Pete Real

Not so long ago brands like QuickBooks and Peachtree dominated the small business accounting software scene. In the past few years as cloud computing has become increasingly common, new entries to the marketplace have leveraged the advantages of the cloud to create accounting software that is easy to use and well-suited for the small business owner who knows little of formal accounting and isn’t in a position to hire someone who does. Xero and FreshBooks are two of the best-known.

Is FreshBooks better than QuickBooks?

In its marketing FreshBooks describes QuickBooks as “slow” and “bloated” and claims there is a “steep learning curve” resulting from “complex double-entry accounting features.” Those of us who have been around the accounting software scene for more than a decade or so might find those descriptions ironic given that for years QuickBooks was often poo-pooed as “not real accounting software,” the kind of program used by people who didn’t really know accounting. Whatever the truth of that might have been, the QuickBooks of today—Enterprise in particular—is quite powerful even for not-so-small businesses. And despite the proclaimed evils of double-entry accounting, if you’re doing anything more sophisticated than running a checkbook, you’re doing double-entry accounting whether you know it or not.

Strong points of FreshBooks Accounting Software

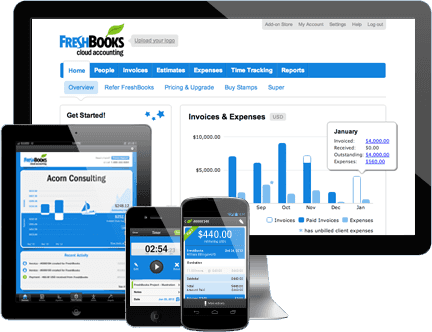

But the merits of its marketing claims aside, FreshBooks is an excellent accounting platform particularly for new businesses and is popular with freelancers, consultants, and others who typically don’t have a bookkeeping (or any other) staff. In fact, the system was designed specifically for such businesses and focuses on service-based models; if you are running an inventory-heavy retail or other company, FreshBooks will not be for you. Much as Xero does, FreshBooks supports integration with third-party applications rather than adding components or modules (often separately priced add-ons) as QuickBooks has done. This allows the introduction of additional capabilities such as payroll with the flexibility to choose the solution that’s best for your business.

Invoicing and Getting Paid With FreshBooks

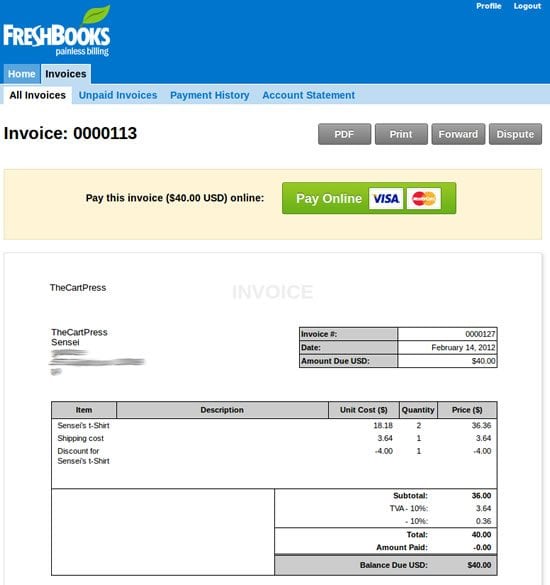

FreshBooks was designed particularly to simplify invoicing and payment with an eye toward improving cash flow for small companies that rely on fast payments from customers. The software generates e-mail invoices as a default, although it includes a service that will mail hardcopy invoices to any customers that require them. It automatically reminds customers of overdue payments and can also automatically apply late fees. To simplify payment, your FreshBooks account can be tied to a merchant processing account provided by WePay so that customers can click-and-pay their invoices with a credit card.

FreshBooks Rates, Fees and Processing Options

However, processing rates through WePay are relatively steep: $0.30 per transaction plus 2.9 percent of the total. The costs are basically identical to PayPal and Stripe (both of which can also be accepted through FreshBooks). A better option is Direct Pay Systems, which has rates about half those of WePay. There is no flat transaction fee, and rates start at 1.49 percent. Direct Pay Systems also offers e-commerce options if your business needs them. FreshBooks allows the scheduling of automatic invoicing for recurring charges, and like any other invoice those can be paid by credit card if your FreshBooks account is set up for that. But Direct Pay Systems makes things even simpler by enabling the scheduling of automatic charges for recurring billing.

If you operate a service-based small business, FreshBooks may well be a less expensive and more effective option for your accounting. It is very well suited for those who are on the go frequently since it is mobile device-friendly. Accepting credit cards is the best way to complement the cash flow tools already in FreshBooks, and a less expensive option for processing that sends more to the bottom line is just another plus.

Have Questions? Need Help?

If you have questions with integrating credit card processing into FreshBooks Accounting Software, give us a call. In just a couple minutes, we can show you how to set up low cost payment processing that will allow you to use FreshBooks as a complete system when it comes to your accounting and billing. If you are currently accepting credit cards elsewhere, we can even customize the pricing to save you money. To learn more, just give us a call at 866.949.7267 or click here to send us a message.

- accept amex american express cards with freshbooksaccept debit cards with freshbooksaccept discover cards with freshbooksaccept mastercard credit cards with freshbooksaccept visa cards with freshbooksbest credit card processing for freshbooksbest merchant services for freshbooksbest payment processing for freshbooksfreshbooks all invoicesfreshbooks authorize.net payment gatewayfreshbooks credit card processingfreshbooks credit card processing rates and feesfreshbooks merchant servicesfreshbooks merchatn services optionsfreshbooks payment historyfreshbooks payment integrationFreshbooks payment integration optionsfreshbooks payment processing optionsfreshbooks unpaid invoicesgetting paid in freshbookshow can i accept credit cards in freshbookshow can i accept payments in freshbookshow to accept payments with an invoice in freshbooksintegrate credit cards into freshbookspay by invoice in freshbookspaypal payments freshbooksstripe payments freshbookswepay freshbooks