Why Recurring Billing is a Game-Changer for Small Business Owners Using QuickBooks Payments

Paygration, Inc.

One of the biggest challenges of running a business is managing cash flow and ensuring timely payments from customers. That’s where recurring billing in QuickBooks Payments comes in – it can be a game-changer for small business owners looking to streamline their billing process and improve cash flow.

In this blog, we’ll explore the benefits of recurring billing in QuickBooks Payments and how it can help small business owners manage their finances more efficiently.

What is Recurring Billing in QuickBooks Payments?

The recurring billing feature in QuickBooks Payments allows businesses to set up automatic payments for customers who pay on a regular basis. You can create a recurring payment schedule for customers and specify the amount, frequency, and duration of the payments. QuickBooks Payments will automatically charge the customer’s credit card or bank account on the specified dates, making the billing process more efficient and reducing the risk of late payments.

Learn how to take and process payments in QuickBooks Online with QuickBooks Payments.

Benefits of Recurring Billing in QuickBooks Payments

Saves Time and Resources

Since you can create a payment schedule for customers and set up automatic payments, you don’t need to manually create and send invoices, saving time and resources. Also, automated billing frees you up from administrative tasks, including printing invoices, stuffing envelopes, and sending them in the mail. This allows you to focus your time and resources on other important aspects of your business.

Improves Cash Flow

Recurring billing in QuickBooks Payments can improve cash flow in many ways. For instance, business owners can set up recurring billing in QuickBooks Payments to automatically charge each member’s credit card on a monthly basis. This provides a reliable stream of revenue that businesses can count on, which can help them better manage their cash flow. Also, it helps ensure that payments are collected on time, removing the need for time-consuming follow-up on late payments.

Reduces Manual Errors

Manual errors in billing can lead to delays, disputes, and costly corrections, which can negatively impact a business’s reputation and bottom line. Luckily, recurring billing in QuickBooks Payments eliminates the need for manual data entry, reducing the risk of errors caused by human error. This is particularly important for businesses that process a large number of invoices or payments each month. Also, businesses can stick to consistent billing schedules, which can help avoid mistakes caused by missed or late payments.

Improves Customer Satisfaction

The recurring billing feature in QuickBooks Payments allows businesses to offer their customers convenient payment options such as credit card or bank account payments. This can help customers avoid the hassle of writing checks or remembering to make manual payments. Additionally, businesses can offer their customers flexible payment schedules that fit their needs and preferences. For example, customers can choose to pay monthly, quarterly, or annually, depending on their budget and cash flow.

Connecting QuickBooks Online to QuickBooks Payments

Connecting your QuickBooks Online account to QuickBooks Payments is pretty straightforward. Note that while QuickBooks Payments has no monthly fee, you need to subscribe to a QuickBooks Online plan which requires a subscription fee. Here’s how you connect QuickBooks Online to QuickBooks Payments.

- Sign up for QuickBooks Payments: If you haven’t already, you will need to sign up for a QuickBooks Payments account. You can do this by visiting the QuickBooks Payments website and clicking “Sign Up.”

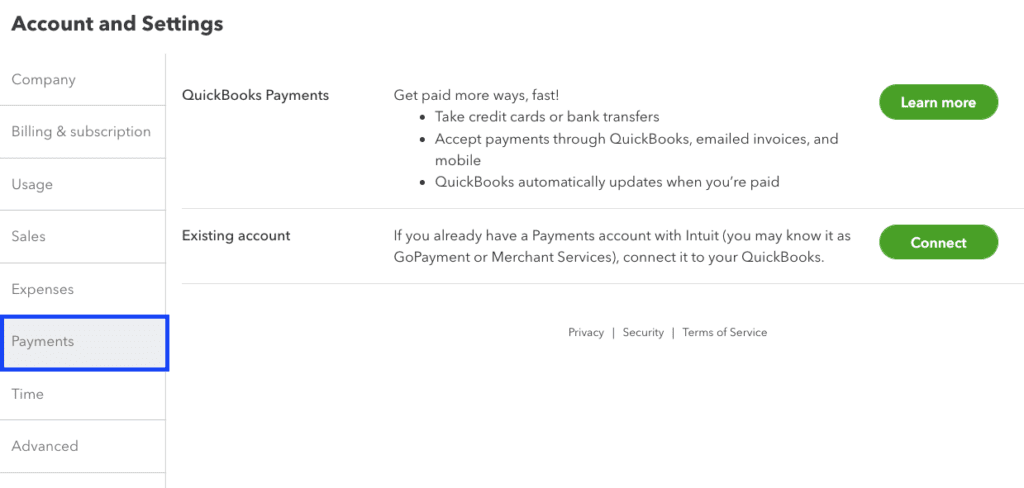

- Log in to QuickBooks Online: Log in to your QuickBooks Online account and navigate to the Account and settings menu by clicking on the Gear icon in the top right corner of the screen.

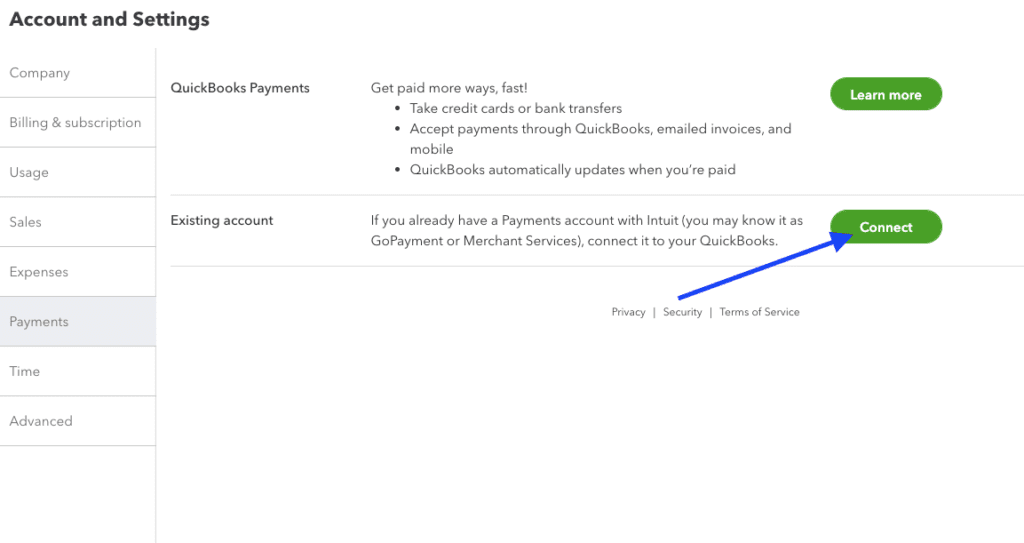

- Select “Payments”: From the Account and settings menu, select Payments in the left-hand column.

- Connect your QuickBooks Payments account: Click on the “Connect” button and follow the prompts to connect your QuickBooks Payments account to QuickBooks Online. You will need to enter your QuickBooks Payments login credentials and authorize the connection.

- Set up your payment preferences: Once the connection is established, you can set up your payment preferences, such as which payment methods you accept and whether you want to enable recurring payment

How Recurring Billing in QuickBooks Payments Works

Set up the recurring billing schedule

You will need to set up the billing schedule for the recurring payments, including the frequency (e.g., weekly, monthly, quarterly) and the amount to be charged. This information is stored in your QuickBooks Payments account.

Create a recurring invoice

Once the billing schedule is set up, you can create a recurring invoice in QuickBooks Online. This invoice will include the details of the recurring payment, such as the payment frequency, amount, and start date.

Link the invoice to the recurring billing schedule

In QuickBooks Online, you will need to link the recurring invoice to the billing schedule that you created in QuickBooks Payments. This ensures that the invoice is automatically sent to the customer on the appropriate schedule.

Invoice is automatically sent

QuickBooks Payments will automatically generate and send the invoice to the customer at the specified intervals. The customer will receive an email notification with a link to view and pay the invoice.

Payment is processed

When the customer pays the invoice, the payment is processed through QuickBooks Payments. The payment is then automatically recorded in your QuickBooks Online account.

Bottom Line

Overall, recurring billing in QuickBooks Payments automates the process of generating and sending invoices, as well as processing payments, which can save businesses time and reduce the risk of errors. By setting up recurring billing, businesses can improve their cash flow, reduce manual work, and improve customer satisfaction.