actual project costs. The good news is that the new version of QuickBooks Online Advanced addresses this issue.

In this article, we’ll take a closer look at the new project estimate vs. actual reporting feature in QuickBooks and how this new feature can benefit small business owners.

What is Project Estimate vs. Actual Reporting in QuickBooks Online Advanced?

The Project Estimate vs. Actual Report in QuickBooks Advanced is a financial report that compares the estimated costs and revenues of a project against the actual costs and revenues incurred during the project’s duration and after it’s complete. This report helps project managers and business owners track their project’s financial performance, identify any variances between the estimates and actuals, and make informed decisions about future projects. The report displays a summary of the project’s estimated and actual income, expenses, and profitability, as well as a breakdown of the cost and revenue categories.

If you would like to try the full version of QuickBooks Online Advanced, click here to get a free 30-day no-commitment trial plus access to the full video training library.

How Project Estimate vs. Actual Reports Benefit Small Businesses

Track the status of projects

QuickBooks Advanced’s Project Estimate vs. Actual Reporting feature allows small businesses to track the progress of their projects over time. Business owners can easily see how much of the project is completed and how much is left, allowing them to adjust their resources and timeline accordingly.

For instance, a small marketing agency is working on a website redesign project. They estimated the project to take three months to complete, but after the first month, they notice that the project is behind schedule. By running a Project Estimate vs Actual Report in QuickBooks Advanced, the business owner can see how much of the project is completed and how much is left and adjust their timeline accordingly.

Ensure project profitability

By monitoring the project’s financial performance, business owners can identify potential issues and take corrective action before it’s too late. For example, if a project is trending towards a loss, the business owner may decide to adjust their estimates or resource allocation to ensure profitability.

Let’s say a small construction company is working on a home renovation project. They estimated the project to cost $100,000 and estimated revenue of $120,000. However, after completing half the project, they notice that the actual costs are higher than expected, and revenue is not as high as anticipated. By running a Project Estimate vs Actual Report in QuickBooks Advanced, the business owner can identify the variances and make the necessary adjustments to ensure that the project is profitable in the long run.

Identify cost overruns

By comparing the estimated costs with actual costs, business owners can quickly identify areas where costs are higher than expected and take corrective action. Let’s say a small manufacturing company is working on a new product launch project. They estimated the project to cost $50,000, but after the first month, they notice that the actual costs are already at $60,000. By running estimates vs. actual cost reports in QuickBooks Advanced, the business owner can identify the cost overruns and implement the right measures to stay on budget.

Improve project estimates:

The ability to compare estimated vs. actual project costs can also help business owners identify areas where their estimates were inaccurate and adjust their estimates for future projects. For example, a small IT consulting company is working on a software implementation project. They estimated the project to cost $100,000, but after completing the project, they notice that the actual costs were only $80,000. By comparing the estimated costs with actual costs, the team can pinpoint areas where their estimates were inaccurate and revise their estimations for upcoming projects.

How to Use Project Estimate vs. Actual Reporting in QuickBooks

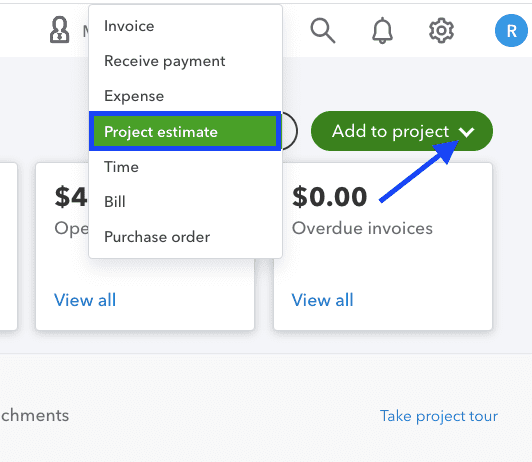

You can use the Project Estimate vs. Actual Reporting feature from the Projects tab in QuickBooks Online. To record a cost estimate for your service, you have to set it up as a project first. Once set up, click on the green Add to project button and select the Project estimate dropdown.

Setting up a cost estimate as a project in QuickBooks Advanced

From the project cost estimate screen, add the product/service items that will be rendered as part of the project, including the quantity and rate. Click Save to record the new estimate.

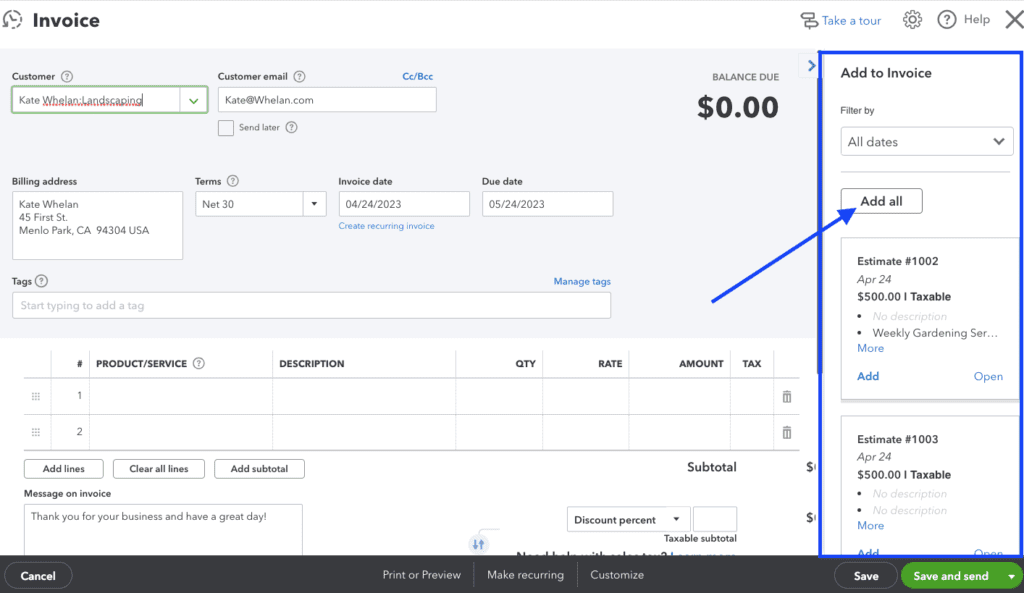

Once the estimate is approved by your customer, change the status to Accepted. This is very important because only estimates that are accepted or closed can be included in the project estimate vs actual report. Then when it’s time to invoice your customer for the project, click on the Add to project button on your project and select Invoice this time. The invoice screen includes a tab showing all the estimates you created for the project. Click Add or Add all, and the product/service details will automatically populate. You can also enter them manually if needed.

Adding estimates to invoices in QuickBooks Online Advanced

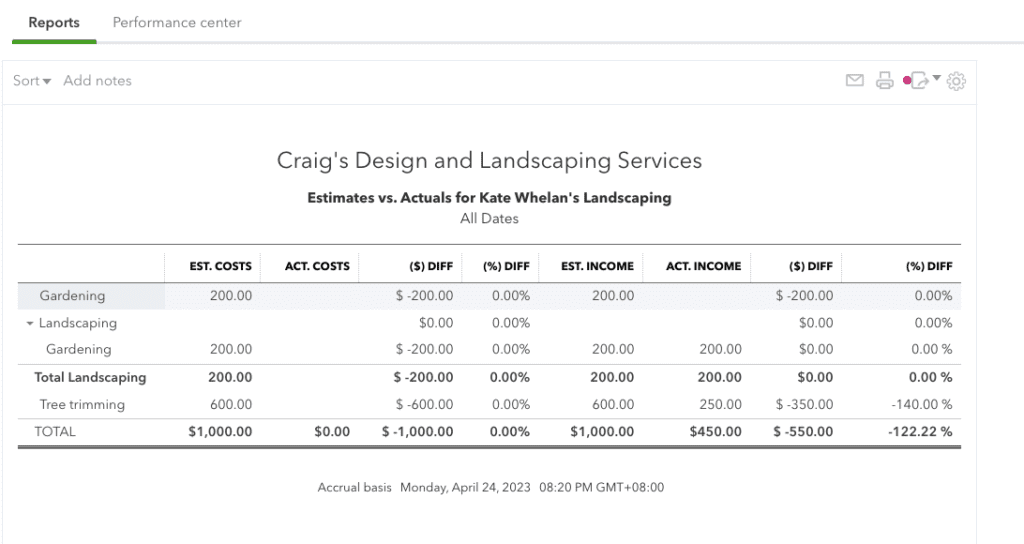

Now you can run a project estimate vs actual report. To do this, click on Project Reports under the Projects tab, and select Estimates vs. actuals. Below is a sample estimates vs. actuals report in QuickBooks Online.

Sample estimates vs actuals reports in QuickBooks Online Advanced

Bottom Line

QuickBooks Online Advanced’s new actual vs. estimate reporting feature is a valuable upgrade to the software, as it provides businesses with greater insight into their financial performance. With this feature, businesses can easily compare their actual financial results to their estimates and budgets, which can help them identify areas where they are performing well and areas where they need to improve.

If you want to see how else Advanced can help you streamline your accounting and financial workflows, explore the top 10 advantages of using QuickBooks Advanced.