Pete Real

Every industry is different. Each sector presents its own unique landscape, challenges, and needs. Fortunately, QuickBooks offers an Enterprise version that has platforms for multiple industries. They have been able to customize solutions for industries such as Contractors, Manufacturing, Wholesale, Retail, Non-Profit, Professional Services, and Accountants. We want to make sure everyone properly understands the differences between the Enterprise Industry versions, so we’re breaking down the unique features in a blog series. In this post, we’ll cover the Non-profit edition, so if you work in that area – keep reading to learn about all the ways that QuickBooks Enterprise 2021 Non-profit Edition is tailored to your business and can help you achieve your goals.

New Enterprise Features for 2021

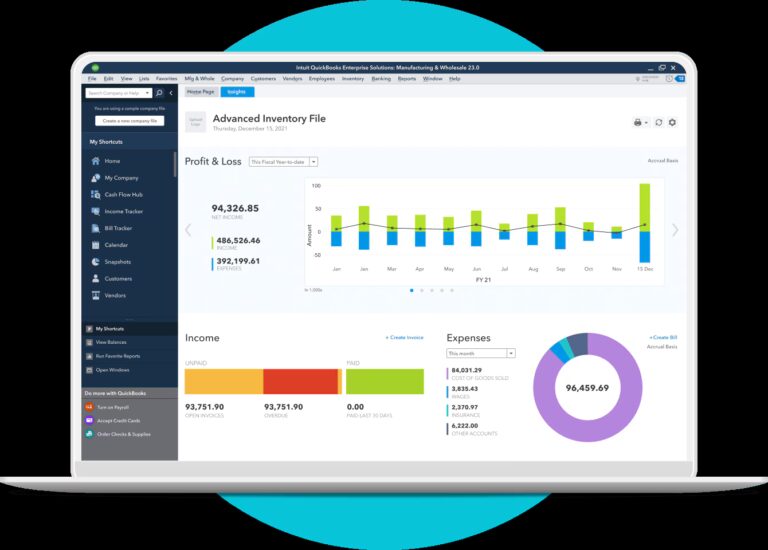

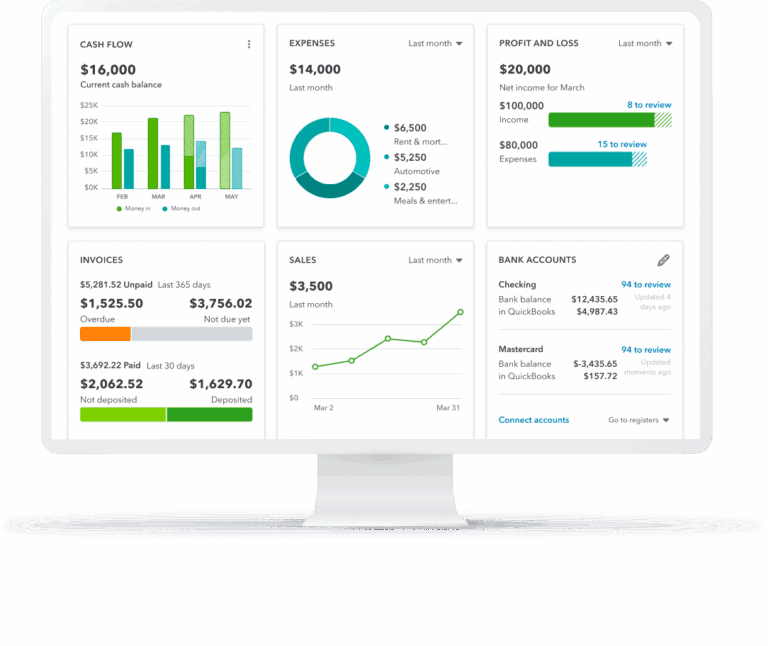

Remember that any QuickBooks Enterprise 2021 Edition can be set-up for hosted remote access that allows workers to access the platform from anywhere. With QuickBooks Enhanced Payroll, you can create unlimited checks, use free direct deposit, file payroll taxes, and generate W-2s on your own with no monthly fees. Furthermore, the software provides customizable reports that save time and reduce errors. Some of the new, key features that QuickBooks has rolled out across all of the Enterprise editions are:

- New Data Level Permissions – Allow specific users to view, edit, or delete only the specific customers, vendors, or data that they’re responsible for.

- New Receipt Management – Assign every expense to a project as it is incurred using only your mobile device, and even record multiple transactions at once.

- New Ability to Automatically Send Statements – Automate regularly sent statement emails and get paid faster by easily reminding customers what they owe.

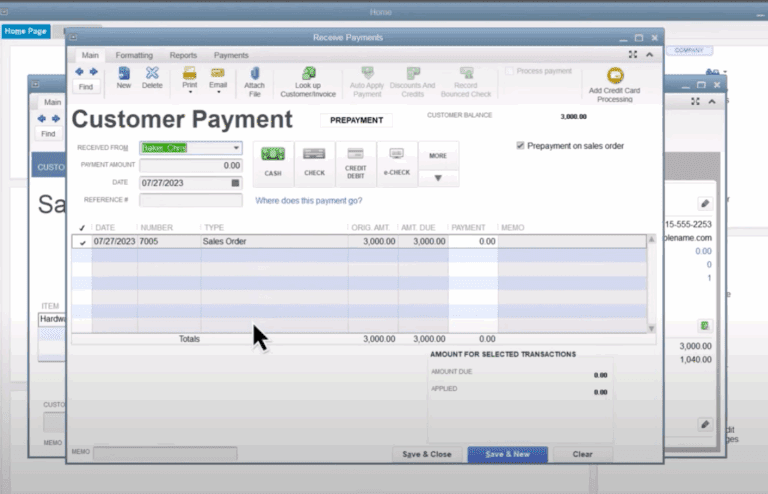

- New Ability to Customize Payment Receipts – Create a more professional look with receipt formatting and the ability to include logos and other custom elements.

- New Salesforce CRM Connector – Have one source of information between sales and support so that you can answer customer questions quickly or resolve issues before they escalate.

Nonprofit Specific Functionality

In addition to all of these features (which have made QuickBooks the most popular bookkeeping platform), the software company has created some new functionality specific to the Non-profit sector. With the understanding that Non-profit organizations are out to change the world, they’ve streamlined several features to make it easier to manage finances in a way that doesn’t detract from more important work. Some of these features are:

- Time-saving tools – Between 1 and 40 users can work at one time; work in multiple files or combine them to get more done, faster.

- Protection of sensitive donor data – Individual data level permissions for up to 115 activities ensure that protected data will only be viewed by those who are authorized.

- Intuitive and non-technical interface – Your staff can store hundreds of thousands of donors, vendors, and items without a technical background.

- Enhanced donor list storage – With over six times the capacity of any other Enterprise product, the Non-profit version allows you to store hundreds of thousands of donors, vendors, and items, growing your lists without compromising processing time.

- Microsoft integrations – Use prepared letters made with Microsoft® Word templates; QuickBooks pre-populates the letters with your data, so no retyping is required.

- Customization options – Use built-in templates, format reports, and donor forms to create documents the way that you want, even adding your logo or mission statement.

- Nonprofit Chart of Accounts – The nonprofit chart of accounts incorporates a unified chart of accounts, so you can easily and reliably transfer data directly into IRS forms.

- Customized payment receipts – Create a professional and consistent look across receipts with customized formatting.

Custom Nonprofit Reports

It’s important that Non-profits keep various parties up to speed – from board members to the IRS, Non-profits require specialized reporting and data management. This version of QuickBooks makes it easier to manage donors, fundraising campaigns, and employees with special reports, such as:

- Budget by programs – View projects by projected vs. actual budget.

- Statement of functional expenses – Gather expenses to report on your IRS 990 forms.

- Donor and grant reporting – Break down contributions by individual donor or grant.

- Biggest donors – Keep track of your most significant donors.

- Statement of financial position – It’s important to understand where your organization stands compared to the prior year, so view balance sheets from today compared to other time periods.

- Statement of financial income and expense – Obtain an understanding of how much money is coming in and where it is going

It’s critical that Non-profits work smarter, not harder. QuickBooks Enterprise 2021 Non-profit Edition enables organizations to do just that. Their goal is to put the information you need to manage employees, donors, campaigns, and IRS information right at your fingertips. To learn more about the Non-profit edition and how it can help your organization, call our experts directly at 866.949.7267 and we can set up a free consultation to discuss your needs and even get you a 30-day free test drive of the software.

[wpcaptevrix_sscta id=”5″]