The available options for merchant credit card processing are many. All sorts of considerations factor into choosing a processor – from the type of card payments you accept, how you process them, and the frequency and size of card transactions. One option that may make sense for your business is Intuit Merchant Services, from the company that produces QuickBooks.

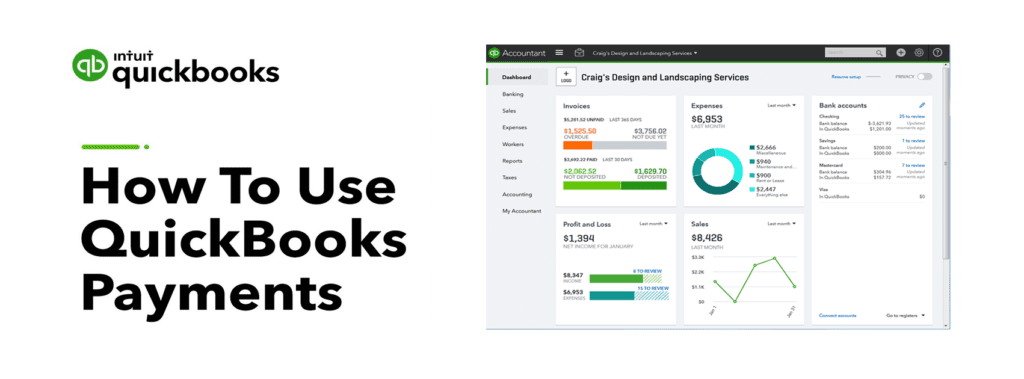

Intuit payment processing makes particular sense if you’re already using (or planning to use) any of the many versions of QuickBooks. From QuickBooks Online, which is best for small businesses, to the widely used Desktop Pro and Premier versions as well as Enterprise, Intuit’s merchant service can be directly integrated into its accounting software.

Multiple Ways To Accept Payments

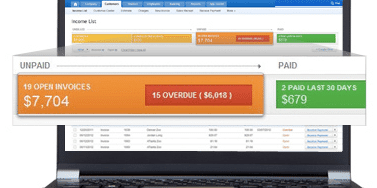

Card payments can be processed in a couple of different ways. One is via mobile device, including both iPhone and Android phones as well as tablets. (More on mobile devices will follow in a moment.) Another is directly into your QuickBooks software, which is particularly suited for businesses with no face-to-face customer contact at the time of the transaction. Card swipers are also available so that you can have a card present transaction with lowest rates.

Save Time And Money

The integration provided by Intuit payment processing combined with QuickBooks can be a tremendous time saver. Both banking and card processing transactions can be downloaded, which makes keeping your merchant account, your bank account, and your books synchronized much easier and much more accurate. A handy feature is the transaction fee calculator, which lets you know up front exactly what a given card transaction is going to cost you in fees.

Compatible With Most Devices

Mobile device card processing works with a wide range of devices, including common phones and tablet devices. The only major product line excluded is the BlackBerry family. Intuit has a list of compatible devices (with phones handily grouped by wireless carrier) that will let you verify the device you want to use. You can find the list by going to Intuit’s mobile device site and clicking “See all” under Compatible Devices.

Two Pricing Options

This transaction processing option (which doesn’t require you to use QuickBooks, by the way) comes in two formats. One is a flat monthly fee with no transaction fee; the other (obviously intended for merchants with few transactions) is “pay-as-you-go” and has no fixed fees. However, the swipe rates are about 1% higher with this option than with the monthly subscription, so you’ll want to do the math to determine which plan makes financial sense for your business.

Virtual Terminal Included

Intuit also has what they call an “online terminal.” This system functions through any web browser; all you need to do is log into your account and enter the card information. You have the option to e-mail receipts to your customers, too. You can establish recurring payments on customers’ cards as needed, and more than one user can log into the system at one time. A full range of reporting, including an option to export data to Excel, is also available. Since it is possible to process payments directly from within QuickBooks, the online terminal makes sense for those who do not use QuickBooks for their accounting.

Reporting

If you operate with minimal bookkeeping staff (or if you or a family member is the bookkeeper while wearing several other hats), the savings in time and labor provided by integrating QuickBooks and Intuit payment processing may very well represent a significant consideration when comparing the pricing and features available from other merchant services. With reporting features comparable to those offered by other providers, you’ll lose nothing in analytical tools while eliminating the need to import data into your accounting system.

Have questions? Need help?

Looking for the best payment solution for your business but not sure where to start? We can help! With over 20 years experience in the payments industry, we can help guide you into the best solution in just a couple minutes time. Best of all, if what we offer is not the best solution, we will let you know. To see if we can help, just give us a call at 866-949-7267 or click here to send us a email. We look forward to helping you!