Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Enterprise including 30-day access, sample company files, and the full 88-page QuickBooks Enterprise Guide that details everything that you can do in the software. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Paygration, Inc.

Intuit has been helping businesses in many different ways—from accounting, bookkeeping, and reporting to payment processing and payroll. QuickBooks offers payroll services to make it easy for companies to pay their employees. It offers several plan types at different prices, making it a great option for almost any kind and size of business.

If you want to make payroll an easier task for you, QuickBooks Desktop Payroll is a logical choice. This post tackles the different plans of QuickBooks Desktop Payroll, along with a breakdown of pricing, features, and advantages so you can decide which version fits your needs.

QuickBooks Desktop Payroll Pricing

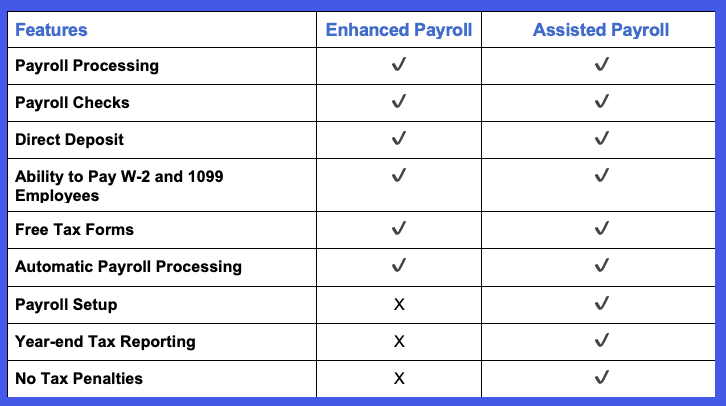

QuickBooks Desktop Payroll is offered in two subscription options (Enhanced Payroll and Assisted Payroll) which cost $50 per month plus $2 per employee and $109 per month plus $2 per employee, respectively. However, note that Enhanced Payroll is already included in the Gold and Platinum plan, so if you sign up for these subscriptions, then you don’t have to pay the monthly base fee. Assisted Payroll, on the other hand, comes with the purchase of QuickBooks Enterprise Diamond. If you need other essential features aside from Assisted Payroll, such as advanced pricing and advanced inventory, explore the benefits of using QuickBooks Enterprise for your business.

If you would like to try the full version of QuickBooks Enterprise Desktop, click here to get a free, 30-day no-commitment trial plus access to the Resource Guide that lists all the features available in Enterprise.

QuickBooks Desktop Enhanced Payroll

QuickBooks Desktop Enhanced Payroll is designed for those who file their own taxes. If you have many employees and you’re handling payroll tax payments and filing taxes on your own, then Enhanced Payroll is right for you. Enhanced Payroll allows you to pay your employees by checks and direct deposits. While you have to file and remit tax payments by yourself, it provides some really useful e-payment and e-filing resources to help you make the process easier.

Enhanced Payroll includes the following features:

- Free tax forms

- Tax filing support

- Ability to pay 1099 and W-2 employees

- Online access to paystubs

- Automatic tax calculations

- Free direct deposit for employees

- Two-day direct deposit

QuickBooks Desktop Assisted Payroll

QuickBooks Desktop Assisted Payroll, as the name itself suggests, includes assisted or automatic tax filings. This means you don’t have to file and remit tax payments, as QuickBooks will do it for you. Not only QuickBooks will remove the burden of tax filing, but it also includes year-end tax reporting. On top of that, you’ll benefit from next-day direct deposits compared to Enhanced’s two-day processing.

Assisted Payroll contains the same general features as Enhanced, in addition to the following:

- Automatic tax filing

- Automatic tax deductions

- Assisted payroll setup

- No-tax penalties guarantee

Enhanced Vs. Assisted Payroll: Which is Right for Me?

Whether Enhanced or Assisted Payroll is right for you depends on your needs and how much you can afford. A crucial differentiator between the two is the availability of automatic tax filing, which makes sense for busy business owners who don’t have time to file and remit tax payments by themselves. However, if you are comfortable running payroll by yourself, then Enhanced might be a good choice for you.

To further help you make an informed decision, here’s how Enhanced and Assisted Payroll stack up against each other.