Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Enterprise including 30-day access, sample company files, and the full 88-page QuickBooks Enterprise Guide that details everything that you can do in the software. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Unlocking the Power of Landed Cost in QuickBooks Enterprise: A Game-Changer for Businesses

Paygration, Inc.

Landed cost calculation plays a pivotal role in achieving this understanding, especially for businesses that import goods or incur significant shipping and handling expenses. QuickBooks Enterprise, particularly its Platinum and Diamond versions, offers a robust solution for businesses seeking precision in cost tracking through its landed cost feature. This comprehensive guide delves into what landed cost is, its significance, and how QuickBooks Enterprise facilitates landed cost calculation, with a step-by-step walkthrough on setting it up.

What is Landed Cost?

Landed cost represents the total expense of a product that a business incurs to purchase, transport, and move into inventory, ready for sale. This encompasses the purchase price, freight, insurance, taxes, duties, and any other costs up to the product’s arrival at your warehouse. Accurately calculating landed cost is essential for businesses to determine the true cost of goods sold (COGS) and, consequently, their gross margins.

The Significance of Landed Cost for Cost Tracking

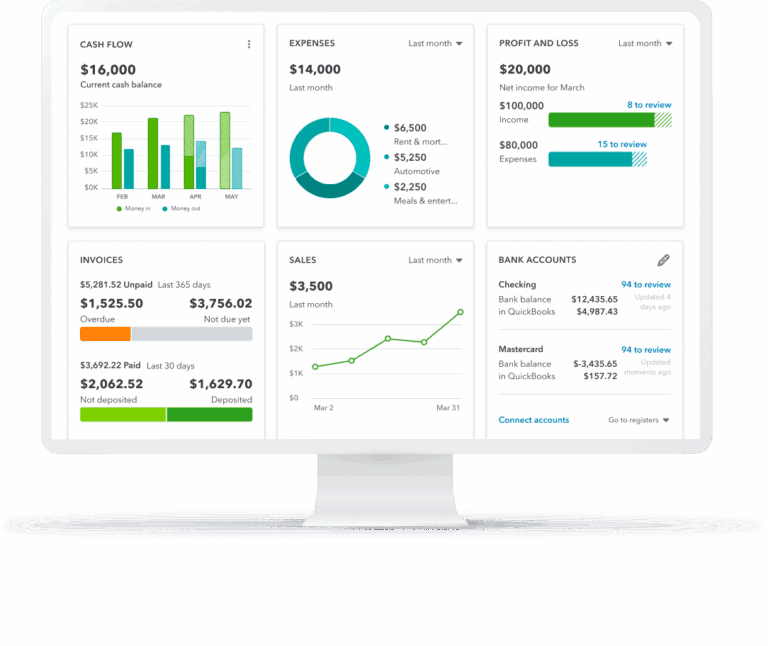

Understanding landed costs helps businesses price their products correctly, maintain profitability, manage inventory more efficiently, and prepare more accurate financial statements. Without incorporating landed costs into your product pricing strategy, you risk underpricing goods, which can erode profit margins, or overpricing, which could make your products less competitive in the market.

For more information, learn how QuickBooks Enterprise can help you streamline inventory management.

If you would like to try the full version of QuickBooks Enterprise Desktop, click here to get a free, 30-day no-commitment trial plus access to the Resource Guide that lists all the features available in Enterprise.

Exclusive Feature in QuickBooks Enterprise Platinum and Diamond Versions

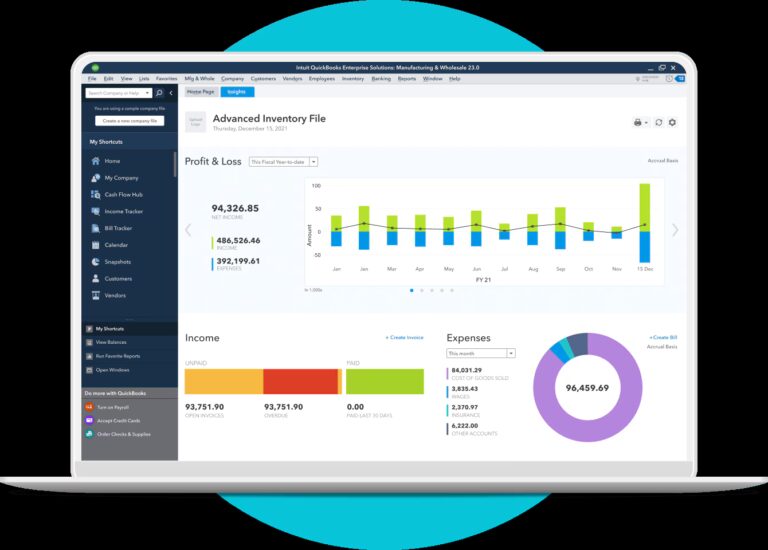

The landed cost feature is an exclusive benefit of the QuickBooks Enterprise Platinum and Diamond versions. This tool allows businesses to allocate additional costs beyond the purchase price to their inventory items, providing a more accurate picture of inventory valuation and COGS.

Example of Landed Cost Calculation

Imagine your business imports a container of goods valued at $50,000. The shipping costs $5,000, insurance is $500, and customs duties are $2,500. The total landed cost for the container is $58,000. If the container holds 1,000 items, the landed cost per item is $58. This information is crucial for pricing the items correctly to ensure profitability.

Step-by-Step Walkthrough: Setting Up Landed Cost in QuickBooks Enterprise

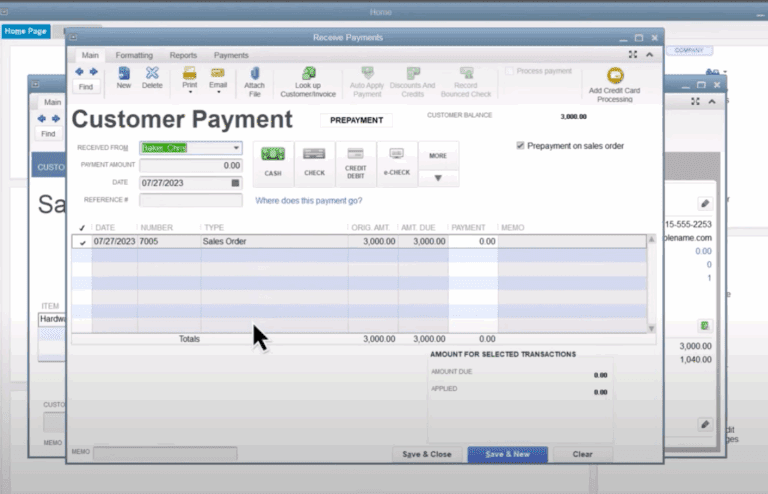

- Turn On Landed Cost: First, navigate to the “Edit” menu, select “Preferences,” and then “Items & Inventory.” Go to the “Company Preferences” tab and ensure that inventory and purchase orders are activated. Then, activate the landed cost feature.

- Set Up Landed Cost Accounts: Create new accounts in your chart of accounts to track landed costs, such as freight, duties, and insurance.

- Assign Landed Cost to Items: When recording a bill or adjusting inventory, allocate the additional costs to your items. QuickBooks will distribute these costs based on the method you choose (by quantity, value, or weight).

- Review Reports: Utilize QuickBooks reports to analyze how landed costs affect your inventory valuation and COGS.

How Paygration Elevates Your QuickBooks Experience

As an Intuit Elite Solution Provider, Paygration is your go-to expert for leveraging QuickBooks Enterprise to its fullest potential. We offer a 30-day free trial of QuickBooks Enterprise, providing businesses an opportunity to explore its comprehensive features, including landed cost calculation, without commitment.

- Unlimited Consultation and Support: Our team of QuickBooks-certified professionals is available to guide you through every step of setting up and maximizing the use of your QuickBooks Enterprise software.

- Free Online Training: Gain access to over 100 free training videos that cover a wide range of topics, from basic setup to advanced features like landed cost calculation.

- Special Lifetime Discounts: Choose to move forward with QuickBooks Enterprise through Paygration, and enjoy exclusive discounts that make this powerful tool even more accessible.

Conclusion

Understanding and implementing landed cost calculation can significantly impact your business’s financial health and competitive edge. With QuickBooks Enterprise Platinum or Diamond version and Paygration’s expert support, you’re well-equipped to take this step confidently. Don’t let complexity hold you back from accurate inventory costing and improved profitability.

- advanced inventory in quickbooks enterprise diamondadvanced pricing in quickboooks enterprise diamondbenefits of quickbooks enterpriseinventory expiration tracking in QuickBooks Enterpriseinventory management in QuickBooks Onlineinventory tracking in QuickBooks Online Advancedquickbooks enterprise advanced inventoryquickbooks enterprise inventory