Just register for the free trial below and we will send you everything you need to evaluate QuickBooks Online including 30-day access, the full 76-page QuickBooks Online Guide (details everything that you can do in the software) plus the video training library. Free end-to-end consultation and support are included so if you need any help along the way, just let us know!

Paygration, Inc.

In a previous article, we tackled some of the latest features that QuickBooks Online Advanced rolled out before 2022 ended. In early 2023, QuickBooks Advanced has introduced some exciting new features that make it an even more powerful tool for businesses.

In this article, let’s go over the latest features of QuickBooks Online Advanced as of March 2023.

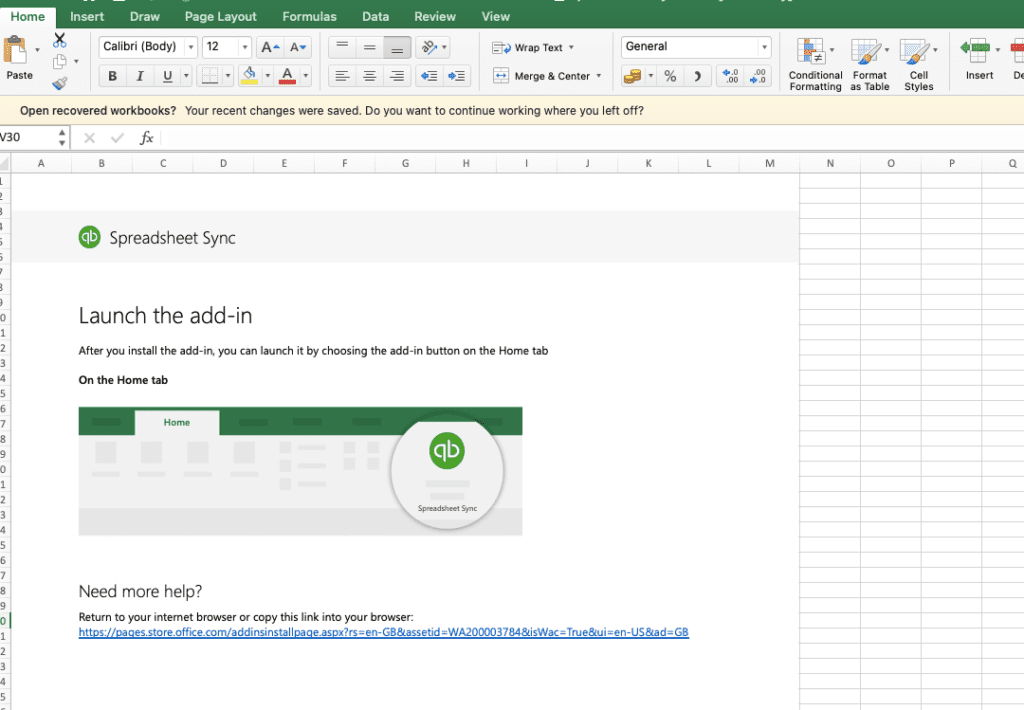

Multi-company Reporting with Spreadsheet Sync

Multi-company reporting with Spreadsheet Sync in QuickBooks Advanced allows you to consolidate financial information from multiple company files into a single report. This feature is particularly useful for businesses that operate multiple entities, such as a parent company with multiple subsidiaries, or franchise owners who own multiple locations.

If you would like to try the full version of QuickBooks Online Advanced, click here to get a free 30-day no-commitment trial plus access to the full video training library.

With the multi-company reporting feature in QuickBooks Advanced feature, you can easily view and analyze financial data from different companies in a single spreadsheet, making it easier to identify trends, compare performance, and make informed decisions. The Spreadsheet Sync feature automates the process of transferring data

between QuickBooks company files and the spreadsheet, which helps to reduce errors and save time. You customize reports in Excel according to your needs and sync all the changes made with QuickBooks Online in just a few clicks.

Learn more about multi-company reporting with Spreadsheet Sync in QuickBooks Advanced.

Setting up Spreadsheet Sync in QuickBooks Online Advanced

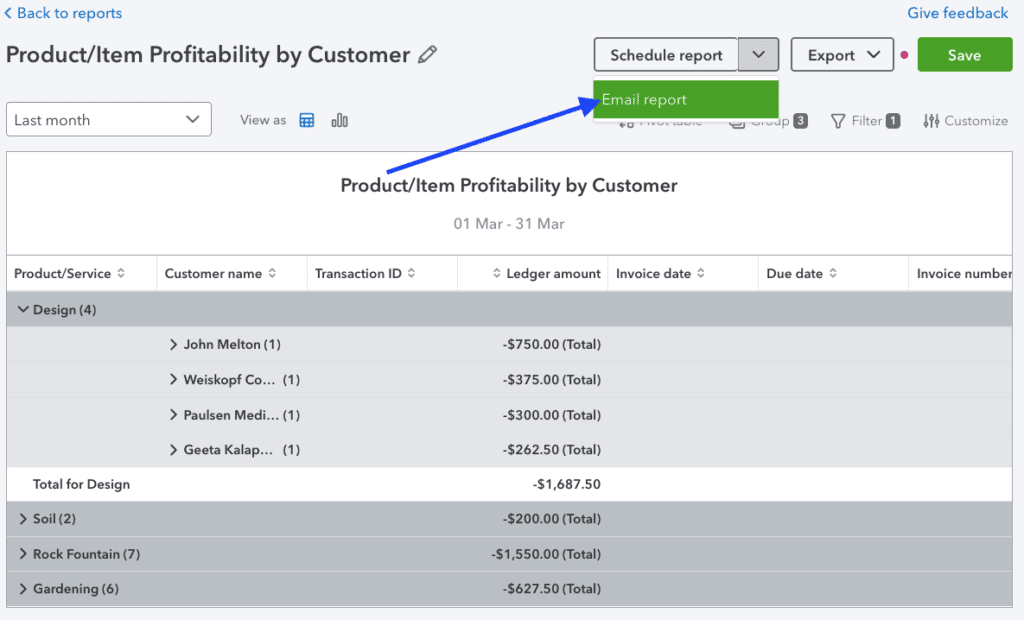

Scheduled Email Reports

With QuickBooks Online Advanced, you can schedule standard and custom reports to automatically send to yourself, your team, or stakeholders at a specified frequency, such as daily, weekly, or monthly. Simply choose who will receive report and how often, and you’re all set. There are three ways you can schedule email reports in QuickBooks: in the standard reports tab, in the custom reports tab, and while creating a custom report.

Scheduled email reports can be useful for a variety of purposes, such as keeping track of accounts receivable and accounts payable. For instance, you can schedule email reports to be sent to yourself or your accounting team on a regular basis to keep track of outstanding invoices, payments due, and payments received. You can schedule email reports to be sent to your sales team to track sales trends, revenue by product or service, and other key performance indicators.

Setting up scheduled email reports in QuickBooks Online Advanced

Revenue Recognition

This new feature in QuickBooks Online Advanced allows businesses to automatically recognize deferred revenue in compliance with Generally Accepted Accounting Principles (GAAP). This feature is particularly useful for businesses that offer subscription-based products or services, as well as businesses that sell products or services that are delivered over a period of time.

When a business sets up automatic revenue recognition in QuickBooks Advanced, they can specify how revenue should be recognized for each product or service that they offer. For instance, they can choose to recognize revenue evenly over the subscription period, or they can recognize revenue based on the percentage of the subscription period that has been completed.

When a sales transaction occurs, QuickBooks Advanced automatically recognizes the appropriate amount of revenue based on the business’s revenue recognition settings.

Learn more about revenue recognition in QuickBooks Advanced.

Enhanced Custom Roles

Custom roles in QuickBooks Online Advanced now include more detailed permissions for invoices and bills, giving businesses greater control over who has access to sensitive financial documents. With these new permissions, businesses can ensure that only the appropriate team members have access to invoices and bills, and that they can only perform specific actions on them.

For instance, you may have a custom role for an accounts payable clerk who is responsible for paying bills. You can specify that the accounts payable clerk can view bills, create and edit bills, but cannot delete bills or issue payments without approval from a manager or other authorized team member. Similarly, you may have a custom role for a sales team member who needs access to customer invoices. You can specify that the sales team member can view invoices, create and edit invoices for their own customers, but cannot view or edit invoices for customers assigned to other team members.

These more detailed permissions for invoices and bills in custom roles can help you ensure that your financial data is secure and only accessible to authorized team members.

Project Estimate vs. Actual Reporting

This new feature in QuickBooks Advanced allows you to create estimates for each project and track actual costs and revenue against those estimates. This gives you a clear picture of project performance and helps you identify areas where you can improve efficiency and profitability.

For instance, a construction company may use Project Estimate vs. Actual Reporting in QuickBooks Advanced to track the costs and revenue for a new building project. The company can compare actual results against the estimate, identify areas where costs are higher than expected, and make adjustments to improve efficiency and profitability. For example, if the cost of materials is higher than expected, the company may look for ways to reduce costs or adjust the estimate for future projects to ensure they remain profitable. Similarly, if the project is generating more revenue than expected, the company may look for ways to capitalize on this success and replicate it in future projects.

Learn more about project estimate vs. actual reporting in QuickBooks Advanced.

Bottom Line

QuickBooks Advanced continues to prove itself as one of the most comprehensive and user-friendly accounting software solutions on the market. You might check out the top 10 advantages of using Advanced for your small business.

- benefits of quickbooks online advancedcustom roles in QuickBooks Online Advancedemail reports in QuickBooks Online Advancedestimates vs actuals in QuickBooks Online Advancedinventory tracking in QuickBooks Online Advancedproject reporting in QuickBooks Online Advancedquickbooks online advancedquickbooks online advanced automationquickbooks online advanced custom reportsquickbooks online advanced custom workflowquickbooks online advanced KPI'squickbooks online advanced reportsquickbooks online advanced vs online plusquickbooks online advanced workflows