Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Enterprise including 30-day access, sample company files, and the full 88-page QuickBooks Enterprise Guide that details everything that you can do in the software. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Paygration, Inc.

Nonprofits have unique financial management needs that differ significantly from for-profit businesses. QuickBooks Enterprise is a powerful solution tailored to meet these specific requirements. It offers an industry-specific edition that is built specifically to the needs of nonprofit organizations.

Below, we explore the top ten reasons why QuickBooks Enterprise is ideal for nonprofits.

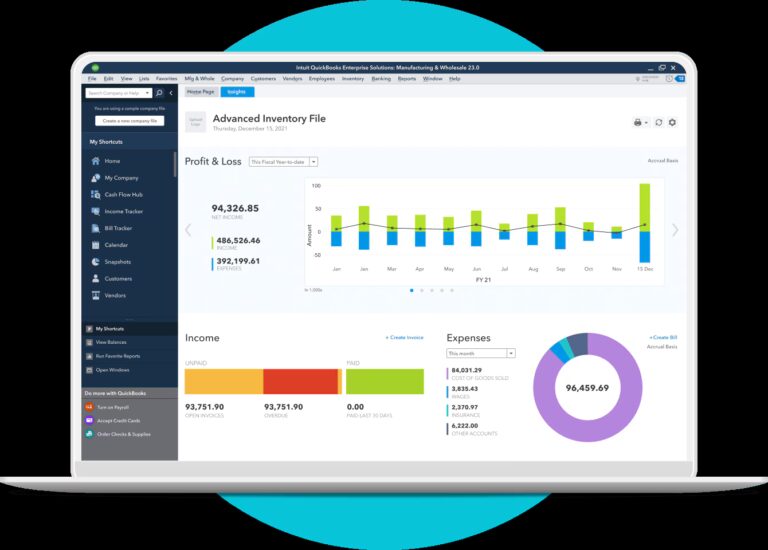

1. Advanced Financial Reporting

Nonprofits need detailed financial reporting to meet regulatory requirements and demonstrate transparency to donors. QuickBooks Enterprise offers over 200 customizable reports, including Statement of Financial Position, Statement of Activities, and donor contribution summaries. These reports provide insights into the financial health of your organization, making it easier to comply with accounting standards and enhance accountability. QuickBooks Enterprise also allows you to generate reports tailored to grant requirements, ensuring that every dollar is tracked and reported accurately.

Learn more about advanced reporting in QuickBooks Enterprise.

2. Advanced Budgeting Tools

Effective budgeting is crucial for nonprofits to manage funds efficiently and achieve their mission. QuickBooks Enterprise features advanced budgeting tools that enable nonprofits to create, track, and adjust budgets in real-time. Organizations can set up multiple budgets for different programs or departments, compare actuals versus budgeted amounts, and make data-driven decisions. The software’s forecasting capabilities help predict future financial needs, ensuring that nonprofits can allocate resources strategically and avoid overspending.

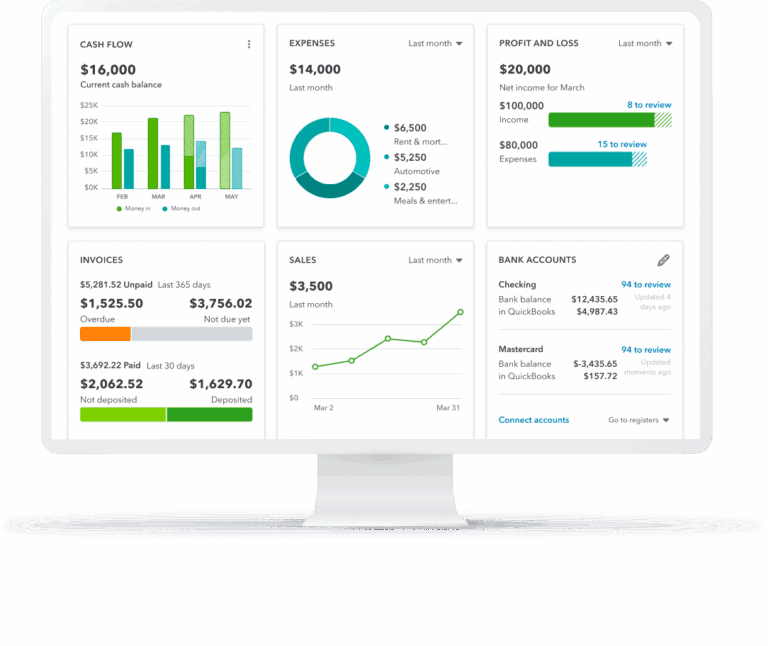

3. Fund Accounting Capabilities

Fund accounting is essential for nonprofits to separate and manage different funding sources. QuickBooks Enterprise Nonprofit supports fund accounting by allowing users to create and manage multiple funds, ensuring that restricted and unrestricted funds are accurately tracked. This feature helps organizations comply with donor restrictions and regulatory requirements, providing a clear view of how funds are utilized. Fund accounting in QuickBooks Enterprise also simplifies the auditing process, making it easier to provide transparent financial statements to stakeholders.

If you would like to try the full version of QuickBooks Enterprise Desktop, click here to get a free, 30-day no-commitment trial plus access to the Resource Guide that lists all the features available in Enterprise.

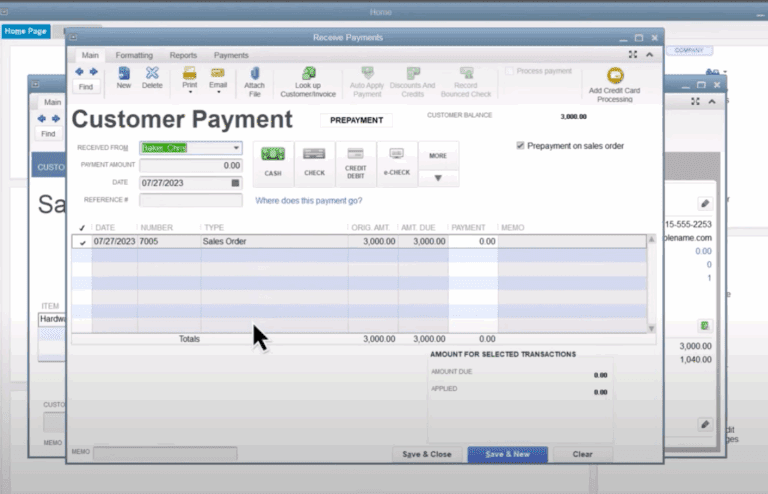

4. Streamlined Donor Management

Maintaining strong relationships with donors is vital for the sustainability of nonprofits. QuickBooks Enterprise Nonprofit includes a robust donor management system that tracks donations, pledges, and donor information. This integration allows nonprofits to manage donor communications, recognize donation patterns, and segment donors for targeted campaigns. With detailed donor histories and automated thank-you letters, QuickBooks Enterprise helps enhance donor engagement and retention, ensuring ongoing support for your mission.

5. Grant Tracking and Management

Managing grants effectively is critical for nonprofits that rely on external funding. QuickBooks Enterprise Nonprofit offers comprehensive grant tracking features, allowing organizations to monitor grant statuses, deadlines, and reporting requirements. The software provides tools to track grant expenses and revenues, ensuring compliance with grantor conditions. By consolidating grant information in one place, QuickBooks Enterprise simplifies the management process, helping nonprofits maximize their grant opportunities and maintain accurate records.

6. Inventory and Asset Management

Nonprofits often manage various types of inventory and assets, from office supplies to program-related equipment. QuickBooks Enterprise includes advanced inventory and asset management features, enabling organizations to track items, manage stock levels, and record asset depreciation. This functionality helps nonprofits maintain control over their resources, reduce waste, and ensure that program needs are met efficiently. Accurate inventory tracking also supports financial reporting and audit compliance.

Discover why QuickBooks Enterprise is the best inventory management software.

7. Enhanced Security and User Permissions

Protecting sensitive financial data is a top priority for nonprofits. QuickBooks Enterprise offers robust security features, including customizable user permissions that restrict access based on roles. This ensures that only authorized personnel can view or modify financial information, reducing the risk of fraud and data breaches. Additionally, QuickBooks Enterprise includes audit trails that track changes made to financial records, providing an extra layer of security and accountability.

8. Multi-User Collaboration

Nonprofits often have teams working collaboratively on financial tasks. QuickBooks Enterprise supports multi-user access, allowing multiple team members to work on the system simultaneously. This feature enhances efficiency by enabling real-time updates and reducing bottlenecks in financial processes. With user-specific access levels, team members can collaborate on budgeting, reporting, and donor management without compromising data security.

9. Seamless Integration with Other Tools

QuickBooks Enterprise integrates seamlessly with various third-party applications, enhancing its functionality and streamlining operations. Nonprofits can connect QuickBooks Enterprise with donor management systems, payroll services, and CRM tools to create a unified financial ecosystem. This integration reduces data entry errors, improves data consistency, and saves time by automating routine tasks. By centralizing information, QuickBooks Enterprise helps nonprofits maintain accurate records and make informed decisions.

10. Multi-entity Management

Nonprofits often oversee various programs, projects, or even distinct entities, each with its own financial needs. QuickBooks Enterprise excels in multi-entity management, enabling organizations to handle separate accounts, budgets, and financial reports for each entity within one unified system. This feature simplifies the complexities of managing diverse operations by ensuring precise tracking and reporting for each segment. Nonprofits can easily produce consolidated financial statements, offering a holistic view of the organization’s overall financial status while maintaining detailed records for individual entities. This functionality is especially valuable for large nonprofits with multiple funding streams and operational division

Get Started with QuickBooks Enterprise Today

QuickBooks Enterprise offers a comprehensive suite of features tailored to meet the unique needs of nonprofits, ensuring efficient financial management, transparency, and compliance. To explore how QuickBooks Enterprise can benefit your organization, contact Paygration for a free demo and consultation. Our team of experts will guide you through the software’s capabilities and help you get started.

Paygration also offers exclusive discounts and ongoing support for as long as your account is active, ensuring you have the resources needed to succeed. Call us today at 866-949-7267 or click the link below to get started.