Overview

We make Intuit Payroll Services easy so you can get back to doing what you love

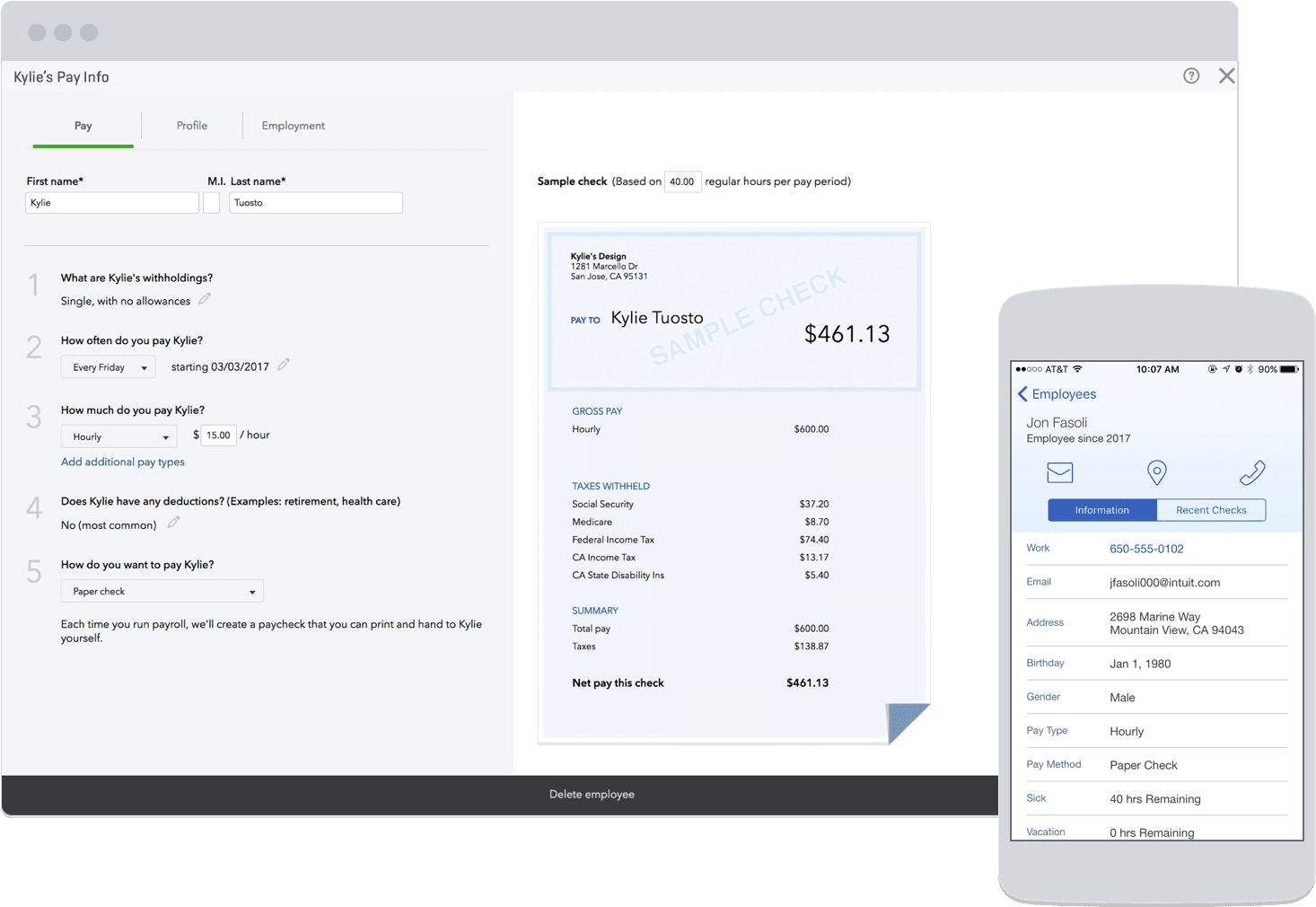

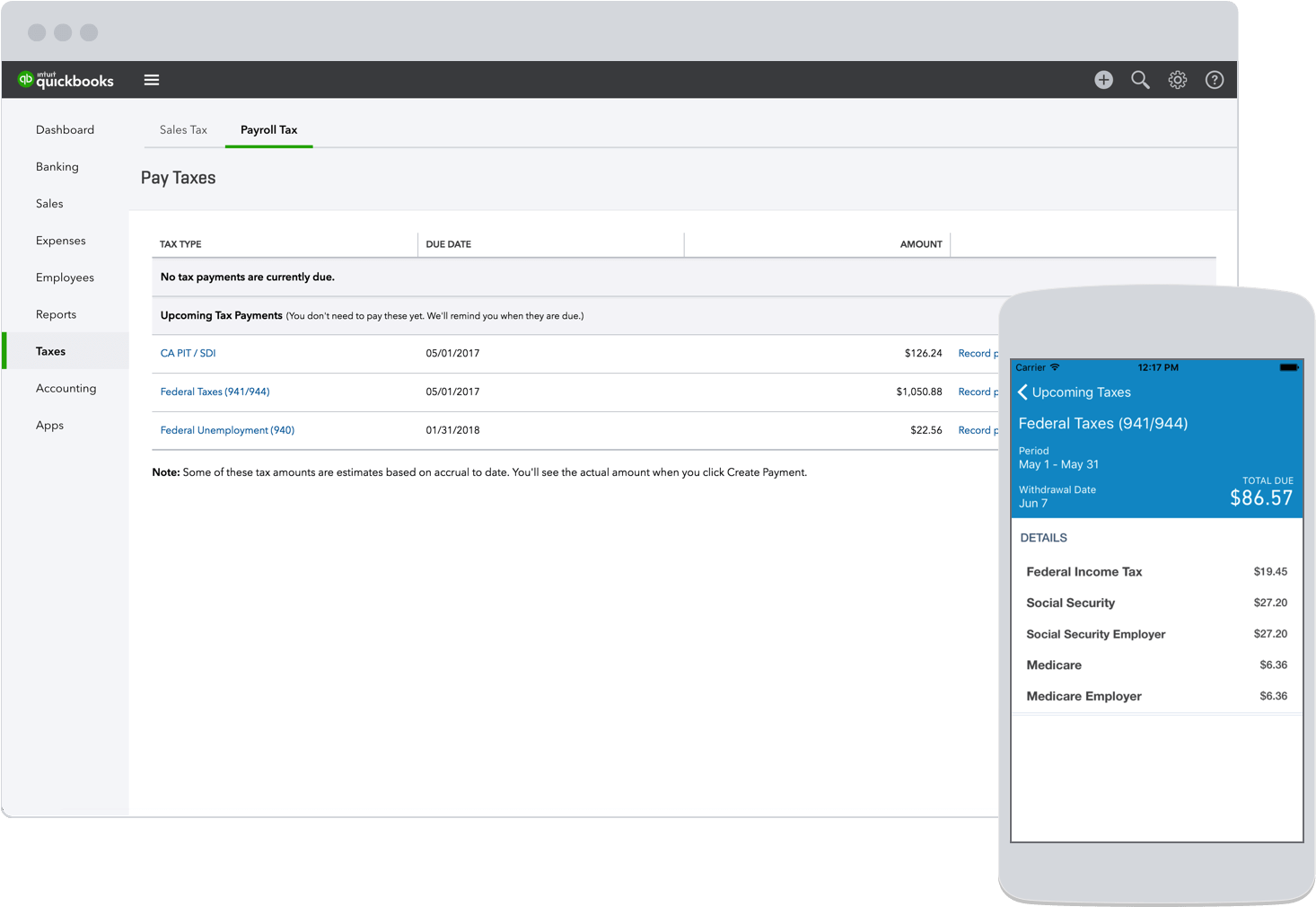

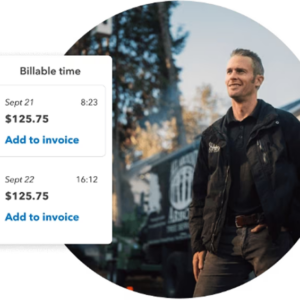

Payroll in your QuickBooks

Save time with everything in one place. No exporting or double checking. Everything is done right in QuickBooks.

Paychecks in 3 easy steps

Just enter your hours in QuickBooks, review and approve your payroll and pay your employees. That's it!

Free direct deposit

Two ways to get employees paid - print checks or use direct deposit, choose whichever your employees prefer.

Free expert support

Intuit Enhanced payroll includes free support from payroll experts so if you have questions, just call.