Take & Process Payments in QuickBooks Online with QuickBooks Payments

Paygration, Inc.

As a small business owner, managing payments can be a time-consuming task. QuickBooks Payments is a payment processing solution that can simplify this process, allowing you to accept payments through various payment methods and seamlessly integrate with QuickBooks Online.

QuickBooks Payments integrates with both QuickBooks Online and QuickBooks Desktop, but today, we will discuss QuickBooks Payments for QBO users. We will explore its features and benefits to help you decide whether it’s the right payment processing solution for your business. We’ll also show you how to set up QuickBooks Payments.

What is QuickBooks Payments?

QuickBooks Payments is a payment processing solution that integrates seamlessly with QuickBooks Online. It allows businesses to accept payments through various payment methods, including credit and debit cards, ACH bank transfers, and card readers. QuickBooks Payments also allows you to create and send invoices and accept payments directly through the QuickBooks Online platform.

QuickBooks Payment Cost

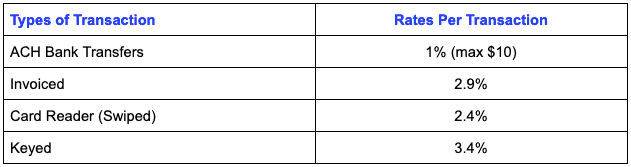

QuickBooks Payments doesn’t charge a monthly fee, and you only pay a fee for each transaction. Fees depend on the type of transaction, whether it’s through invoiced transactions, ACH transfers, card readers, or keyed-in transactions.

QuickBooks Payment fees per transaction for various payment types

QuickBooks Payments Features

Direct Integration with QuickBooks Online

When a payment is processed through QuickBooks Payments, the system automatically sends the transaction data to QuickBooks Online. QuickBooks then matches the payment with the corresponding invoice or sale, records the transaction in the correct account, and updates the business’s financial records in real time. This process eliminates the need for manual data entry, reducing the risk of errors and saving time.

Accept Multiple Payment Methods

QuickBooks Payments supports various payment methods, making it a flexible solution for businesses to accept customer payments. The payment methods supported by QuickBooks Payments include:

- Invoiced payments: QuickBooks Payments lets you send invoices to customers, providing them a secure link to make payments online. This feature simplifies the payment process for customers, enabling them to pay their invoices with just a few clicks.

- Swiped payments: QuickBooks Payments also supports swiped payments, which are ideal for businesses that operate a brick-and-mortar store or attend trade shows and events. This payment method involves the use of a card reader, allowing you to accept credit and debit card payments on-site.

- Keyed payments: Keyed payments are ideal for businesses that receive payments over the phone or through the mail. In this payment method, you must enter the customer’s payment information into the QuickBooks Payments system, allowing you to accept payments without the need for a physical card reader.

- ACH bank transfers: QuickBooks Payments also supports ACH bank transfers, which means you can accept payments directly from customers’ bank accounts. This payment method is ideal for recurring payments, such as subscriptions or membership fees, as it eliminates the need for customers to make payments each time manually.

Deposits

Originally, it would talk two to three business days to receive funds from card transactions and even longer process ACH payments. Fortunately, when you have a QuickBooks Payments account, you can get instant deposits. Once your QuickBooks Payments account is set up, you simply need to connect your debit card or a bank account eligible for instant deposits. If you have a QuickBooks Checking account, you will even get free instant deposits.

To use the instant deposit feature, you need to enable the feature in your QuickBooks Payments account settings. Eligible transactions processed before a certain cutoff time will be deposited into your QuickBooks Checking account instantly.

Instant deposits can be particularly useful for businesses that need immediate access to their funds, such as those with tight cash flow or those that rely on fast payment processing to keep their operations running smoothly.

No Set up Fees or Monthly Charges

QuickBooks Payments offers competitive pricing, with no setup fees or monthly charges. You only pay a processing fee for each transaction, which varies based on the payment method used. This means you can start using the system without any upfront costs, making it a cost-effective solution for businesses of all sizes.

Additionally, QuickBooks Payments also offers competitive processing rates for credit and debit card payments. These rates can be significantly lower than those charged by traditional merchant services providers, allowing businesses to save money on payment processing fees.

Quick and Easy Invoicing

With QuickBooks Payments, businesses can create and send invoices directly through the QuickBooks Online platform. Once an invoice is sent, customers can easily make payments online using a secure payment link included in the invoice. The payment link enables customers to pay with a credit or debit card or directly from their bank account, and the payment is processed and recorded automatically in QuickBooks Online.

QuickBooks Payments also offers a feature called “recurring invoices,” which automates the invoicing process for businesses that offer subscription-based services or products. This feature allows businesses to set up recurring invoices that are automatically sent to customers on a regular basis, eliminating the need for manual invoicing and saving time.

Reporting and Analytics

One of the key reporting features of QuickBooks Payments is the ability to generate detailed transaction reports. These reports provide you with a summary of all transactions processed through QuickBooks Payments, including the transaction amount, date, and payment method. Businesses can also filter reports by specific time periods, payment types, or customers, making it easy to identify trends and patterns in payment processing.

Another important reporting feature is the ability to view and track payments in real-time. QuickBooks Payments offers a dashboard that displays a summary of all payments received and processed, enabling businesses to track their cash flow and identify any payment processing issues in real time. This feature is particularly useful for businesses that rely on regular payments or have strict cash flow requirements.

QuickBooks Payments also offers analytics tools that provide businesses with insights into their payment processing and customer behavior. For example, businesses can use the system to track customer payment history and identify trends in payment frequency or amounts. This information can be used to develop targeted marketing campaigns or adjust pricing strategies to better meet customer needs.

Setting up QuickBooks Payments

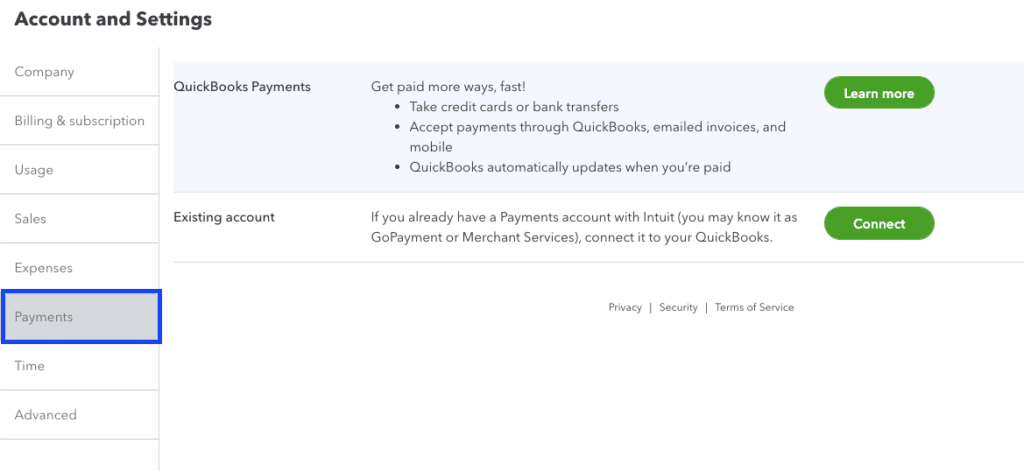

To set up QuickBooks Payments, click on the gear icon on your QBO dashboard, select Account & settings, and choose Payments from the left-side navigation menu.

Navigating to the QuickBooks Payments setup screen in QuickBooks Online

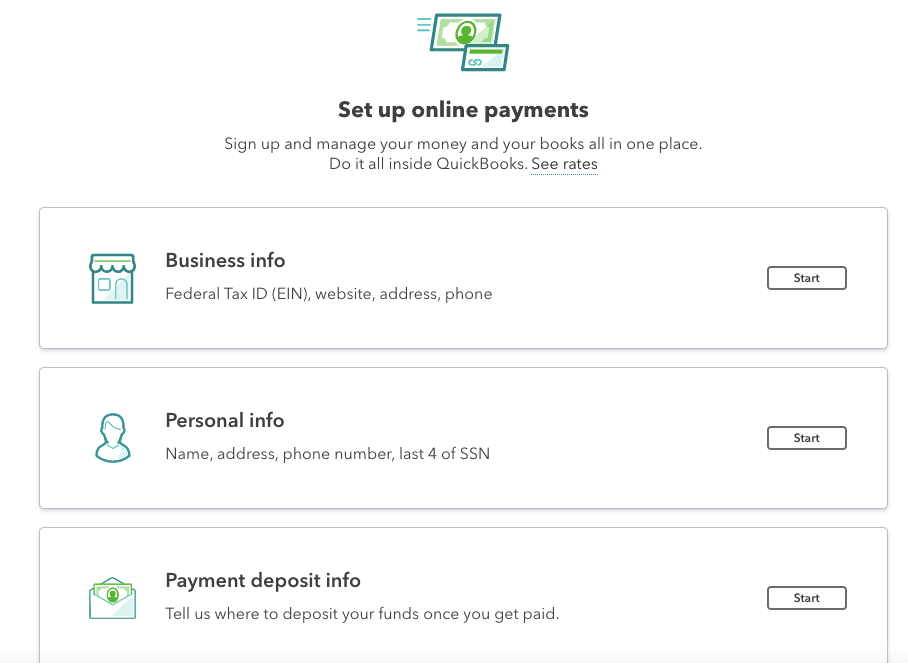

Next, click on Learn More, and you’ll be prompted to follow a series of on-screen steps to set up QuickBooks Payments.

Setting up your QuickBooks Payments information

Once you set up QuickBooks Payments and connect your bank account, you can start sending invoices with a Pay Now button.

Bottom Line

QuickBooks Payments is a valuable payment processing solution for small businesses. Its integration with QuickBooks Online, multiple payment methods, competitive pricing, invoicing capabilities, security features, and reporting and analytics make it a convenient and efficient option for businesses that need to process transactions quickly and securely.