Every business looks for ways to improve productivity and increase sales. And since the way a business receives and records cash inflows can either break or make it, it becomes imperative for your company to have the right method of payments set up for the way that you do business. Just as a retail store would not want to accept payments directly in their QuickBooks Accounting at the front counter, a “back office” business shouldn’t be keying their payments into a standard terminal. Why? It just is not an efficient way of doing things. So let’s first explore the best way to set things up for the two main ways of accepting payments before we dive into the advantages.

Retail Storefront:

Since a retail storefront is dealing with customers face-to-face, speed, being able to swipe the card and having a captured signature is key importance. Cardholder and data security is also a concern since employees are handling sensitive customer information and data. For this reason, Using your QuickBooks accounting program is probably not the best bet. But a program like QuickBooks Point of Sale would be a great choice. It allows you to process sales, track customers and inventory and is completely secure. At the end of the day, it will move all your data and totals into your QuickBooks Accounting Software so that you have accurate totals for managing your business. But what about using a standard credit card terminal or even a payment integrated cash register? Well, the will get the transactions processed but wont do much in the way of saving time with reconciliation. Best solution here: QuickBooks Point of Sale (or equivalent POS that can export data to QuickBooks as a second option).

Back Office Sales (Mail Order/Phone Orders/Invoicing)

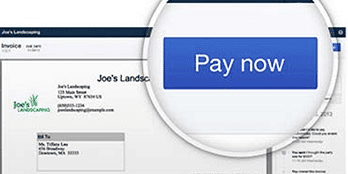

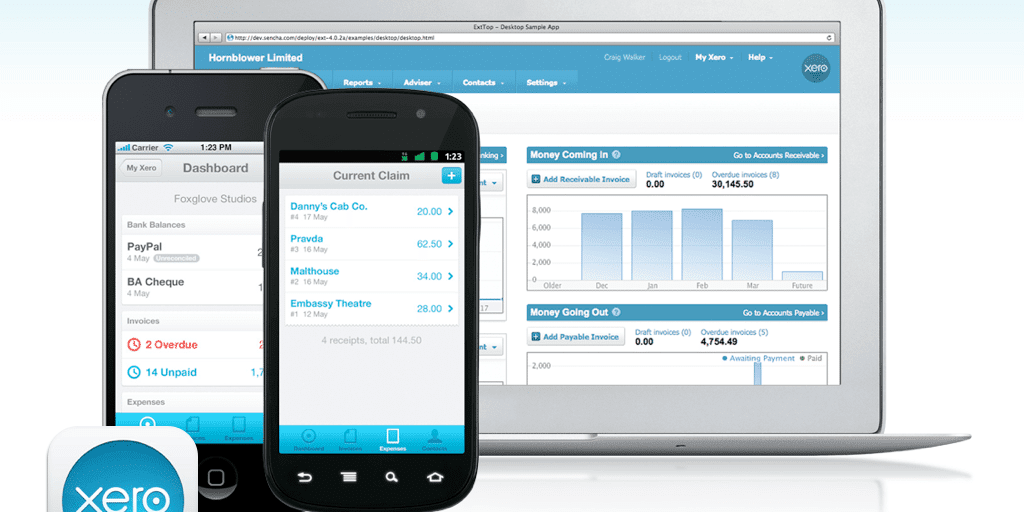

Because there are very little if any “face-to-face” to face transactions in this type of segment, it opens up the ability to more effectively use your actual accounting software to process transactions directly. The types of businesses that fall into this category would be manufacturing, repair and service, or any industries where a product is shipped or billed after shipment. In these situations, the billing or accounting department is usually in the software during the day, so accepting payments directly to a customer in the system is quick and easy. This also allows you to instantly pay off open invoices or email invoices out to customers with a “pay now” link on them. Instead of having to call in to pay or put a check in the mail (ugggggh), they can click the link, enter their card or checking information and hit submit. The bill is paid instantly and the invoice status is updated in the software. This feature is a huge time saver and available in most major accounting platforms such as QuickBooks, Sage, FreshBooks and Xero.

Some other advantages are that for businesses that have any type of continuous billing (such as service contracts or subscriptions), you can set up an automated recurring billing schedule where it will automatically charge the customers credit card or checking account on a preset schedule that you determine. Lastly, most major accounting software (all the ones mentioned above) have the ability to link to mobile payment options and even online shopping carts.

So, now lets discuss the best reasons for integrate payment processing with your accounting software…

1. Reduces Errors and Saves Time

Every business wants to get paid to operate successfully, and in order to receive payments quickly, you have think out-of-the-box. But how can you do that? Well, are you tired of manually entering and reconciling payments? Then why not consider integrating your payment processing? This type of processing reduces the likelihood of ‘human error’ and can save you the time you would otherwise spend reconciling these errors. Integrated payment processing is known to reduce time spent on reconciliation, credit card verification and redundant data entry. Intuit, the makers of QuickBooks Accounting Software estimates a savings of up to 8 hours a week just from this area. Since time is always in short supply for businesses, this is a key factor to make the move.

2. Supports all Major Card Companies

One of the best features of integrated payment processing is it supports all types of major card companies, such as Visa, MasterCard, Discover and American Express, as well as online payment platforms – even including PayPal. In addition, some integrated payment options can even support other non-cash methods, such as gift cards and electronic checks. Having as many payment options as possible makes it easier and more convenient for customers to pay when means that you have less accounts receivables and more cash flow.

3. Improves Transparency and Control

As soon as you integrate payment processing in your business solutions or accounting software, it is automatically recorded, thus providing you improved transparency. In addition, it also gives you the capability to create more accurate and up-to-date accounting reports. In addition, most payment integration methods come with features built in that help reduce and in some cases, practically eliminate intentional fraud which can save you tons of headaches in both the short and long run.

4. Saves Money

You probably do know the saying that goes ‘Time is Money’, and since integrating your processing can save the time spent on re-verifying credit card information and re-entering data, it can help greatly in saving money and side by side also reduce certain errors such as invalid data entry. Additionally, It becomes much easier to track payments as well as process refunds and cancellations easily.

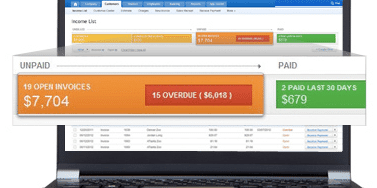

5. Enhances Cash Flow

Most payment systems come with features which allow you to monitor transactions and registrations as they occur via notifications. Therefore, by closely monitoring your transactions and having them all processed in the same system, you can reduce your days’ sales outstanding (DSO). This increases the speed of posting receivables, and ultimately improves your overall cash flow.

The Bottom Line…

As you can see, there are numerous reasons for your business to integrate payment processing in its accounting software. If you are currently accepting credit cards using a “two-step” system of accepting payments in one place and then processing them with another device, this will save you tons of time and money. Hopefully, this provides a good overview of the different possibilities but if you are looking to tie it all together, there is usually some customization and configuration necessary to make everything work seamlessly. This is where we can help guide you so that all the pieces are set up correctly. From using (or choosing) the right software, setting up the integrated payments and connecting it all together, we will help answer your questions and get you an the right path. To contact us, just call 866-949-7267 or click here to send us an email.